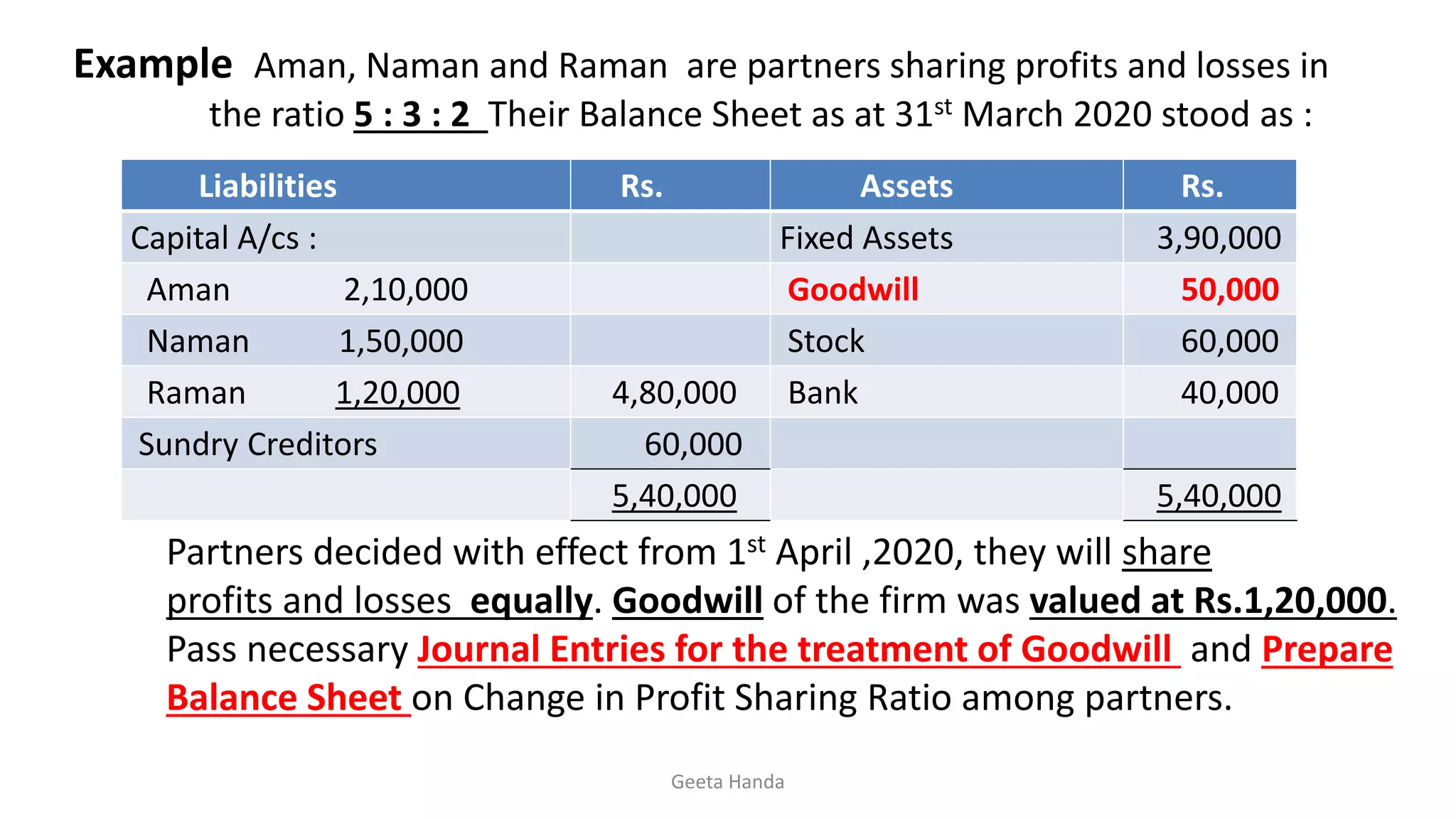

The document discusses the treatment of goodwill when there is a change in profit sharing ratios among partners in a partnership firm. When the profit sharing ratio changes from 5:3:2 to 1:1:1 for partners Aman, Naman, and Raman respectively, an adjustment to goodwill is required. First, the existing goodwill of Rs. 50,000 is written off in the old profit sharing ratio. Then, the gain or sacrifice of each partner due to the change in ratio is calculated and goodwill is adjusted accordingly through journal entries. The capital balances of the partners in the reconstituted firm are then presented.