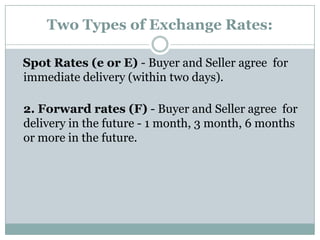

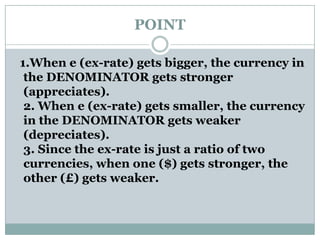

The foreign exchange market allows for the conversion of one country's currency into another's. It has two tiers - an interbank market for large institutions and a retail market for smaller transactions. Key participants include banks, individuals, speculators, central banks, and brokers. Banks act as market makers by constantly buying and selling currencies. Individuals and firms use the market for commercial purposes while speculators and arbitragers seek profits from exchange rate changes. Central banks intervene to influence their currency's value for national interests. Exchange rates quote the price of one currency in terms of another, and transactions usually involve the US dollar being quoted against other currencies. Spot rates are for immediate delivery while forward rates are for future dates.