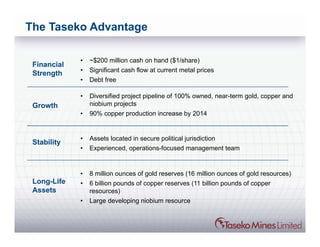

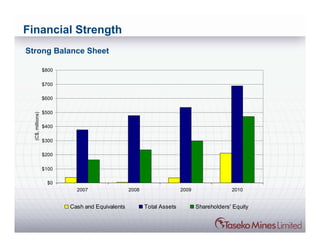

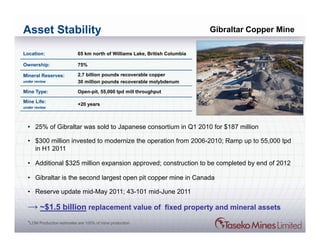

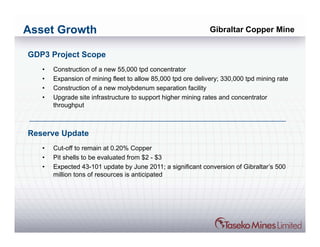

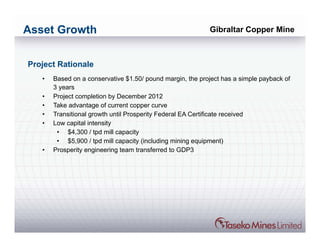

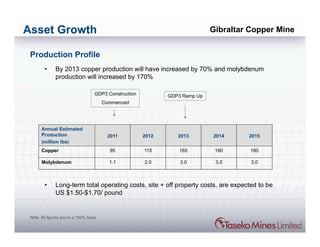

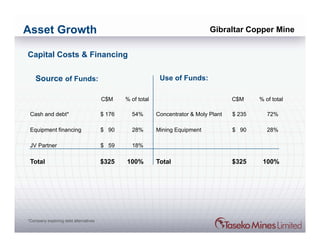

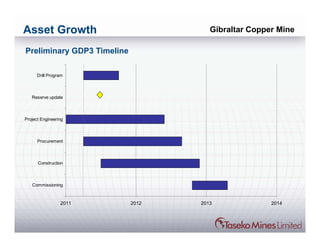

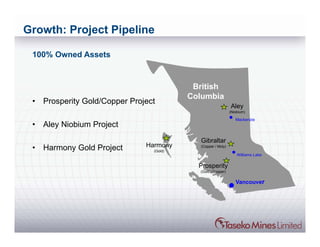

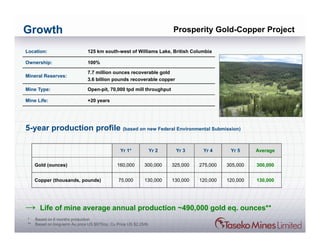

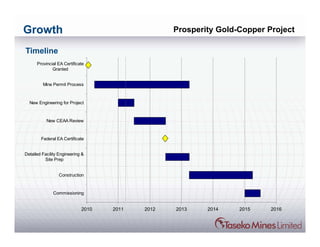

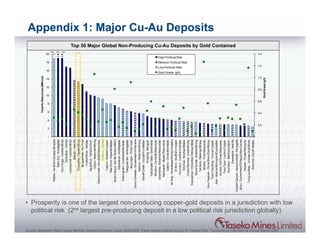

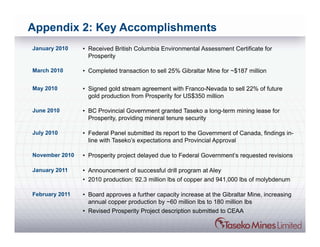

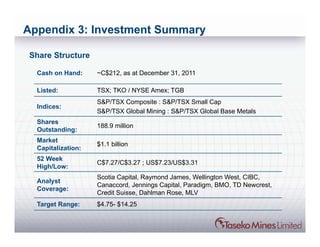

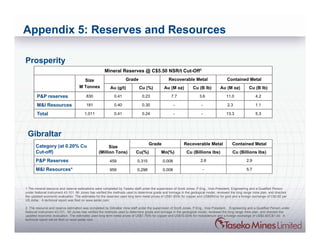

The document outlines Taseko Mines' strategic plans and updates regarding their mining projects in British Columbia, including the Gibraltar copper mine and the Prosperity gold-copper project. It highlights forward-looking statements about mineral resources and potential production increases, as well as financial strength with significant cash reserves and a diversified project pipeline. Additionally, it emphasizes the experienced management team and details the company's growth objectives and project timelines.