Houston Office Market Sees Positive Absorption in Q2 2011

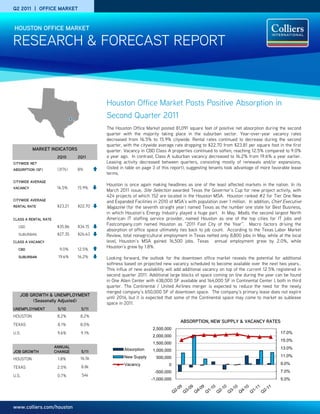

- 1. Q2 2011 | OFFICE MARKET HOUSTON OFFICE MARKET RESEARCH & FORECAST REPORT Houston Office Market Posts Positive Absorption in Second Quarter 2011 The Houston Office Market posted 81,091 square feet of positive net absorption during the second quarter with the majority taking place in the suburban sector. Year-over-year vacancy rates decreased from 16.5% to 15.9% citywide. Rental rates continued to decrease during the second quarter, with the citywide average rate dropping to $22.70 from $23.81 per square foot in the first MARKET INDICATORS quarter. Vacancy in CBD Class A properties continued to soften, reaching 12.5% compared to 9.0% 2Q10 2Q11 a year ago. In contrast, Class A suburban vacancy decreased to 16.2% from 19.6% a year earlier. CITYWIDE NET Leasing activity decreased between quarters, consisting mostly of renewals and/or expansions, ABSORPTION (SF) (317k) 81k (listed in table on page 3 of this report), suggesting tenants took advantage of more favorable lease terms. CITYWIDE AVERAGE Houston is once again making headlines as one of the least affected markets in the nation. In its VACANCY 16.5% 15.9% March 2011 issue, Site Selection awarded Texas the Governor’s Cup for new project activity, with 424 projects of which 152 are located in the Houston MSA. Houston ranked #2 for Tier One New CITYWIDE AVERAGE and Expanded Facilities in 2010 of MSA’s with population over 1 million. In addition, Chief Executive RENTAL RATE $23.21 $22.70 Magazine (for the seventh straight year) named Texas as the number one state for Best Business, in which Houston’s Energy Industry played a huge part. In May, Modis, the second largest North CLASS A RENTAL RATE American IT staffing service provider, named Houston as one of the top cities for IT jobs and Fastcompany.com named Houston as “2011 Fast City of the Year”. Macro factors driving the CBD $35.86 $34.15 absorption of office space ultimately ties back to job count. According to the Texas Labor Market SUBURBAN $27.35 $26.63 Review, total nonagricultural employment in Texas netted only 8,800 jobs in May, while at the local CLASS A VACANCY level, Houston’s MSA gained 16,500 jobs. Texas annual employment grew by 2.0%, while Houston’s grew by 1.8%. CBD 9.0% 12.5% SUBURBAN 19.6% 16.2% Looking forward, the outlook for the downtown office market reveals the potential for additional softness based on projected new vacancy scheduled to become available over the next two years.. This influx of new availability will add additional vacancy on top of the current 12.5% registered in second quarter 2011. Additional large blocks of space coming on line during the year can be found in One Allen Center with 438,000 SF available and 164,000 SF in Continental Center I, both in third quarter. The Continental / United Airlines merger is expected to reduce the need for the newly merged company’s 650,000 SF of