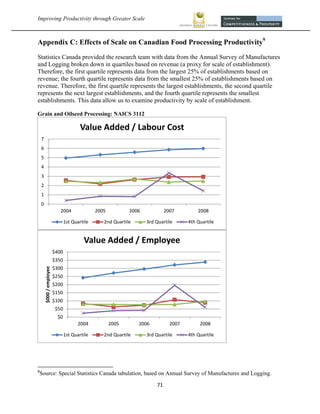

The document analyzes the relationship between scale and productivity in Canada's food processing sector. It finds that:

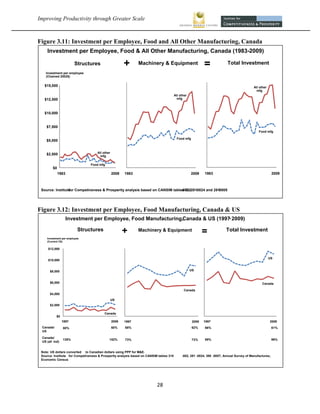

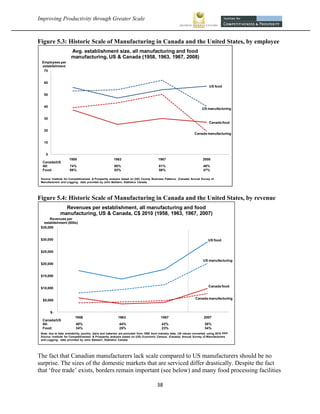

- Canadian food processors are significantly smaller in scale than their US counterparts, with half the employees and sales.

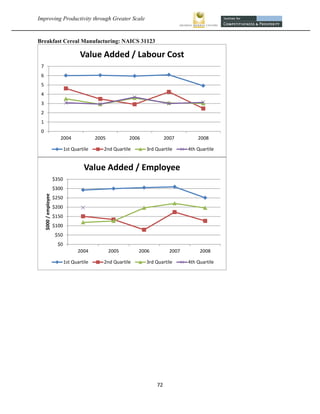

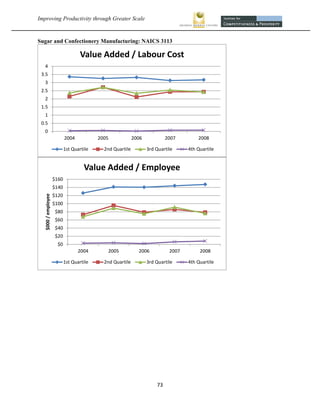

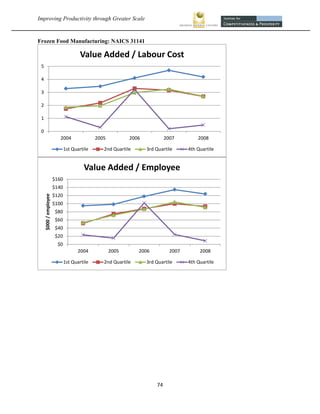

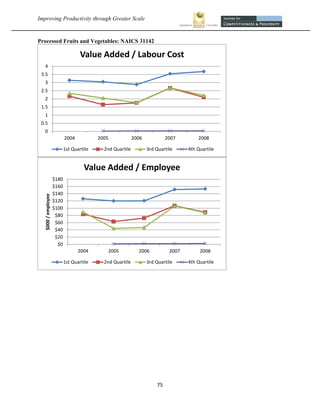

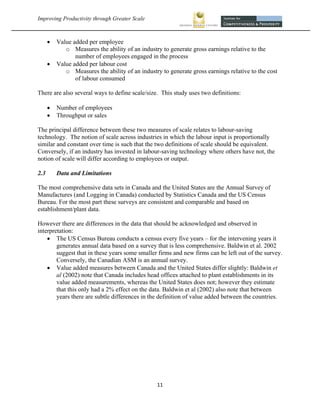

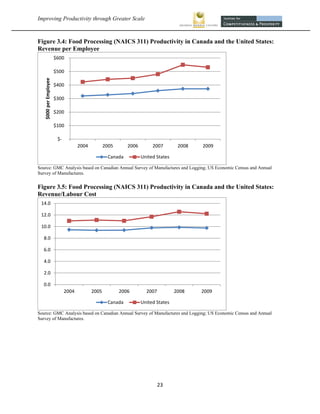

- Larger facilities are more productive, with value added per employee twice as high for large vs median facilities. Canada's smaller scale hurts overall productivity.

