The document summarizes Turkey's economy in 2015. It notes that while Turkey's ambitious economic targets for 2023 are being boosted by a declining current account deficit partly due to lower oil prices, substantial structural reforms will likely be needed to regain strong growth. These include achieving political stability to attract more investor interest in privatization efforts. The construction sector has been a leading driver of GDP growth in recent years and is set to continue expanding given planned infrastructure investments. Agriculture also remains important as Turkey is a top global producer of many crops.

![ECONOMY OVERVIEW

purchasing power parity. In real terms, GDP rose by

over 60%, while GDP per capita was up 40%.

The government has also been keen to stress its

stewardship of public finances. During the height of

the euro crisis at the end of 2011, for example,

Turkey’s performance compared favourably with that

of its European neighbours. Turkey’s budget deficit

at the time stood at 2.5% of GDP, within the EU

benchmark of 3% and well below that of its troubled

European neighbour, Greece, at close to 10%. A

decade of single party governments has also brought

public debt under control. At nearly 80% of GDP in

2001, it fell to 36% by 2013, substantially below

Greece (142.8%), Italy (119%) and Portugal (93%).

By 2016, the World Bank predicts it will reach 33%.

MAKING THE GRADE:Thecountrywasrewardedfor

itscoursecorrectionin2013,whenMoody’sInvestors

Service raised Turkey’s sovereign bond rating to

investmentgrade,bumpingitupfrom“Ba1”to“Baa3”,

with a stable outlook. This gave Turkey the same

credit rating as India, Spain and Columbia, bolster-

ing hopes it would attract a wider investor base.

However, by April 2014 Moody’s revised the coun-

try’s outlook from stable to negative, citing greater

external financing vulnerability due to lower global

liquidity and domestic political uncertainty, as well

as less optimistic near- and medium-term growth

forecasts. Moody’s most recently upheld this posi-

tion in April 2015. In terms of the banking sector, in

March2015Moody’salsoreaffirmeditsnegativeout-

look for the second year running, after putting 10

of its banks on notice for downgrades in early 2014

and lowering various ratings of 11 banks that June.

Standard and Poor’s (S&P) has been similarly bear-

ish. As the only one of the big three credit ratings

agencies not to grant Turkey investment-grade sta-

tus, S&P has maintained a “BB+” rating with a neg-

ative outlook, the highest junk status. However,

according to statements from Nihat Zeybekci, min-

ister of economic affairs, the outcome of the June

elections could have a positive impact on ratings.

BIG PLANS: Turkey’s track record over the last

decade has encouraged the government to set high-

ly ambitious growth targets for the country’s econ-

omy. Between 2014 and 2023 the government is

working to boost GDP from around $800bn to $2trn;

GDP per capita from $10,400 to $25,000; and total

exports from $157.6bn to $500bn.

For some time analysts have warned that it will be

difficult to replicate the performance of the past

decade, and that such ambitious growth figures can-

not be sustained with a burgeoning current account

deficit (CAD) and the structural problems that cre-

ated it. In January 2014 Sinan Ülgen, the director of

the Istanbul-based, Centre for Economics and For-

eign Policy Studies, told the press that Turkey’s

growth model based on low global interest rates and

large capital inflows was outdated. “For years, it has

been clear that this model would come to an end

the moment central banks, like the [US Federal

Reserve], started raising interest rates again.”

UP & AWAY: Much of Turkey’s growth since 2008

has been based on domestic consumption, rapid

credit expansion, and the construction and servic-

es sectors. This has led to rising energy and inter-

mediate imports to fuel manufacturing and exports.

While the loan-to-deposit ratio of the banking sec-

tor stood at 40% in 2003, from 2010 to end-2013 it

grew from 88% to 114%, according to Moody’s.

Although the sector’s 13.4% core tier-1 capital ade-

quacy ratio insulates it from a certain degree of risk,

banks are still exposed to market turbulence, espe-

cially with leverage rising from 8x to 9x since 2010.

