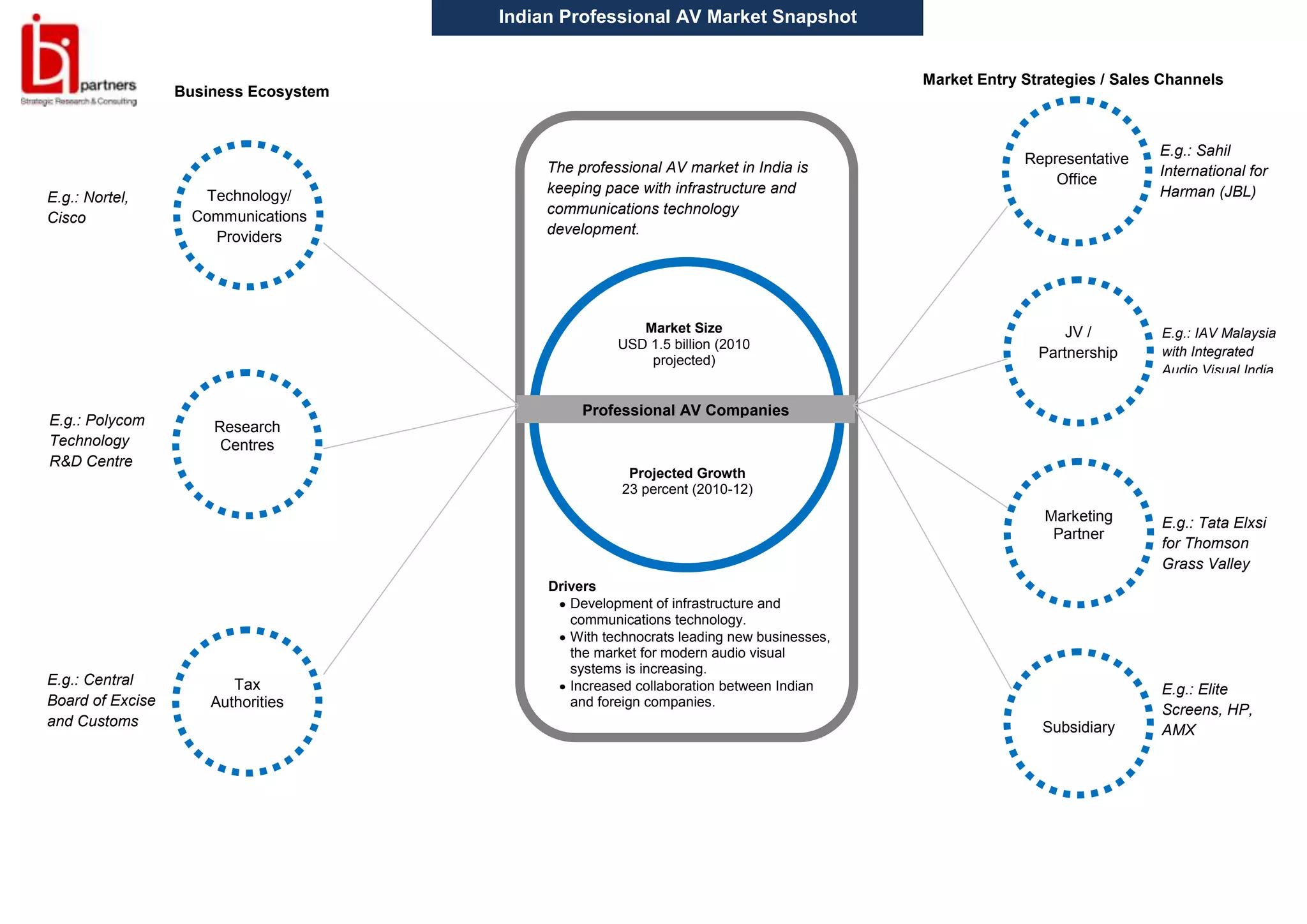

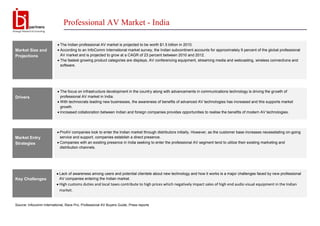

The document discusses the professional audio visual (AV) market in India. It states that the Indian professional AV market is projected to be worth $1.5 billion in 2010 and grow at 23% between 2010-2012. It also outlines some of the key players, market entry strategies, challenges, and drivers for growth in the Indian professional AV market.