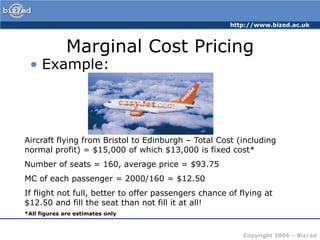

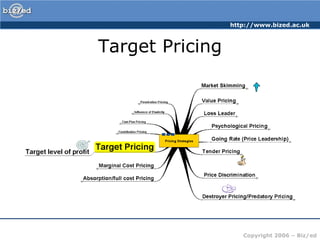

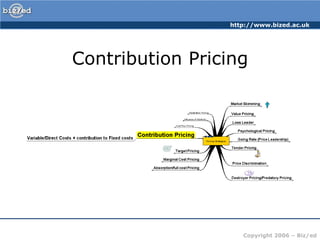

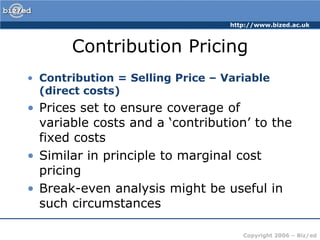

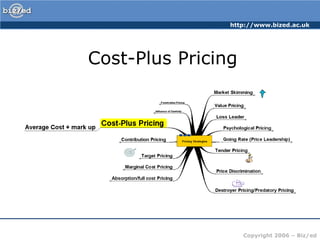

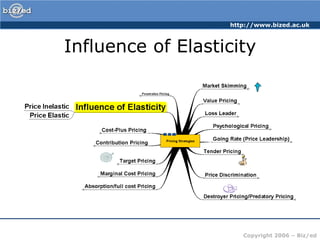

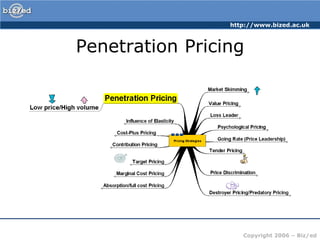

The document discusses several pricing strategies that companies can use to set prices for their products and services. It describes absorption/full cost pricing, marginal cost pricing, target pricing, contribution pricing, cost-plus pricing, and penetration pricing. The influence of price elasticity on revenue is also covered.