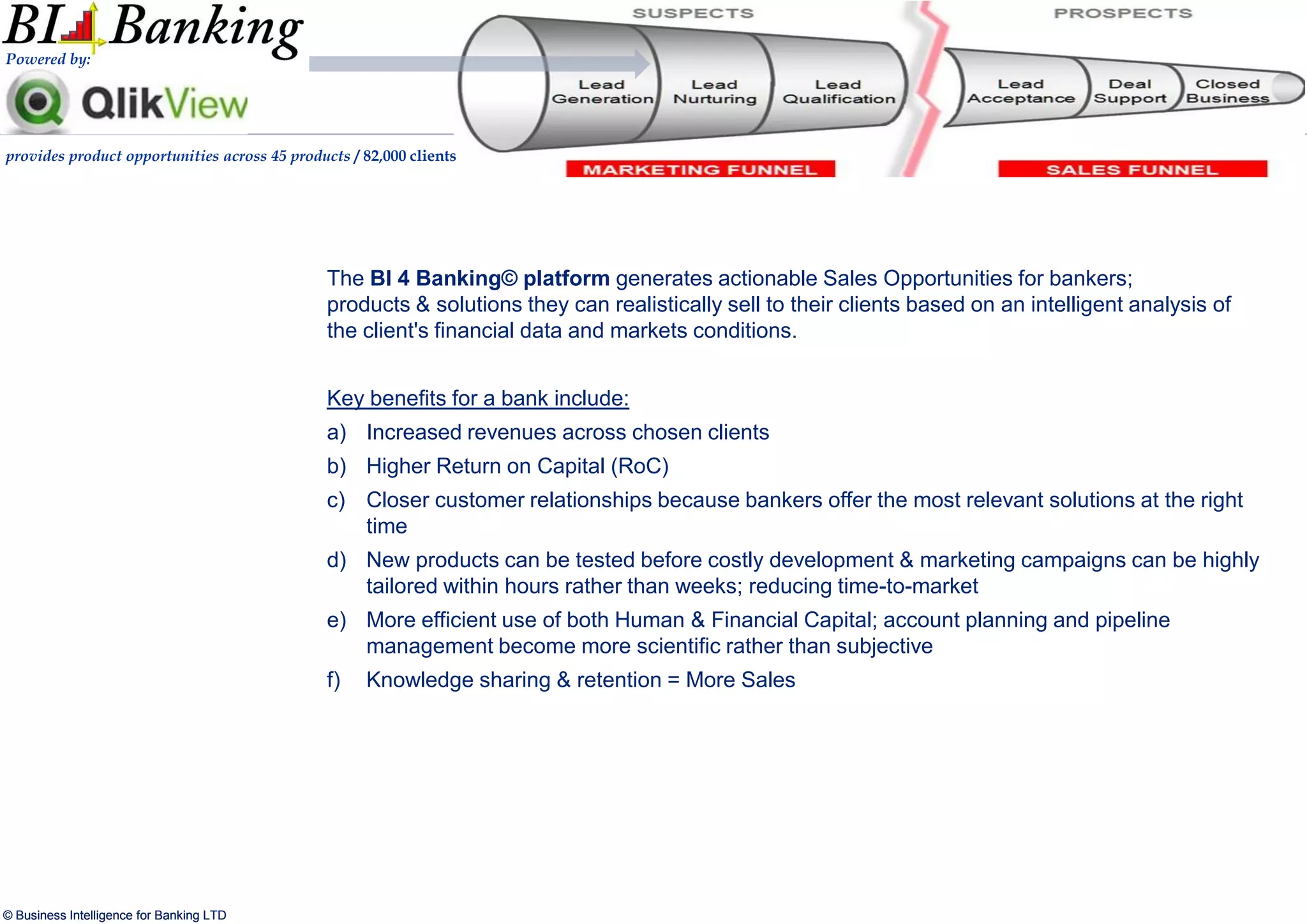

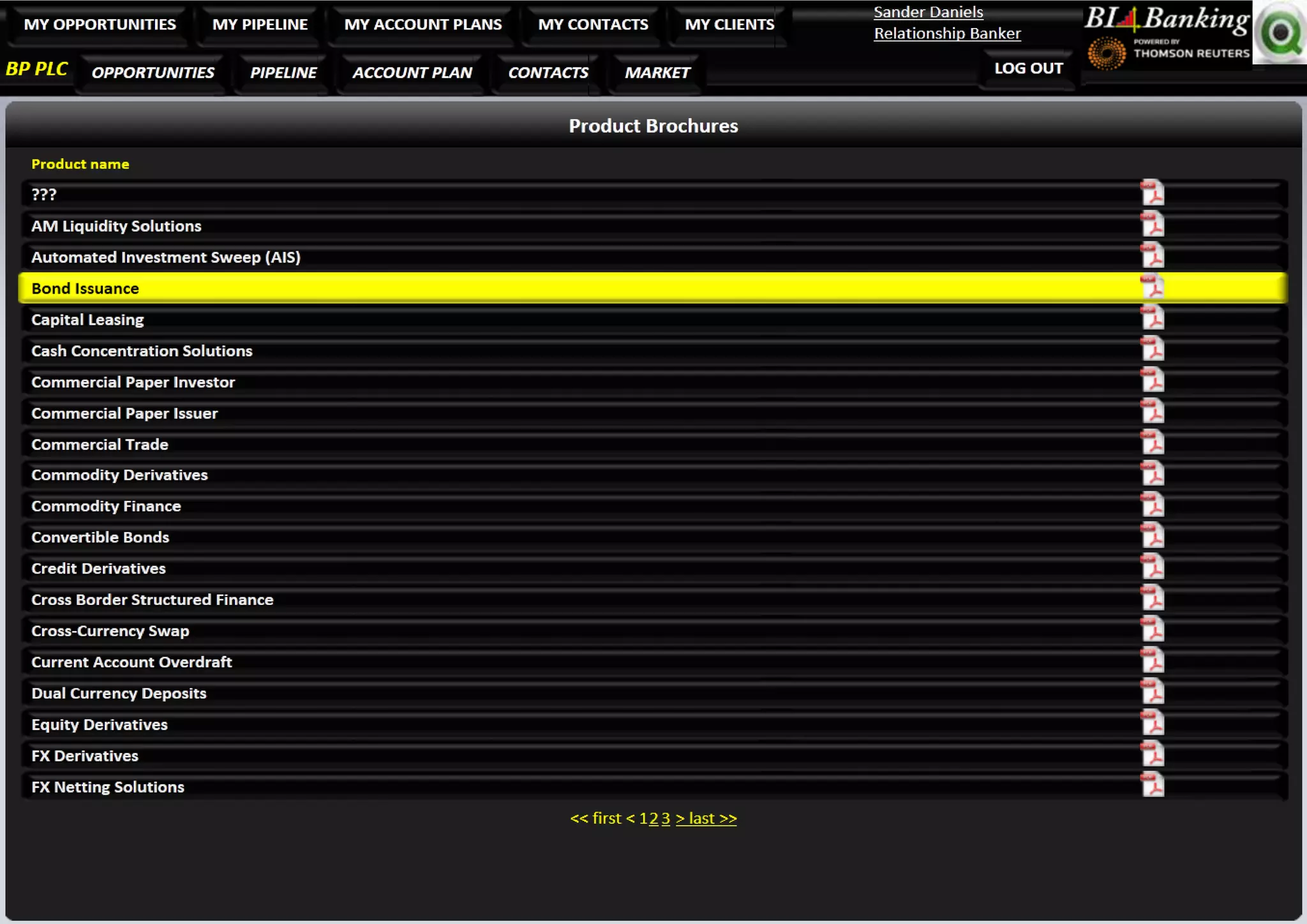

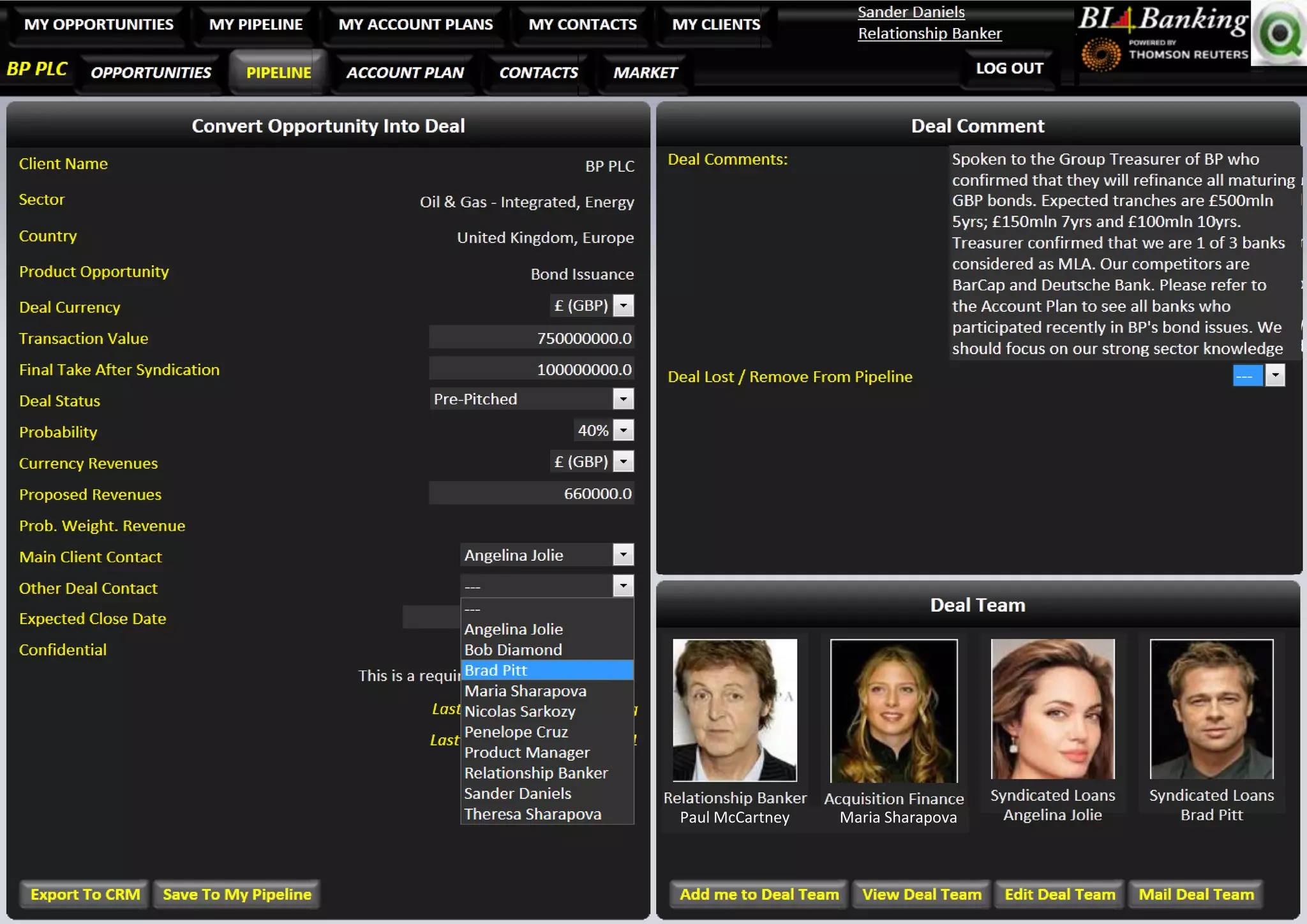