downtown space. The company’s primary lease does not expire JOB GROWTH & UNEMPLOYMENT until 2014, but it is expected that some of the Continental space may come to market as sublease (Seasonally Adjusted) space in 2011. UNEMPLOYMENT 5/10 5/11 HOUSTON 8.2% 8.2% ABSORPTION, NEW SUPPLY & VACANCY RATES TEXAS 8.1% 8.0% 2,500,000 U.S. 9.6% 9.1% 17.0% 2,000,000 15.0% 1,500,000 ANNUAL 13.0% Absorption JOB GROWTH CHANGE 5/11 1,000,000 New Supply 11.0% HOUSTON 1.8% 16.5k 500,000 Vacancy 0 9.0% TEXAS 2.0% 8.8k -500,000 7.0% U.S. 0.7% 54k -1,000,000 5.0% www.colliers.com/houston

- 2. RESEARCH & FORECAST REPORT | Q2 2011 | HOUSTON OFFICE MARKET VACANCY & AVAILABILITY ABSORPTION & DEMAND Overall vacancy levels remained unchanged Houston recorded positive net absorption of between quarters, remaining at 15.9%. The 81,091 SF in the second quarter, compared to CBD VS. SUBURBAN average suburban vacancy rose by 10 basis (316,519) SF of negative net absorption at the points to 15.9% from 15.8% the previous same time last year. Contributing to the CLASS A OFFICE VACANCY quarter, while CBD vacancy remained the same quarters positive gain was Suburban Class A 20.0% at 16.0%. On a year-over-year basis, suburban space with positive net absorption of 261,138 18.0% vacancy decreased by 120 basis points to SF, followed by CBD Class A space with 16.0% 15.9% from 17.1%, and CBD increased 220 positive net absorption at 32,128 SF. Suburban 14.0% 12.0% basis points to 16.0% from 13.8%. Class B space had the largest amount of 10.0% Vacancy in CBD Class A properties continued negative absorption in second quarter 2011 with 8.0% to soften reaching 12.5% compared to 9.0% a (134,965) SF of negative net absorption 6.0% year ago. In contrast, CBD Cass B properties followed by suburban Class C space with 4.0% (64,587) SF of negative net absorption. decreased to 20.0% vacancy, down from 22.8% 12 months earlier. RENTAL RATES Although suburban vacancy rates remained in Citywide rental rates continued to decline CBD VACANCY SUBURBAN VACANCY double-digits, Class A vacancy actually dropped during the second quarter 2011. between quarters to 16.2% from 19.6% on a On a year-over-year basis, CBD Class A year-over-year basis. By comparison, suburban average quoted rental rates dropped $1.71 to Class B vacancy rose to 16.7% from 16.3%. $34.15 per square foot (from $35.86), while CLASS A OFFICE RENTS Citywide, a total of 47 office properties had a suburban Class A rates dropped $0.72 to $40.00 minimum of 100,000 SF available for lease in $26.63 per square foot (from $27.35). The $38.00 both direct and sublease space which is 5 less average CBD Class B asking rate increased by $36.00 than the previous quarter, and 14 of those $0.49 to $23.44 per square foot (from $22.95), $34.00 properties have over 200,000 SF available, while suburban Class B rates remained the $32.00 down from 25. same at $17.95 per square foot on a year-over- $30.00 $28.00 Sublease space totaled 3.4 million