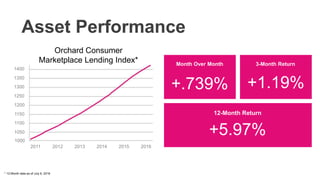

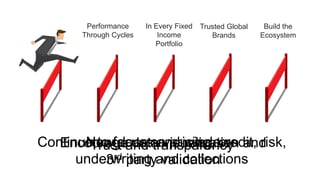

The document discusses the evolution and challenges of marketplace lending and fintech, highlighting its potential to reshape personal finance through technology. Key takeaways include the importance of trust and transparency, the need for sound underwriting practices, and ongoing issues like economic downturns and rising interest rates. The presentation emphasizes the significance of building sustainable companies and the global opportunities within the fintech space.