Consumer debt has also increased, from 4.3% of

household disposable income in 2002 to 55% by the

end of 2013. Credit card debt alone rose by 22% in

2013 on the back of a 31% rise in 2012. Such con-

sumer-led growth is unsustainable in the long run.

STRUCTURAL CONCERNS: To achieve this kind of

persistent growth again, Turkey needs to do more to

tackle the problems of low-value production and

28

Credit card debt rose by 31% in 2012 and 22% in 2013

Between 2014 and 2023

the government is working

to boost GDP from around

$800bn to $2trn; GDP per

capita from $10,400 to

$25,000; and total exports

from $157.6bn to $500bn.

www.oxfordbusinessgroup.com/country/turkey

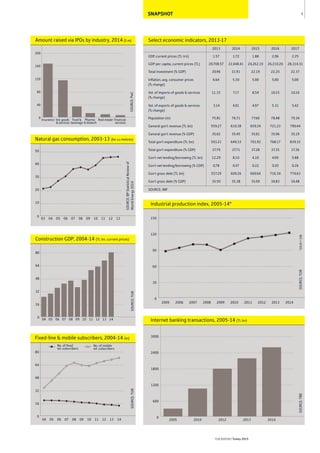

SOURCE: IMF

2014 2015 2016

GDP, current prices (TL trn) 1.72 1.88 2.06

GDP per capita, current prices (TL) 22,448.41 24,262.19 26,210.20

Total investment (% GDP) 21.91 22.19 22.25

Inflation, avg. consumer prices (% change) 5.30 5.00 5.00

Vol. of imports of goods & services (% change) 7.17 8.54 10.15

Vol. of exports of goods & services (% change) 4.01 4.97 5.31

Population (m) 76.71 77.60 78.48

General gov't revenue (TL bn) 610.38 659.24 721.23

General gov't revenue (% GDP) 35.45 35.01 35.06

Total gov't expenditure (TL bn) 649.33 701.92 768.17

Total gov't expenditure (% GDP) 37.71 37.28 37.35

Gov't net lending/borrowing (TL bn) 8.10 4.10 4.09

Gov't net lending/borrowing (% GDP) 0.47 0.22 0.20

Gov't gross debt (TL bn) 609.26 660.64 716.34

Gov't gross debt (% GDP) 35.38 35.09 34.83

Select economic indicators, 2014-16](https://image.slidesharecdn.com/bc9404e3-9a0b-49e9-8bf3-2bf8b66261b3-150621145612-lva1-app6891/85/Turkey-2015-30-320.jpg)

![ECONOMY OVERVIEW

growth being fuelled by imports and short-term cap-

ital flows. According to the IMF roughly 75% of the

downward adjustment in the current account in

2012camefromacyclicaldropinimportsandunusu-

ally large net exports of gold. It was also the result

of a decline in investment rather than an increase

in savings. The fund’s annual staff report on Turkey

from 2014 notes, “The current account deficit

remains 2.5-5% of GDP higher than warranted by

fundamentals and optimal policy settings.”

Turkey’s reliance on imported energy is one of the

main factors behind the deficit. Indeed, the coun-

try’s net energy import bill reached $55bn in 2014,

with net energy imports accounting for 74% of ener-

gy use and 59% of electricity generation.

TAPER TANTRUM: Given the size of the CAD, the

country is particularly vulnerable to any external

shocks that could halt capital inflows, which are cur-

rently financing Turkey’s deficit. In the event of an

abrupt and pronounced reversal of inflows, the econ-

omy would almost certainly face a rough and rapid

adjustment leading to negative growth. Although

analystshavewarnedofthisscenarioforyears,avari-

ety of internal and external factors gained pace in

2013, lending greater credence to risk assessments.

In May 2013 the US Federal Reserve announced

that it might begin to wind down its large-scale asset

purchases. The programme, enacted in response to

the global financial crisis, has spurred lower US inter-

est rates, bringing greater liquidity to emerging mar-

kets offering higher returns. The tapering, which

began in December 2013, signals an eventual US

interest rate hike, which is likely to have a negative

impact on portfolio investment in emerging mar-

kets. However, weaker than expected job and infla-

tion figures in March 2015 have fuelled expectations

that the increase will not happen before September.