SF, including year basis. Until demand outpaces supply, rental $26.00 1.3 million SF of vacant space and 1.2 million SF rates are expected to remain flat. of subleases available for occupancy over the next 12 months. The largest sublease space being marketed is Devon Energy’s space, CBD RENTS SUBURBAN RENTS 282,000 SF in Two Allen Center in the CBD and Braeswood Tower II has the largest suburban contiguous block of sublease space available, 146,392 SF. QUOTED GROSS RENTAL RATES FOR TOP PERFORMING OFFICE BUILDINGS YEAR AVAIL. RENT BUILDING NAME ADDRESS SUBMARKET RBA (SF) LEASED OWNER BUILT SF ($/SF) Metropolitan Life Insurance Co. & Wells Fargo Plaza 1000 Louisiana CBD 1,721,242 1982 94.5% 363,136 $46.10 N.Y. State Retirement Fund Heritage Plaza 1111 Bagby CBD 1,089,266 1986 90.5% 161,357 $40.50 Brookfield Office Properties 1100 Louisiana 1100 Louisiana CBD 1,265,332 1980 98.4% 127,347 $38.64 Enterprise Products Partners CityCentre One 800 Town & Country Blvd Energy Corridor 101,300 2008 100% 15,000 $40.00 Midway Companies Enclave Parkway 1401 Enclave Parkway Energy Corridor 209,185 1999 97.0% 164,547 $33.00 Parkway Properties Minute Maid Building 2150 Town Square Place E. Fort Bend 185,000 2008 76.2% 44,109 $30.00 Planned Community Developers Wells Fargo Bank Tower 1300 Post Oak Blvd. Galleria 491,254 1983 95.1% 59,140 $34.15 TIAA-CREF Williams Tower 2800 Post Oak Blvd Galleria 1,476,973 1983 90.5% 358,966 $33.93 Hines REIT 11 Greenway Plaza 11 Greenway Greenway 745,956 1978 97.9% 139,804 $30.15 Crescent Real Estate Equities One BriarLake Plaza 2000 W. Sam Houston Westchase 550,000 2000 100% 7,507 $39.15 Behringer Harvard Waterway Plaza I 10003 Woodloch Forest Woodlands 223,483 2000 94.0% 20,326 $33.30 W.P. Carey & Co. LLC Waterway Square 4 Waterway Ave. Woodlands 232,364 2009 93.3% 15,680 $36.00 The Woodlands Development Note: Avail. SF includes direct and sublet space. Source: CoStar Property COLLIERS INTERNATIONAL | P. 2

- 3. RESEARCH & FORECAST REPORT | Q2 2011 | HOUSTON OFFICE MARKET SALES ACTIVITY LEASING ACTIVITY Houston’s Office Investment sales Houston’s office leasing activity HOUSTON OFFICE SUBMARKETS activity increased during the second reached 2.1 million SF in the first quarter with 25 properties changing quarter, compared to 4.0 million SF in hands compared to 13 in the previous the same quarter last year. Leasing quarter. According to CoStar, office activity is still below levels prior to sale transactions had a total dollar the economic downturn, and an volume of $409 million, averaging increasing number of office tenants $188/SF with a 8.1% capitalization are renewing lease commitments with rate. better concession packages or Among the most significant relocating to buildings/submarkets transactions closed in the second offering more attractive terms. quarter were: All but three of the more significant New York State Retirement Funds’ office leases signed during the first acquisition of a 50% interest in Wells quarter