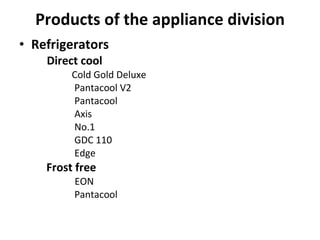

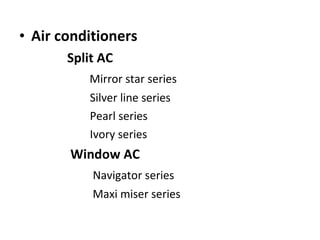

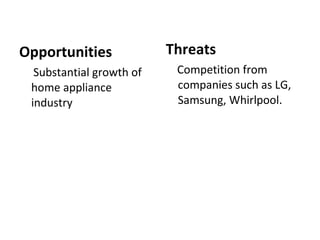

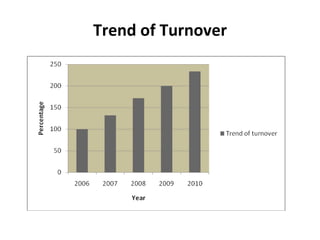

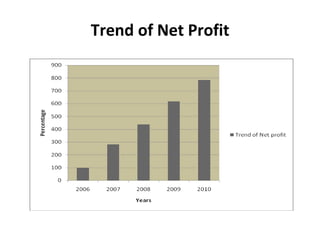

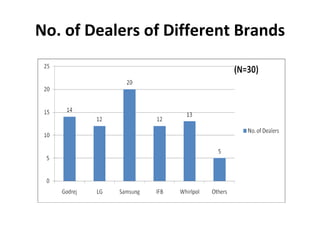

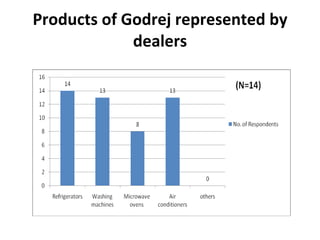

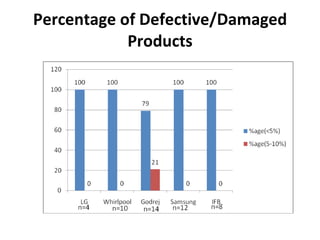

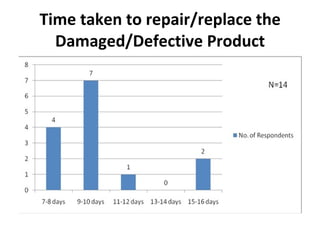

The document summarizes a presentation about summer training at Godrej & Boyce Manufacturing Co. Ltd. It discusses the home appliance industry in India before and after liberalization, key companies including Godrej, Godrej's product portfolio and financial performance from 2006-2009. It also summarizes a study on the distribution efficiency of Godrej home appliances in Chandigarh which found availability and distribution to be issues.