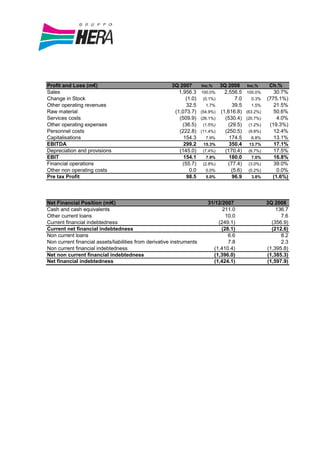

The Hera Group Board of Directors approved financial results for the first nine months of 2008, showing growth across key metrics. Revenues increased 30.7% to €2,556.5 million, EBITDA rose 17.1% to €350.4 million, and EBIT grew 16.8% to €180 million. All business areas achieved increased profits, with the waste management area contributing most to EBITDA at 37.2% and revenues growing 13.5%. The company expects to meet full-year targets for growth and profitability.