were renewals and/or Fargo Plaza from MetLife for $510 expansions. The most significant new million ($300/SF) in the CBD office lease signed in the second submarket. quarter was Columbia Gas Transmissions’ lease for 55,000 Chevron acquired the 1,228,877 square feet in Sage Plaza located in square foot Four Allen Center in the the West Loop/Galleria submarket, CBD submarket from Brookfield followed by Amerigroup Corps lease Office Properties for $340 million for 50,000 square feet in 5959 ($277/SF). Chevron currently leases Corporate Drive located in the the entire building. Southwest submarket. Q2 2011 SIGNIFICANT SALES TRANSACTIONS YEAR SALE BUILDING NAME SUBMARKET RBA (SF) BUYER SELLER $/SF CLOSED BUILT PRICE ING Clarion OBO N.Y. Wells Fargo Plaza (50% Interest) CBD 1,700,000 1979 MetLife $510.0M $300 6/2011 State Retirement Fund Brookfield Office Four Allen Center CBD 1,228,877 1983 Chevron Corporation $340.0M $277 6/2011 Properties Buchanan Street Beltway 8 Corporate Center 3 & 4 Northwest Far 259,505 2007 Panattoni Development $26.3M $101 6/2011 Partners Beacon Investment One & Two Park Ten Place Katy Freeway 91,166 1979/83 KBS Realty Advisors $8.4M $92 5/2011 Properties Q2 2011 TOP OFFICE LEASES BUILDING NAME/ADDRESS SUBMARKET SF TENANT LEASE DATE 1600 Smith CBD 311,000 Chevron* 5/2011 Eldridge Oaks Katy Freeway West 138,000 KBR* 4/2011 Sage Plaza West Loop/Galleria 55,000 Columbia Gas Transmission 5/2011 5959 Corporate Drive Southwest 50,000 Amerigroup Corp 4/2011 Remington Square Northwest 42,364 Seawell 6/2011 Chase Tower CBD 42,136 Breitburn Energy* 4/2011 *Renewal and/or Expansion; COLLIERS INTERNATIONAL | P. 3

- 4. RESEARCH & FORECAST REPORT | Q2 2011 | HOUSTON OFFICE MARKET HOUSTON OFFICE MARKET SUMMARY (CBD, SUBURBAN & CITYWIDE) INVENTORY DIRECT VACANCY SUBLEASE VACANCY VACANCY VACANCY RATE (%) NET ABSORPTION (SF) RENTAL RATE Class # of Bldgs. Total (SF) (SF) Rate (%) (SF) Rate (%) Total (SF) Q2-2011 Q1-2011 Q2-2011 1Q-2011 Avg ($/SF) CBD A 28 26,963,571 2,597,425 9.6% 780,510 2.9% 3,377,935 12.5% 12.6% 32,128 -33,540 $34.15 B 30 9,370,310 1,856,651 19.8% 15,314 0.2% 1,871,965 20.0% 19.6% -10,411 34,868 $23.44 C 19 1,308,204 783,648 59.9% 3957 0.3% 787,605 60.2% 55.2% -2,212 -14,543 $18.03 Total 77 37,642,085 5,237,724 13.9% 799,781 2.1% 6,037,505 16.0% 16.0% 19,505 -13,215 $29.81 SUBURBAN A 272 70,014,873 10,955,541 15.6% 364,565 0.5% 11,320,106 16.2% 16.6% 261,138 537,689 $26.63 B 892 70,401,884 11,321,701 16.1% 413,747 0.6% 11,735,448 16.7% 16.3% -134,965 -127,662 $17.95 C 451 18,856,783 2,145,864 11.4% 49,095 0.3% 2,194,959 11.6% 11.4% -64,587 -18,596 $15.03 Total 1615 159,273,540 24,423,106 15.3% 827,407 0.5% 25,250,513 15.9% 15.8% 61,586 391,431 $21.31 OVERALL A 300 96,978,444 13,552,966 14.0% 1,145,075 1.2% 14,698,041 15.2% 15.5% 293,266 504,149 $28.33 B 922 79,772,194 13,178,352 16.5% 429,061 0.5% 13,607,413 17.1% 16.7% -145,376 -92,794 $18.58 C 470 20,164,987 2,929,512 14.5% 53,052 0.3% 2,982,564 14.8% 