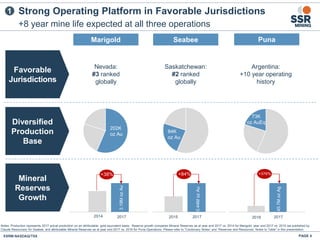

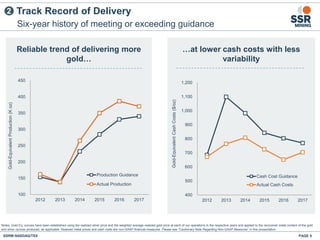

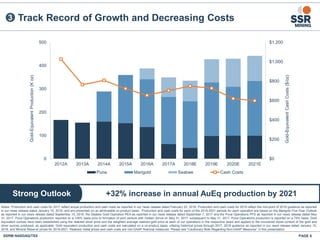

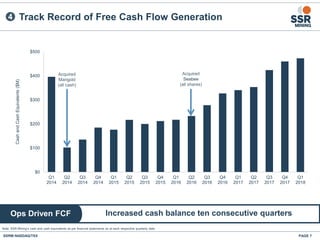

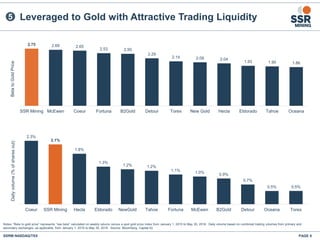

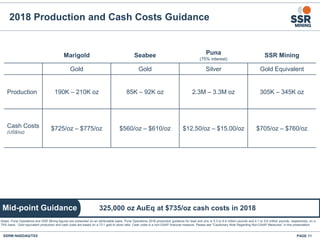

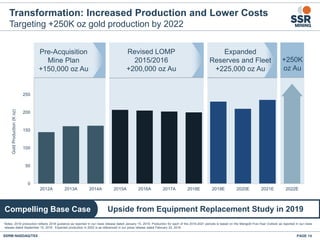

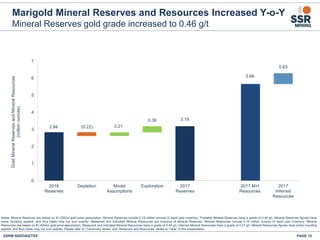

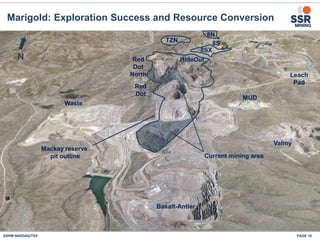

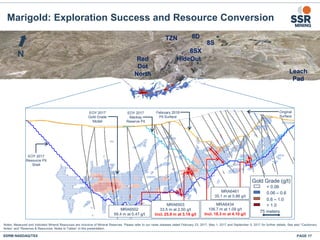

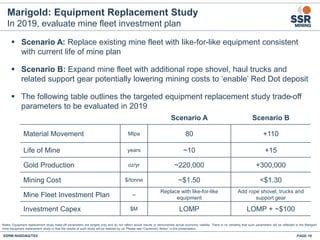

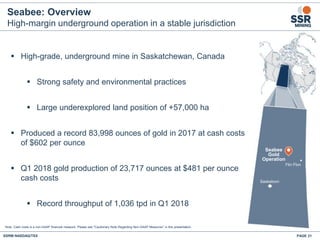

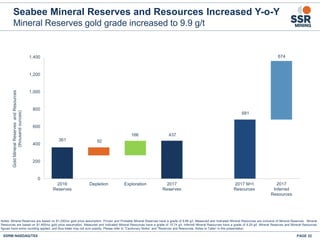

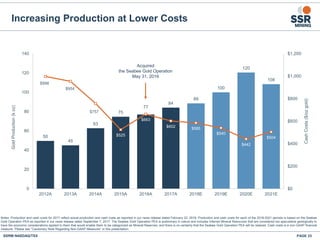

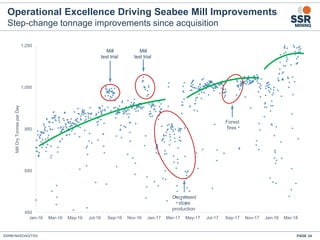

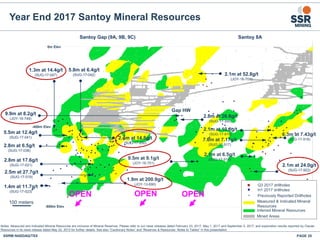

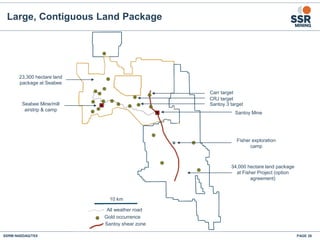

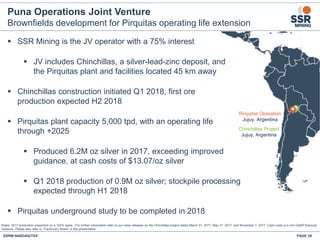

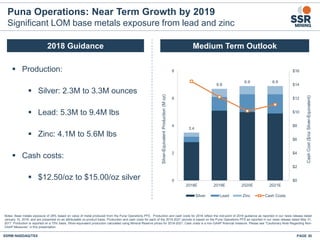

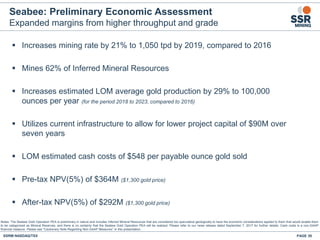

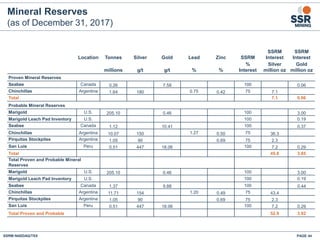

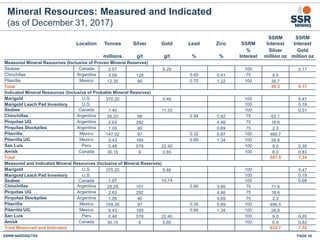

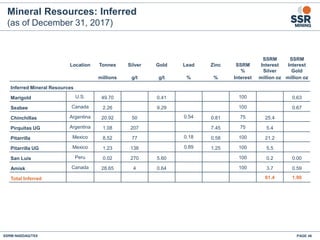

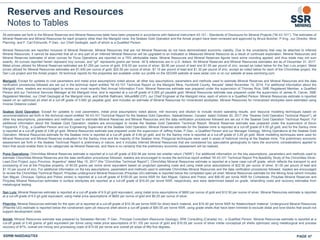

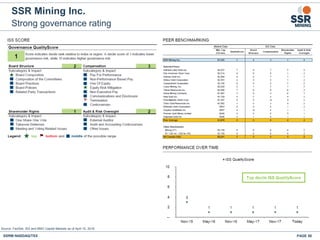

This document provides an overview of SSR Mining and its track record of creating shareholder value through growth and decreasing costs. It discusses SSR Mining's strong operating platform in favorable jurisdictions, including Nevada, Argentina, and Saskatchewan. SSR Mining has a six-year track record of meeting or exceeding production and cost guidance, and it expects to increase annual gold-equivalent production by 32% by 2021 through organic growth at its existing operations. The document also notes some risks and uncertainties inherent in forward-looking statements.