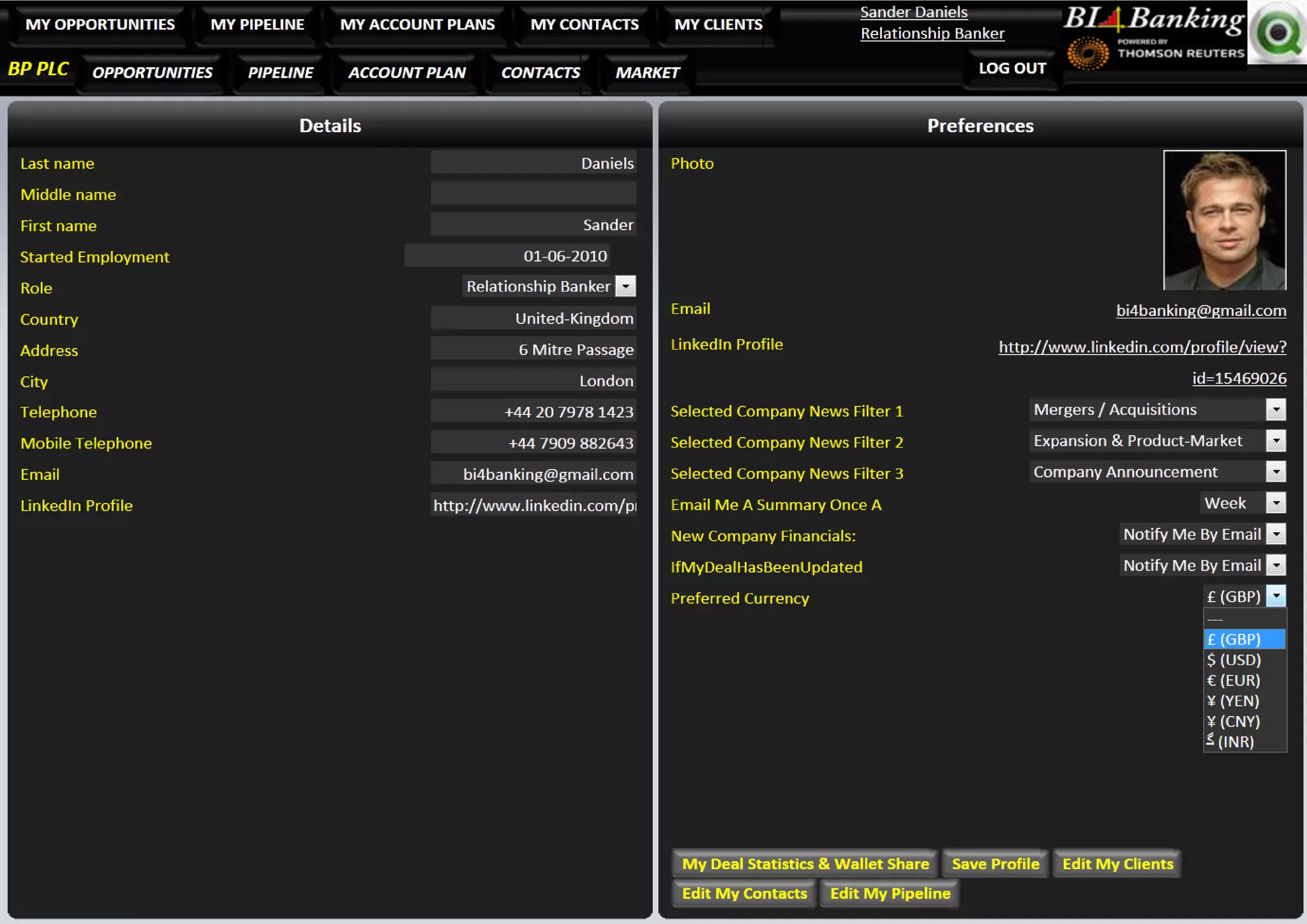

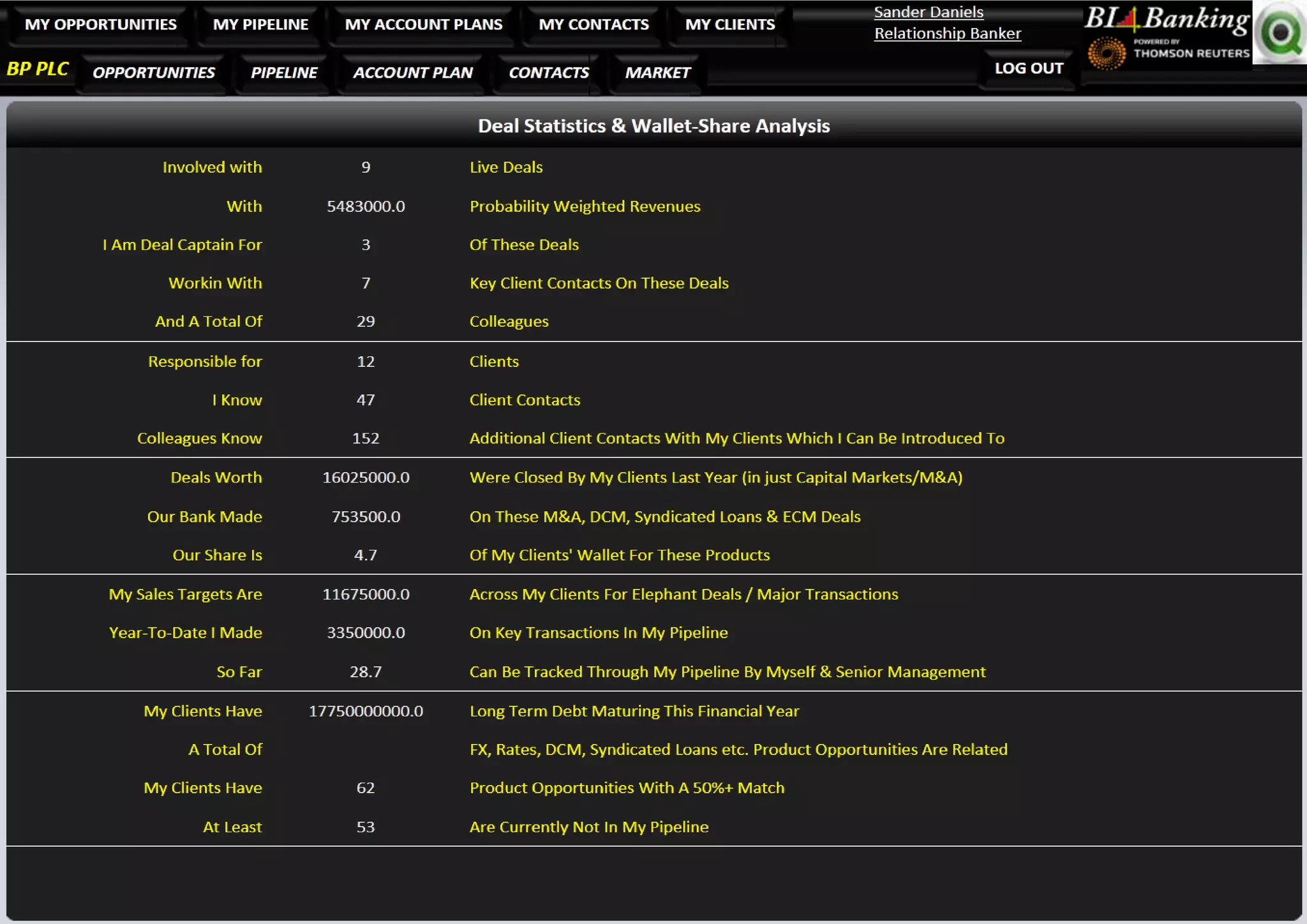

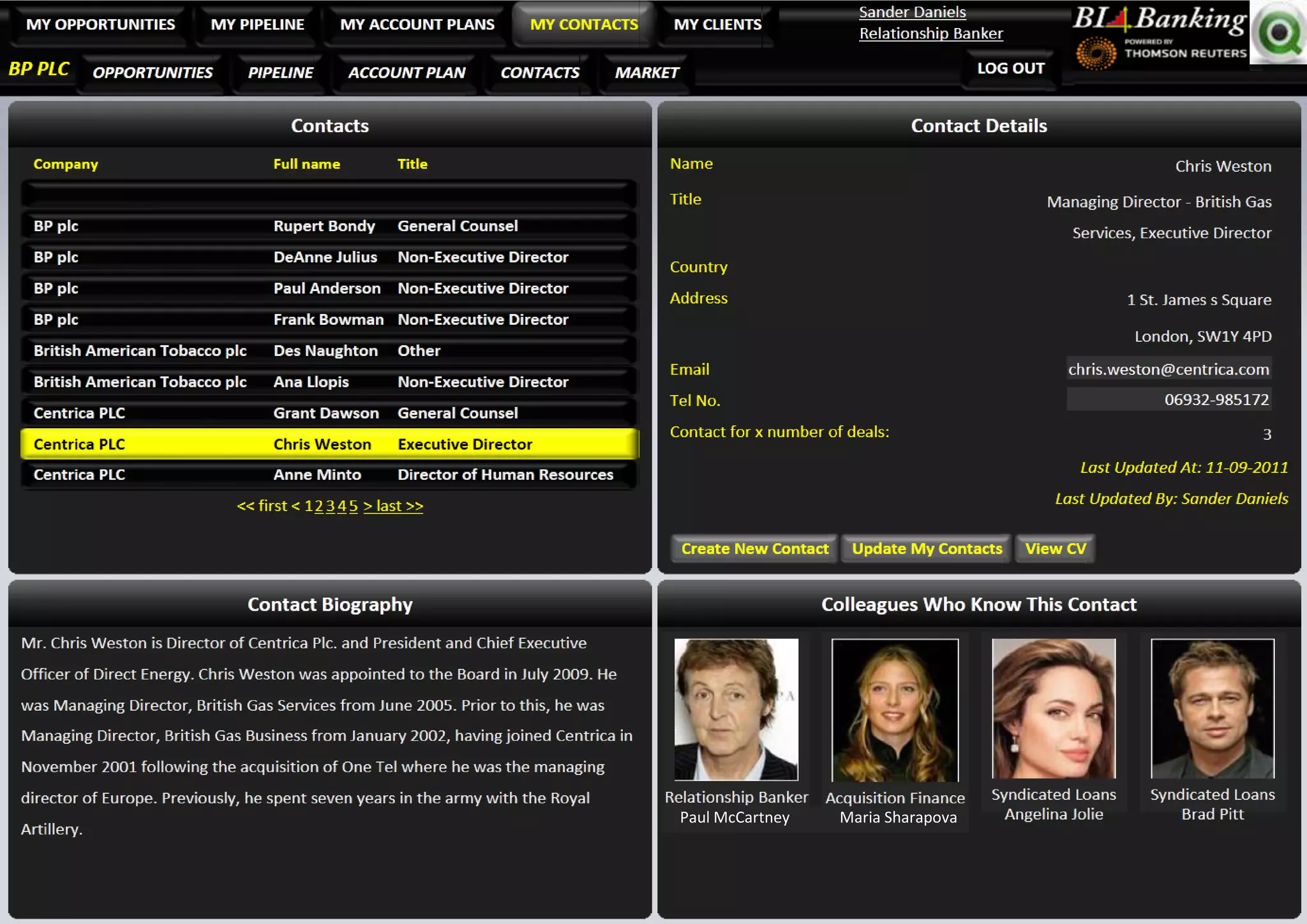

Business Intelligence for Banking Ltd, in collaboration with QlikTech and Thomson Reuters, has launched an online sales opportunity dashboard that analyzes the financials of 82,000 publicly-quoted clients to identify suitable banking products. This platform is designed to enhance cross-selling and return on capital for banks through detailed queries on clients' financial profiles and needs. The application is accessible on mobile devices without complex integration, allowing bankers to improve client relationships and increase revenues efficiently.