14.4% -66,799 -33,139 $15.25 Total 1692 196,915,625 29,660,830 15.1% 1,627,188 0.8% 31,288,018 15.9% 15.9% 81,091 378,216 $22.70 HOUSTON SUBURBAN OFFICE MARKET SUMMARY INVENTORY DIRECT VACANCY SUBLEASE VACANCY VACANCY VACANCY RATE (%) NET ABSORPTION (SF) RENTAL RATE # of Class Total (SF) (SF) Rate (%) (SF) Rate (%) Total (SF) Q2-2011 Q1-2011 Q2-2011 Q1-2011 Avg. ($/SF) Bldgs. Allen Parkway A 3 1,246,576 217,628 17.5% 0 0.0% 217,628 17.5% 18.3% 5,280 33,253 $28.78 B 29 2,815,289 271,944 9.7% 3,348 0.1% 275,292 9.8% 6.6% -73,252 28,658 $22.58 C 26 1,163,150 406,786 35.0% 0 0.0% 406,786 35.0% 35.4% 5,250 14,693 $19.70 Total 58 5,225,015 896,358 17.2% 3,348 0.1% 899,706 17.2% 15.4% -62,722 76,604 $25.57 Baytown B 5 525,544 6,802 1.3% 0 0.0% 6,802 1.3% 1.3% 0 0 $14.67 C 2 60,396 1,563 2.6% 0 0.0% 1,563 2.6% 2.6% 0 1040 $16.25 Total 7 585,940 8,365 1.4% 0 0.0% 8,365 1.4% 1.4% 0 1,040 $15.11 Bellaire A 10 1,389,252 129,033 9.3% 28,822 2.1% 157,855 11.4% 11.2% -2,796 -13,138 $22.95 B 9 1,369,867 166,791 12.2% 4,671 0.3% 171,462 12.5% 12.6% 848 5,038 $19.54 C 7 545,303 36,662 6.7% 10,454 1.9% 47,116 8.6% 8.6% 0 -6,016 $15.14 Total 26 3,304,422 332,486 10.1% 43,947 1.3% 376,433 11.4% 11.3% -1,948 -14,116 $20.54 Conroe A 1 60,000 0 0.0% 0 0.0% 0 0.0% 0.0% 0 0 - B 6 244,782 16,334 6.7% 0 0.0% 16,334 6.7% 6.5% -535 3,784 $15.33 C 5 302,939 0 0.0% 0 0.0% 0 0.0% 0.0% 0 0 $15.00 Total 12 607,721 16,334 2.7% 0 0.0% 16,334 2.7% 2.6% -535 3,784 $15.28 E. Fort Bend A 20 3,564,828 937,429 26.3% 12,199 0.3% 949,628 26.6% 27.6% 34,893 -2,219 $27.64 B 35 2,033,510 264,798 13.0% 15,998 0.8% 280,796 13.8% 10.4% -9,498 -11,174 $18.26 C 4 142,013 2,413 1.7% 0 0.0% 2,413 1.7% 1.7% 0 842 $17.50 Total 59 5,740,351 1,204,640 21.0% 28,197 0.5% 1,232,837 21.5% 21.1% 25,395 -12,551 $23.65 COLLIERS INTERNATIONAL | P. 4

- 5. RESEARCH & FORECAST REPORT | Q2 2011 | HOUSTON OFFICE MARKET HOUSTON SUBURBAN OFFICE MARKET SUMMARY FM 1960 A 14 2,429,161 1,151,235 47.4% 5,442 0.2% 1,156,677 47.6% 51.0% 1,514 -15,081 $21.75 B 85 4,722,924 962,138 20.4% 73,566 1.6% 1,035,704 21.9% 22.3% 20,037 -17,233 $14.65 C 24 851,424 70,068 8.2% 0 0.0% 70,068 8.2% 9.3% 3,062 -8,384 $13.82 Total 123 8,003,509 2,183,441 27.3% 79,008 1.0% 2,262,449 28.3% 29.3% 24,613 -40,698 $16.95 Greenway A 16 6,167,603 885,870 14.4% 99,876 1.6% 985,746 16.0% 16.8% 17,506 -52,232 $27.58 B 25 2,551,389 265,457 10.4% 17,397 0.7% 282,854 11.1% 10.9% 3,034 -18,655 $21.65 C 21 873,877 261,217 29.9% 0 0.0% 261,217 29.9% 29.8% -984 -15,419 $17.29 Total 62 9,592,869 1,412,544 14.7% 117,273 1.2% 1,529,817 15.9% 16.4% 19,556 -86,306 $24.85 Gulf Freeway/Pasadena A 2 75,066 18,718 24.9% 6,095 8.1% 24,813 33.1% 35.5% 1,809 1,834 $27.20 B 29 1,709,060 201,497 11.8% 6,870 0.4% 208,367 12.2% 11.2% -17,386 5,487 $18.90 C 27 1,121,270 92,787 8.3% 0 0.0% 92,787 8.3% 9.4% 12,396 -11,517 $15.09 Total 58 2,905,396 313,002 10.8% 12,965 0.4% 325,967 11.2% 11.1% -3,181 -4,196 $18.60 I-10 East B 4 274,672 80,160 29.2% 0 0.0% 80,160 