A reversal in investment flows is particularly trou-

blesome for a country like Turkey, which has become

so highly dependent on short-term capital inflows.

However, according the IMF, low interest rates in the

EU and Turkey’s investment-grade status could help

to mitigate this effect, creating more of a “mixed”

environment for capital flows. The Foreign Econom-

ic Relations Board (DEİK), having been restructured

in September 2014, is focused on reaching the Vision

2023 targets of boosting exports to $500bn and

the volume of foreign trade to $1trn. To this end, DEİK

works with international organisations to bolster

ties with the global business community and increase

opportunities for domestic firms (see interview).

EXTERNAL EXPOSURE: The more pressing concern

for Turkey at present is the amount of foreign debt

held that is set to mature in the near term. The short-

term external debt stock on a remaining maturity

basis, meaning debt that is set to mature within one

year, stood at $164.9bn as of end-February 2015, up

26% since the end of 2011. The vast majority – over

85% – of this debt is held by the private sector, with

more than two-thirds accounted for by banks. While

this increases economic vulnerability and presents

a long-term challenge to sustainable growth, the

banking sector has had “no difficulty in rolling over

its external borrowings and has adequate buffers

against any [foreign exchange] liquidity shocks that

may emanate from abroad”, according to the TCMB’s

most recent Financial Stability Report from Novem-

ber 2014. Moody’s has echoed this view, noting that

the country’s banks, corporates and public institu-

tions alike have historically been able to roll over

maturing debt even during times of crisis.

CURRENCY WOES: The currency composition of

Turkey’s short-term external debt stock is also note-

worthy, particularly in light of recent depreciations

in the lira. According to the TCMB, as of the end of

February 2015, just 12.1% of all short-term external

debt was denominated in lira, while more than half

was in US dollars and nearly one-third was in euros.

The CAD, fed by high imports, a substantial trade

deficit and newly vulnerable to capital outflows, has

had a sizable impact on the strength of the lira. The

currency depreciated 28% against the dollar between

May 2013 and the end of 2014, before falling by

another 15% through to the end of April 2015.

The depreciation of the lira has also been exacer-

bated by risk-averse local actors. According to Ozer

Balkız, the director of economic research at the Inde-

32

Just 12.1% of short-term external debt was denominated in lira as of the end of February 2015

According the IMF, low

interest rates in the EU

and Turkey’s

investment-grade status

could help to mitigate the

effect of a US interest rate

hike on capital flows.

The short-term external

debt stock on a remaining

maturity basis stood at

$164.9bn as of the end of

February 2015, up 26%

since the end of 2011.

www.oxfordbusinessgroup.com/country/turkey

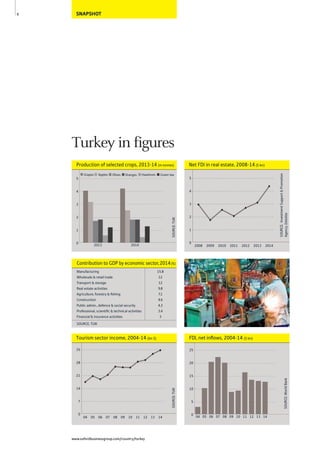

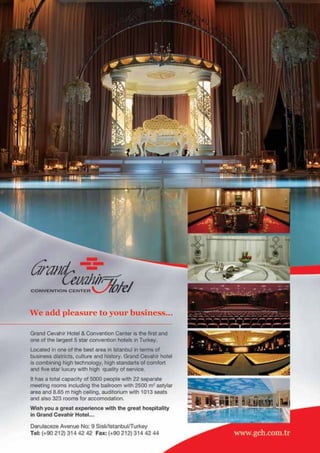

SOURCE: TUIK

Manufacturing 15.8

Wholesale & retail trade 12

Transport & storage 12

Real estate activities 9.8

Agriculture, forestry & fishing 7.1

Construction 4.6

Public admin., defence & social security 4.2

Professional, scientific & technical activities 3.4

Financial & insurance activities 3

Other 28.1

Contribution to GDP by economic sector,2014(%)](https://image.slidesharecdn.com/bc9404e3-9a0b-49e9-8bf3-2bf8b66261b3-150621145612-lva1-app6891/85/Turkey-2015-34-320.jpg)