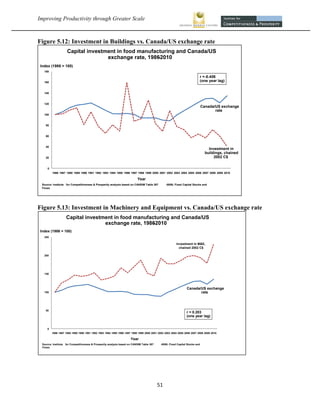

- Investment in machinery and equipment per worker is lower in Canada.

- Barriers like marketing regulations, border effects, and allocation of supply limit the scale of Canadian firms.

Increasing scale through policy reforms could help narrow Canada's productivity gap with the US in the food processing industry.

![Improving Productivity through Greater Scale

Martin, L. H. Mayer and J. Bouma.Benefits and Costs of a Voluntary Wheat Board for the

Province of Alberta.A George Morris Centre and Toma and Bouma publication. 2002.

McKenzie, K.J. and J.M. Mintz.“Tax Effects on the Cost of Capital: A Canada-United States

Comparison” in Canada- US Tax Comparisons, J. Whalley and J. Shoveneds.NBER Research

Volume, University of Chicago.189-216. 1992.

McKenzie, K.J. and A. J. Thompson. “Taxes, the Cost of Capital and Investment: A Comparison

of Canada and the United States”. Technical Committee on Business Taxation.Working Paper

97-3, Department of Finance, Ottawa, Ontario. 1997.

Morrison Paul, C.J. “Cost Economies and Market Power: The Case of the U.S. Meat Packing

Industry”, The Review of Economics and Statistics 83 (3) 531-540. 2001.

Myers, J. Invest to Grow: Technology, Innovation and Canada’s Productivity Challenge. A

Canadian Manufacturers and Exporters Publication. 2010. http://www.cpia-aci.ca/government-

affairs/docs/invest2grow_e.pdf

OECD. “Defining and Measuring Productivity”. Retrieved on July 20, 2011 from

http://www.oecd.org/dataoecd/4/57/40526851.pdf

Rao, S. T. Tang and W. Wang. “What explains the Canada-US productivity gap?”Canadian

Public Policy.34(2).163-192. 2008.

Sabourin, D. Skill Shortages and Advanced Technology Adoption. Research Paper Series,

Analytical Studies Branch No. 11F0019MPE No. 175. Ottawa: Statistics Canada. 2001

Sosland, M. 1997. The State of the North American Cereal Processing Sector. Speech given at

the Moving Up Market Conference, Calgary, AB. November 4.

Tirole, J..The Theory of Industrial Organization. Cambridge, MA: The MIT Press. 1988.

United States Department of Commerce (International Trade Administration).Employment

Changes in US Food Manufacturing: The Impact of Sugar Prices. 2006.

http://trade.gov/media/Publications/pdf/sugar06.pdf

Western Canadian Wheat Growers’ Association. 2010. Submission to the Rail Freight Service

Review Panel. April 30, 2010.

Williamson, O.E. The Economic Institutions of Capitalism. New York: The Free Press. 1985.

Wijnands, J.H.M, B.M.J. van der Meulen, and K.J. Poppe [eds]. Competitiveness

of the European Food Industry:An economic and legal assessment-2007. Luxembourg: Office

for Official European Union Publications. 2007.

World Economic Forum. The Global Competitiveness Report 2008-2009. 2009.

62](https://image.slidesharecdn.com/productivity-1330222681165-phpapp01-120225202000-phpapp01/85/Productivity-62-320.jpg)