29.2% 27.3% -5,120 194 $13.96 C 5 157,955 0 0.0% 0 0.0% 0 0.0% 0.0% 0 6,536 $12.00 Total 9 432,627 80,160 18.5% 0 0.0% 80,160 18.5% 17.3% -5,120 6,730 $13.93 Katy Freeway A 45 11,556,573 2,004,724 17.3% 9,799 0.1% 2,014,523 17.4% 18.6% 115,848 284,723 $28.38 B 86 7,166,755 902,121 12.6% 81,924 1.1% 984,045 13.7% 13.8% -31,806 -39,566 $18.64 C 38 1,762,617 172,675 9.8% 0 0.0% 172,675 9.8% 9.5% -2,315 -2,287 $14.82 Total 169 20,485,945 3,079,520 15.0% 91,723 0.4% 3,171,243 15.5% 16.1% 81,727 242,870 $23.51 Kingwood/Humble A 2 133,924 25,518 19.1% 0 0.0% 25,518 19.1% 16.9% 1,247 -861 $29.40 B 59 1,817,907 162,882 9.0% 3,224 0.2% 166,106 9.1% 9.8% 11,646 8,805 $19.82 C 79 735,090 26,235 3.6% 0 0.0% 26,235 3.6% 4.2% 3,423 232 $16.47 Total 140 2,686,921 214,635 8.0% 3,224 0.1% 217,859 8.1% 8.7% 16,316 8,176 $19.39 NASA/Clear Lake A 6 809,351 148,739 18.4% 0 0.0% 148,739 18.4% 17.1% -10,128 -57,096 $24.97 B 45 3,174,176 423,535 13.3% 2,629 0.1% 426,164 13.4% 6.9% -200,841 23,123 $19.55 C 24 880,366 136,921 15.6% 0 0.0% 136,921 15.6% 15.1% 2,672 10,375 $15.38 Total 75 4,863,893 709,195 14.6% 2,629 0.1% 711,824 14.6% 10.2% -208,297 -23,598 $19.98 North Belt/Greenspoint A 20 4,750,418 326,657 6.9% 62,232 1.3% 388,889 8.2% 7.3% -42,465 -39,550 $20.02 B 56 5,323,159 1,167,670 21.9% 54,602 1.0% 1,222,272 23.0% 25.0% 73,335 57,035 $15.72 C 21 1,323,627 259,291 19.6% 10,971 0.8% 270,262 20.4% 18.2% -29,572 -4,192 $13.80 Total 97 11,397,204 1,753,618 15.4% 127,805 1.1% 1,881,423 16.5% 16.7% 1,298 13,293 $16.42 Northeast Far and Outlier B 5 301,773 73,763 24.4% 0 0.0% 73,763 24.4% 25.0% 1,764 0 $17.40 C 6 149,813 17,289 11.5% 0 0.0% 17,289 11.5% 8.0% -5,355 572 $12.00 Total 11 451,586 91,052 20.2% 0 0.0% 91,052 20.2% 19.4% -3,591 572 $15.98 COLLIERS INTERNATIONAL | P. 5

- 6. RESEARCH & FORECAST REPORT | Q2 2011 | HOUSTON OFFICE MARKET HOUSTON SUBURBAN OFFICE MARKET SUMMARY Northwest A 22 3,725,391 1,120,246 30.1% 7,378 0.2% 1,127,624 30.3% 31.0% 7,495 136,112 $24.55 B 69 6,545,554 1,500,004 22.9% 15,809 0.2% 1,515,813 23.2% 22.2% -2,174 26,751 $16.30 C 41 1,568,998 121,993 7.8% 0 0.0% 121,993 7.8% 6.5% -24,895 -11,622 $12.18 Total 132 11,839,943 2,742,243 23.2% 23,187 0.2% 2,765,430 23.4% 22.9% -19,574 151,241 $19.08 Northwest Outlier A 1 89,750 0 0.0% 0 0.0% 0 0.0% 0.0% 0 0 - B 4 135,457 4,621 3.4% 0 0.0% 4,621 3.4% 1.7% -2282 0 $18.12 Total 5 225,207 4,621 2.1% 0 0.0% 4,621 2.1% 1.0% -2282 0 $18.12 Richmond/Fountainview B 14 781,369 94,677 12.1% 0 0.0% 94,677 12.1% 10.8% -10,676 634 $15.39 C 17 664,389 57,651 8.7% 0 0.0% 57,651 8.7% 7.6% -7,385 -6,192 $13.42 Total 31 1,445,758 152,328 10.5% 0 0.0% 152,328 10.5% 9.3% -18,061 -5,558 $14.93 San Felipe/Voss A 3 1,710,531 271,586 15.9% 0 0.0% 271,586 15.9% 14.7% -15,348 21,232 $30.75 B 32 3,357,119 285,972 8.5% 22,748 0.7% 308,720 9.2% 9.0% -4,060 24,004 $19.36 C 3 161,393 32,136 19.9% 0 0.0% 32,136 19.9% 18.8% -1,744 -7,819 $16.49 Total 38 5,229,043 589,694 11.3% 22,748 0.4% 612,442 11.7% 