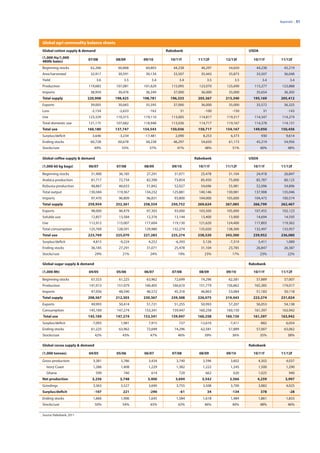

This document provides an outlook for agricultural commodity markets in 2012. It discusses key themes like an expected economic slowdown, the influence of speculators and the US dollar, and potential policy risks. Under a base case scenario of a stumbling economic recovery, most commodity prices are forecasted to be down from 2011 levels but supported by capacity constraints that raise price floors. Alternative high and low cases are also considered. Outlooks with price forecasts are given for various crops, oils, meats, and soft commodities.