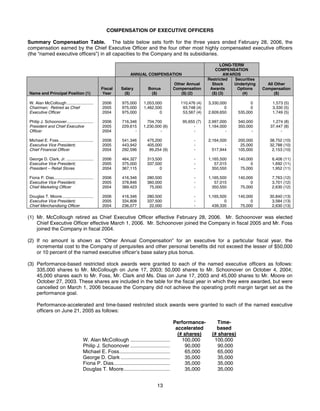

Embed presentation

Download to read offline

The document provides notice of Circuit City Stores, Inc.'s annual meeting of shareholders to be held on June 27, 2006 at 10:00 am at The Jepson Alumni Center at the University of Richmond. The items of business to be voted on include the election of five directors, ratification of the appointment of KPMG LLP as the independent registered public accounting firm, and any other business properly brought before the meeting. Shareholders of record as of April 21, 2006 are entitled to vote. Details are provided on how to vote by proxy.