11.2% -21,152 37,417 $23.51 South A 1 80,000 19,000 23.8% 0 0.0% 19,000 23.8% 23.8% 0 1,500 $26.63 B 15 602,907 97,038 16.1% 0 0.0% 97,038 16.1% 12.7% -7,000 -3,888 $19.62 C 4 223,029 39,529 17.7% 0 0.0% 39,529 17.7% 17.9% 368 -977 $14.78 Total 20 905,936 155,567 17.2% 0 0.0% 155,567 17.2% 15.0% -6,632 -3,365 $19.29 South Main/Med Center A 15 4,159,577 324,246 7.8% 0 0.0% 324,246 7.8% 6.9% -17,283 14,320 $29.35 B 34 4,005,469 309,992 7.7% 4,800 0.1% 314,792 7.9% 8.5% 6,734 -3,986 $22.84 C 31 2,453,446 107,776 4.4% 0 0.0% 107,776 4.4% 4.8% -2,533 1,950 $19.31 Total 80 10,618,492 742,014 7.0% 4,800 0.0% 746,814 7.0% 7.0% -13,082 12,284 $24.74 Southeast/Outlier A 1 159,304 0 0.0% 0 0.0% 0 0.0% 0.0% 0 0 - B 9 520,515 103,077 19.8% 0 0.0% 103,077 19.8% 19.8% 0 -18,800 $20.56 C 2 118,772 12,533 10.6% 0 0.0% 12,533 10.6% 55.0% 0 0 $24.00 Total 12 798,591 115,610 14.5% 0 0.0% 115,610 14.5% 16.4% 0 -18,800 $20.97 Southwest A 6 1,501,746 319,312 21.3% 0 0.0% 319,312 21.3% 29.0% 110,609 16,998 $16.15 B 59 6,017,052 1,286,043 21.4% 7,500 0.1% 1,293,543 21.5% 22.6% 41,981 -122,584 $16.26 C 41 2,325,162 226,576 9.7% 27,670 1.2% 254,246 10.9% 9.4% -26,149 4,294 $12.25 Total 106 9,843,960 1,831,931 18.6% 35,170 0.4% 1,867,101 19.0% 20.2% 126,441 -101,292 $15.70 Southwest Far and Outlier A 2 87,710 10,505 12.0% 0 0.0% 10,505 12.0% 9.1% -2,553 0 $25.35 B 14 616,117 76,118 12.4% 1,365 0.2% 77,483 12.6% 11.8% -4,479 5,620 $26.76 C 3 128,735 1,000 0.8% 0 0.0% 1,000 0.8% 0.0% -1000 0 $16.00 Total 19 832,562 87,623 10.5% 1,365 0.2% 88,988 10.7% 9.7% -8,032 5,620 $26.43 COLLIERS INTERNATIONAL | P. 6

- 7. RESEARCH & FORECAST REPORT | Q2 2011 | HOUSTON OFFICE MARKET HOUSTON SUBURBAN OFFICE MARKET SUMMARY INVENTORY DIRECT VACANCY SUBLEASE VACANCY VACANCY VACANCY RATE (%) NET ABSORPTION (SF) RENTAL RATE Class # of Bldgs. Total (SF) (SF) Rate (%) (SF) Rate (%) Total (SF) Q2-2011 Q1-2011 Q2-2011 Q1-2011 Avg. ($/SF) West Loop/Galleria A 40 16,207,654 1,539,832 9.5% 67,024 0.4% 1,606,856 9.9% 10.0% 38,983 8,513 $27.96 B 54 5,665,149 1,218,433 21.5% 5,482 0.1% 1,223,915 21.6% 22.7% 56,703 29,970 $20.35 C 6 332,166 0 0.0% 0 0.0% 0 0.0% 0.0% 0 940 $16.75 Total 100 22,204,969 2,758,265 12.4% 72,506 0.3% 2,830,771 12.7% 13.1% 95,686 39,423 $25.49 Westchase A 27 7,861,857 1,068,173 13.6% 50,047 0.6% 1,118,220 14.2% 14.2% 1,004 182,004 $27.73 B 51 4,939,227 904,412 18.3% 48,571 1.0% 952,983 19.3% 18.7% 8,905 -168,429 $18.12 C 9 439,977 36,542 8.3% 0 0.0% 36,542 8.3% 10.9% 11,485 5,398 $15.08 Total 87 13,241,061 2,009,127 15.2% 98,618 0.7% 2,107,745 15.9% 15.8% 21,394 18,973 $22.85 The Woodlands A 15 2,248,601 437,090 19.4% 15,651 0.7% 452,741 20.1% 20.8% 15,523 17,377 $29.98 B 59 3,185,142 475,422 14.9% 43,243 1.4% 518,665 16.3% 15.2% 9,157 57,550 $19.82 C 5 370,876 26,221 7.1% 0 0.0% 26,221 7.1% 6.3% -1,311 8,957 - Total 79 5,804,619 938,733 16.2% 58,894 1.0% 997,627 17.2% 16.8% 23,369 83,884 $24.11 OFFICE DEVELOPMENT PIPELINE Houston’s development activity increased slightly during the second quarter, with six projects under construction. The Redstone Group in partnership with Stream Realty Partners held a groundbreaking ceremony in June for BBVA Compass Bank’s new 5 6 home, 2200 Post Oak Blvd. The 306,000 square foot, Class A office building is 2 scheduled for completion in April 2013. BBVA Compass Bank will occupy about half of the building. 