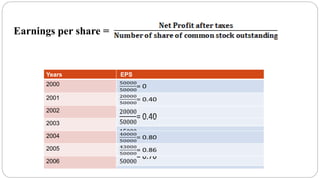

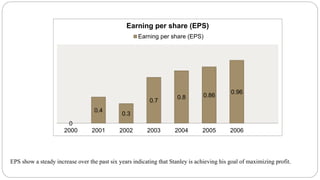

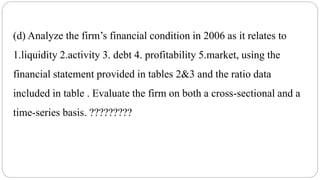

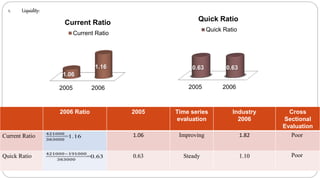

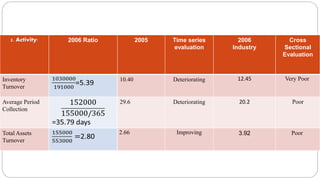

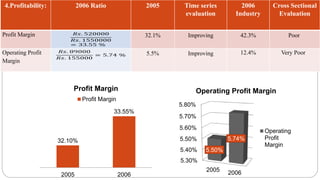

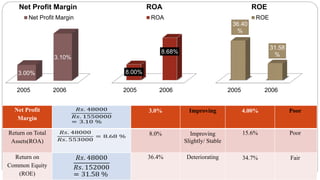

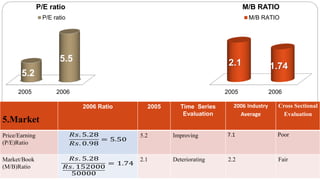

Stanley started a software firm called Track Software Ltd with Rs. 100,000 in equity and debt. He developed a cost accounting program but needed to hire a software developer to complete it. While profits have increased over six years, an analysis of the firm's 2006 financials shows liquidity, activity, and profitability ratios below industry averages. Hiring the developer could improve ratios and sales, in line with Stanley's goal of maximizing profits, though it may temporarily lower earnings per share. Overall, the firm is not performing as well as peers but hiring could boost potential if sales increase as expected.