- Asgar, Chaman and Dholu are partners in a firm, with opening capital balances of Rs. 6,00,000, Rs. 5,00,000 and Rs. 4,00,000 respectively

- The profit for the year ending 31 March 2020 was Rs. 4,24,000

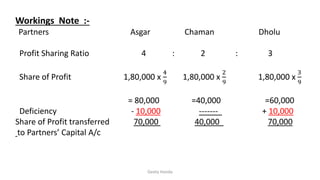

- Profits and losses are shared in the ratio of 4:2:3

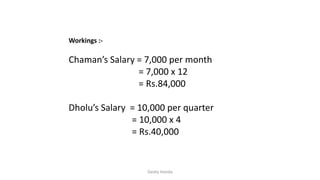

- Interest on capital is paid at 8% and salaries to Chaman and Dholu are Rs. 7,000/month and Rs. 10,000/quarter respectively

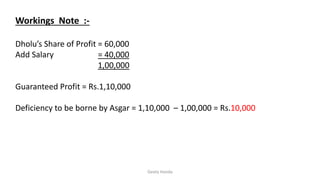

- Dholu's share of profit is guaranteed at Rs. 1,10,000, with any deficiency met by Asgar