![ECONOMY OVERVIEW

pendent Industrialists and Businessmen’s Associa-

tion, “Turkey is a dollarised economy. When some-

thing bad happens, not only corporates, but also

consumers go into foreign exchange.” Since mid-

2013 many Turkish residents have been transferring

their bank deposits into foreign currencies – name-

ly euros, dollars and sterling – in an attempt to pro-

tect themselves from further currency volatility.

The instability of the lira has left the banking and

business sector exposed to substantial risk, given the

private sector’s share of foreign currency debt.

According to Emre Sezan, head of equity research

at İş Investment, private sector foreign currency net

debt stands at 22% of GDP, and depreciation of the

lira will necessarily increase the cost of servicing

these loans. According to the TCMB’s November

2014 report, currency risk is comparably higher

amongst electricity producing firms and real estate

investment companies, as they generate less revenue

inforeigncurrencies.However,non-performingloans

have been stable thus far, at 2.6-2.7% since 2011.

The depreciation of the euro against the dollar has

also had an effect on the corporate segment, with

45% of the country’s exports invoiced in euros,

according to the World Bank. This in turn has made

it more difficult for firms to finance dollar-denom-

inated imports, though the impact on the wider

economy has been negligible.

DOMESTIC DEMAND: In general terms, the new

regulations regarding consumer credit introduced

in early 2014 could have a negative effect on domes-

tic demand, though they are also likely to improve

the consumer loan portfolios of banks. Domestic

uncertainty ahead of the June 2015 general elec-

tions is also depressing demand. According to the

World Bank’s April 2015 Regular Economic Note,

consumer confidence is at its lowest level since

March 2009, when the global economy was in the

throes of the financial crisis. While major spending

decisions by households and corporates are being

put off until after the elections, the World Bank’s

3% GDP growth forecast for 2015 assumes that

domestic demand will recover shortly thereafter.

COURTING CONFIDENCE: In the short term,

Moody’s outlook downgrade in April 2014, which it

reaffirmed most recently in April 2015, is unlikely to

have a dramatic impact. However, if Turkey were

downgraded further, losing its investment grade sta-

tus, the country could witness more serious capital

outflows. According to Moody’s, while the country’s

sovereign rating is unlikely to see any improvements

in the near term, a move backwards in terms of pub-

lic finances, heightened political instability or a dete-

rioration in its external finances are all possible alert

signals for a ratings downgrade.

Fortunately, the government has had few problems

with its external financing needs. In April 2015 Turkey

issued a $1.5bn dollar-denominated bond with a

yield of 4.4% – some 250 basis points over compa-

rable US Treasury bills, according to the Turkish Treas-

ury. Combined with another $1.5bn issue in January,

this sale marks $3bn out of the $4.5bn in planned

issues for 2015. Oversubscribed by five times, the

April sale signals continued interest in the country’s

sovereign debt from international investors. Indeed,

just15%ofthebondsweresoldtodomesticinvestors.

MEASURED PROGRESS: Further improvements to

Turkey’s external position could be in the offing. As

of February 2015 the CAD was down by nearly 9%

from $46.9bn in September 2014 to $42.8bn, driv-

en by a $3.1bn drop in the energy deficit and a $2.1bn

adjustment on higher gold exports. This represents

a drop from 5.8% of GDP to 5.4% over the period.

Looking ahead, the depreciation of the lira should

also have a positive impact on exports and the cur-

rent account. Balkız told OBG, “We do not want the

lira to go to 2 [against the dollar] again, because it

kills the competitiveness of Turkish exports. We see

the effect of exports increasing. As developed coun-

tries show better performances, this is good for us.

