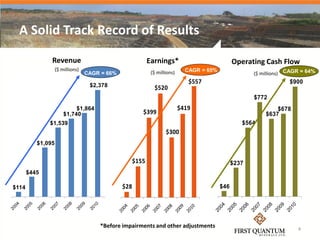

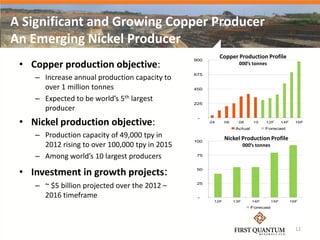

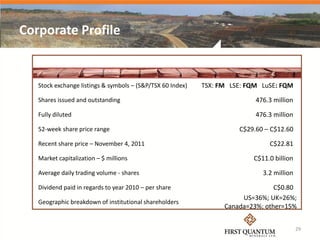

First Quantum has a solid track record of operational and financial success, having developed five mines on schedule and within budget over the past nine years. It is tripling its copper production capacity to over 1 million tonnes annually by expanding existing mines and developing new projects. First Quantum is also emerging as a major nickel producer, with plans to increase nickel production capacity from 49,000 tonnes in 2012 to over 100,000 tonnes by 2015. It has invested billions in growth projects through 2016 to achieve these objectives.