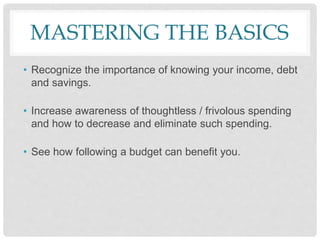

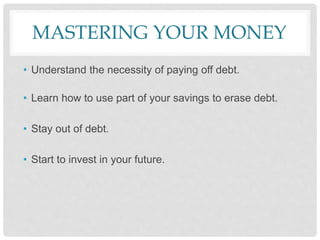

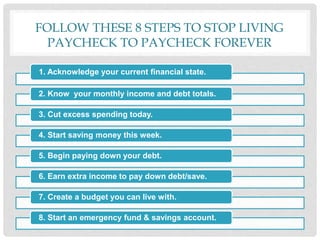

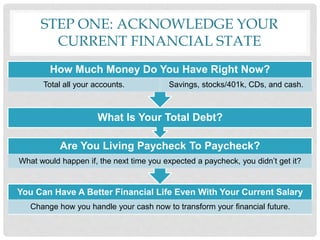

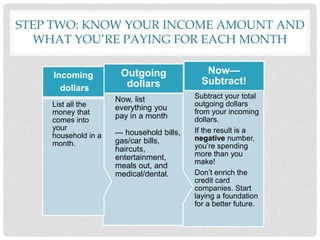

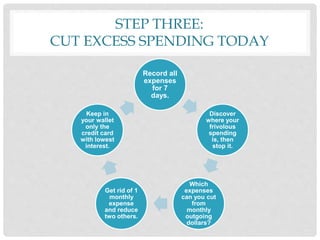

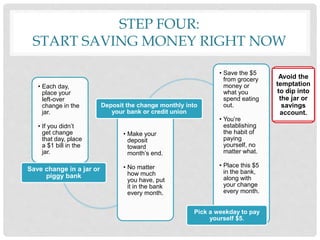

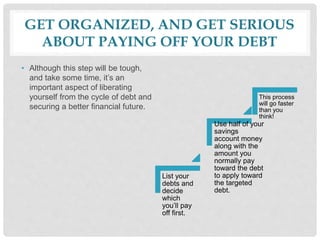

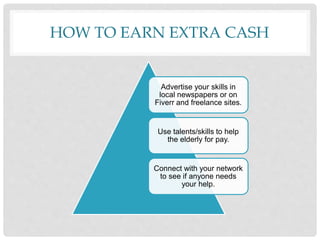

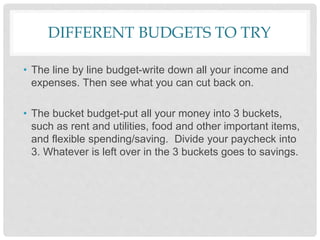

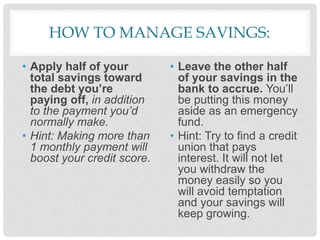

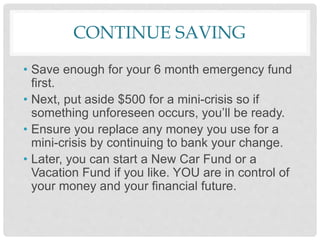

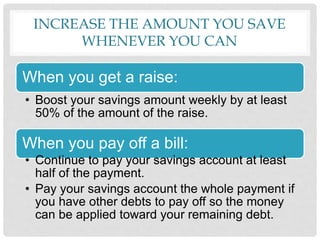

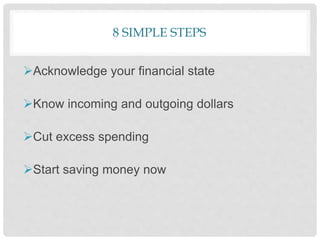

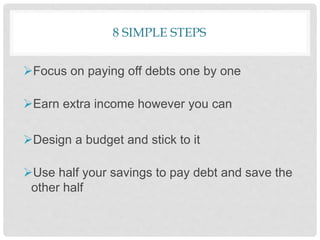

The document outlines a guide to financial stability, advising individuals on managing their finances to break free from living paycheck to paycheck. It details eight essential steps, including acknowledging one's financial status, cutting unnecessary expenses, saving money, paying off debts, earning extra income, and creating a realistic budget. The aim is to promote awareness of spending habits and encourage the establishment of savings and financial security.