Also, it will be positive for the CAD.” Indeed, most pre-

dictions are for a further contraction of the CAD in

2015. According to the World Bank, weak oil prices

could help cut it to 4.4% of GDP, which should help

to reduce the country’s external financing burden

from $220bn in 2014 to $200bn in 2015.

OUTLOOK: While a reduction in external vulnerabil-

ities is welcome in the short term, it belies persist-

ent structural concerns. As it stands, the country

remains reliant on domestic demand and a large

CAD to reach its growth targets, generate sufficient

employment or boost per capita income. In the long

run,thecountryneedstoaddresssupply-sidereforms

such as labour market regulations and education.

While Turkey has recorded impressive growth in

the past decade, it may have reached its limit with-

out substantial structural overhauls of the econo-

my. If the country can overcome the current investor

uncertainty and improve productivity through much-

needed reforms, the ambitious growth targets

set by the government could eventually be reached.

34

Since mid-2013 many Turkish residents have been transferring their bank deposits into foreign currencies

Turkey issued a $1.5bn

dollar-denominated bond

in April 2015, its second of

the year. The sale, which

was oversubscribed by five

times, is indicative of

continued interest in the

country’s sovereign debt.

As of February 2015 the

current account deficit

was down by nearly 9%

from $46.9bn in

September 2014 to

$42.8bn. This represents a

drop from 5.8% of GDP to

5.4% over the period.

www.oxfordbusinessgroup.com/country/turkey](https://image.slidesharecdn.com/bc9404e3-9a0b-49e9-8bf3-2bf8b66261b3-150621145612-lva1-app6891/85/Turkey-2015-36-320.jpg)

![ENERGY OVERVIEW

of Turkey’s total energy needs. The plant began oper-

ations in the third quarter of 2014.

RENEWABLES: Turkey could also boost supply more

sustainably.Greenpeacesaysrehabilitatingageinginfra-

structurewouldsave16%ofelectricitywastedintrans-

mission.Environmentalistsalsopointtosunlight,wind,

biomass and rivers as sources of relief. Green energy

is only now being tapped, accounting for just 25% of

theenergymix(nearlyallfromhydroelectricity),accord-

ing to the state Electricity Generation Company.

Published at the end of 2014, the National Renew-

ableEnergyActionPlanoutlinesthecountry’sapproach

for developing renewable sources of energy. By 2023

Turkeywantstoexploitallviablehydroelectricresources,

up from the current 50%. The country has 1% of the

world’s hydropower potential, and 16% of Europe’s.

That could produce about 128bn KWh, according to

state estimates. But hydropower rouses mixed feel-

ings. Although it generates almost no carbon emis-

sions,thedammingofriversharmsbiodiversityandlocal

populations’ ways of life. The government appears to

havetakenastepbackfromitspreviousunbridledsup-

port for smaller hydropower projects, especially run-

of-riverdams.Inlate2013theEnvironmentandUrban

Planning Ministry said it would no longer back hydro

projects with capacity below 10 MW. Environmental-

ists fear this may prompt the government to resume

mega-damprojects,liketheIlısuDaminsouth-eastern

Turkey, which threatens to submerge the ancient city

ofHasankeyf.Acourtin2013blockeditsconstruction;

however, activists report that work quietly continues,

such as resettling residents, despite the injunction.

WIND-BLOWN:Turkeyranks16thinwind-energycapac-

ity worldwide, with installed capacity of 3.7 GW and

another 11 GW in the pipeline. Its wind potential rivals

that of Spain, according to MENR. “Wind energy is

becomingincreasinglyimportantinTurkey.Inthepast,

connectioncapacitylimitedtheamountofwindlicences

thatcouldbeawarded,butnowimprovementsintrans-

missionandgridtechnologyshouldresultinanincrease

in the number of available licences,” said Serdar Nişli,

chief executive at Aksa Energy, one of Turkey’s biggest

power producers. “Improved wind-capturing technol-

ogyhasalsoresultedinhighercapacityutilisationrates,

making the economics of certain sites more viable.”

