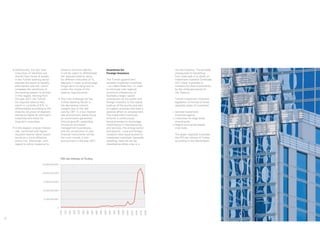

This document, issued by HSBC Bank in collaboration with PricewaterhouseCoopers, outlines the business environment in Turkey, highlighting its economic growth, legal framework, and attractive investment climate for foreign investors. Turkey is considered an emerging market with significant potential, driven by a young population and advantageous geographic positioning. The publication emphasizes the importance of consulting specific professional advice before acting on the information provided, as it reflects general trends rather than detailed analysis.