4 Griffin Partners’ four-story, 102,000 SF Nassau Bay Town Square office building is located in the NASA/Clear Lake submarket. This pre-certified LEED Silver office building is scheduled to come on line 60% pre-leased with Hamilton Sundstrand Corporation as the lead tenant. Also included in the 781,000 SF currently under construction is Greenwood Corporation’s 156,000 SF Chasewood Crossing II in the FM 1960-Highway 1 249 submarket (scheduled for completion in July 2011). Trammell Crow Company’s Hess Tower (formerly Discovery Tower) was delivered during the second quarter, adding 845,000 square feet to the CBD Class A office market. The building is 100% leased by Hess Corporation, who will be vacating their 3 space in One Allen Center to move into the building sometime during the third quarter. Halliburton broke ground on a 100,000 SF office building located in its 94-acre North Belt Campus, situated just south of Beltway 8 and Houston’s George Bush Intercontinental Airport. The campus will house approximately 2,200 employees and includes a new Research and Development facility featuring state-of-the-art laboratories, two new parking garages, a new cafeteria and new childcare and employee wellness and fitness centers. The building is being developed by D. E. Harvey Builders and is scheduled for completion in January 2013. SELECT OFFICE BUILDINGS UNDER CONSTRUCTION EST. BUILDING NAME ADDRESS SUBMARKET SF PRE-LEASED DEVELOPER DELIVERY 1 BBVA Compass/2200 Post Oak 2200 Post Oak Blvd. Galleria/Uptown 306,012 51.1% Redstone and Stream 4/2013 2 Chasewood Crossing II 19450 State Hwy 249 FM 1960/Hwy 249 156,000 0.0% Greenwood Corporation 7/2011 3 Nassau Bay Town Square I 18050 Saturn Ln NASA/Clear Lake 100,000 60.0% Griffin Partners Inc. 9/2011 4 Halliburton North Belt Campus Milner Road North Belt/Greenspoint 100,000 100.0% D. E. Harvey Builders 1/2013 5 Research Forest Lakeside 2 9320 Lakeside Blvd Woodlands 68,500 0.0% Warmack & Co 9/2011 6 Technology Forest Professional 4055 Technology Forest Woodlands 50,000 50.0% Woodlands Land Dev 12/2011 Total SF Under Construction 780,512 COLLIERS INTERNATIONAL | P. 7

- 8. RESEARCH & FORECAST REPORT | Q2 2011 | HOUSTON OFFICE MARKET Colliers International Statistics Revenues: $1.9 Billion Countries: 61 Offices: 480 Professionals & Staff: 15,052 Brokers: 4,788 Square Feet Managed: 2.4 Billion Lease/Sale Transactions: 135,977 Total Transaction Value: $53 Billion COLLIERS INTERNATIONAL | HOUSTON 1300 Post Oak Boulevard Suite 200 Houston, Texas 77056 MAIN +1 713 222 2111 Accelerating success. COLLIERS INTERNATIONAL | P. 8