The Energy Market Regulatory Authority (EPDK)

received over 1500 applications for 600-MW wind

licences that were being tendered in 2014, according

to local media. “Growth potential in the Turkish wind

sector is higher than in Europe, as there are better

wind sites available. That said, many of the best sites

havealreadybeendeveloped,andlower-windsitesare

harder to make economically viable. Turkey needs to

concentrateoninvestingindevelopingbetterwind-cap-

turetechnology,”saidMaltepe.Windturbinesdesigned

tocapturemoreenergyareneededforsuchlesser-rat-

ed sites. Turkey has a manufacturing base for blades

andtowers,butnoturbineproduction;thereforeoper-

ators must import key components. Better education

isneededassomedevelopersareusingtechnologythat

is incompatible with their licensed site, Nişli told OBG.

NEW COSTS & DELAYS: Changes to regulations gov-

erningforestrylandcouldsteeplyraiserentalcostsfor

wind-farmoperatorsonstate-ownedpropertiesandban

certainregionsoutrightthattheForestryMinistrywants

to protect. Some €1.5bn of wind-energy projects are

on hold, according to Mustafa Serdar Ataseven, chair-

man of the Turkish Wind Energy Association.

“Projects approved in the last quarter of 2011 were

first hampered by problems with radar. After that was

resolved, permission was suddenly required from the

National Intelligence Organisation, which was also

resolved,butthennationalisationfromtheprimemin-

ister’s office has slowed because of a backlog there.

Trouble stemming from permission [to build] in forest-

land has been under way for a year,” Ataseven told

trade magazine GreenPower in March 2014. Industry

insiders say another 800 MW of wind power could

become available if the forestry dispute is resolved.

SUN-KISSED: Turkey’s raw solar potential rivals that

of Europe’s sunniest nations, including Spain and Italy.

It ranks 27th in the world for solar capacity. The aim is

to lift capacity to 3000 MW by 2023, according to the

Renewable Energy Law, ratified in 2011. Currently,

expensive large-scale projects are mainly in the hands

of state bodies, like the solar photovoltaic array cover-

ing 10,000 sq metres near the city of Izmir on the

Aegean coast. It was expected to come online in mid-

2014 and produce 493 KW to power three municipal

facilities, Radikal newspaper reported, but at the time

of writing had yet to begin production.

The EPDK held a second round of bidding for 2 GW

worth of solar licences in January 2015, and as OBG

wenttopress,thewinnerswereawaitingconfirmation

oftheirawardforthe5-MWand8-MWprojectsinthe

Erzurum and Elazığ regions, respectively. There will be

additionaltendersfor302MWofnewsolarphotovolta-

ic capacity at the end of April 2015, according to the

Turkish Electricity Transmission Company (TEİAŞ).

Additionalmarketdevelopmentsincludetheentrance

of Germany’s energy firm Conergy, and a joint venture

involving the UK's Belectric, which tendered success-

fullytoTEİAŞfortwolarge-scale,ground-mountedsolar

energy projects. The two projects have a combined

101

THEREPORT Turkey 2015

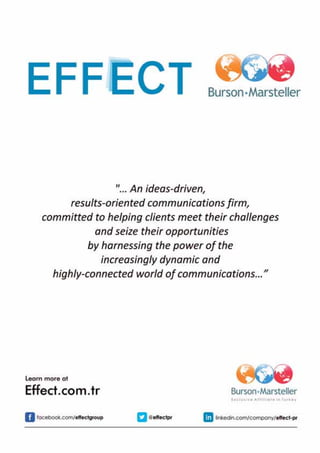

SOURCE:BPStatisticalReviewof

WorldEnergy2014

Coal production, 2003-13 (m toe)

0

4

8

12

16

20

20132012201120102009200820072006200520042003

Green energy is only now

being tapped and accounts

for just 25% of the energy

mix, and almost all of that

is from hydroelectricity,

according to figures from

the state Electricity

Generation Company.](https://image.slidesharecdn.com/bc9404e3-9a0b-49e9-8bf3-2bf8b66261b3-150621145612-lva1-app6891/85/Turkey-2015-103-320.jpg)