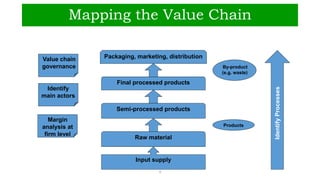

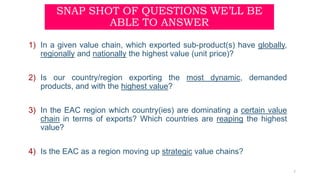

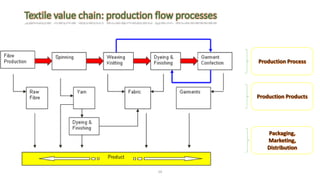

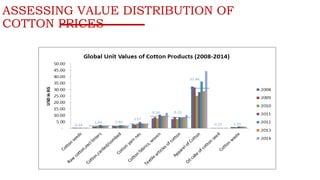

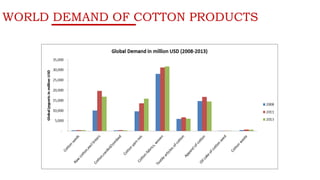

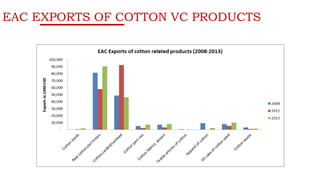

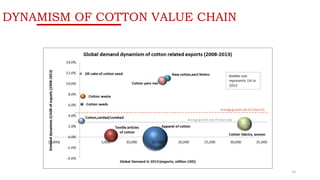

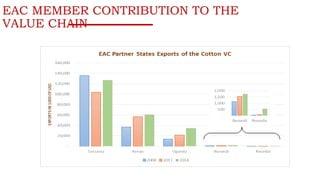

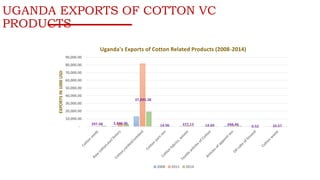

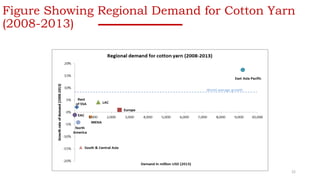

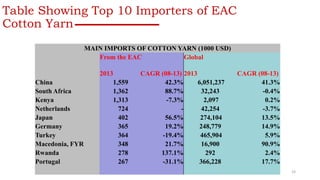

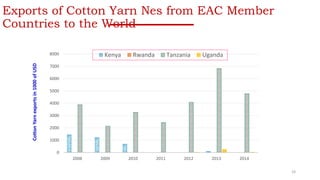

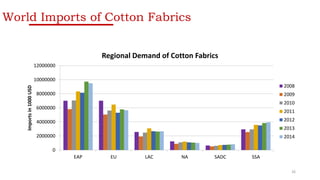

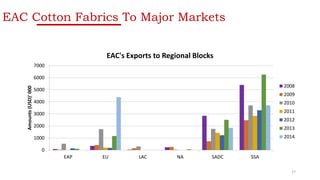

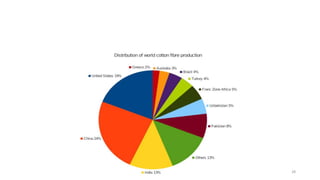

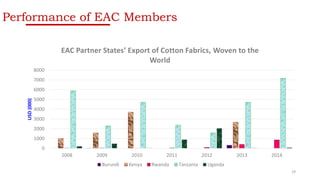

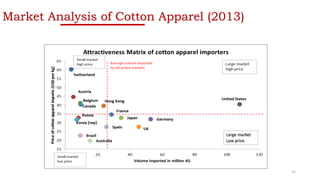

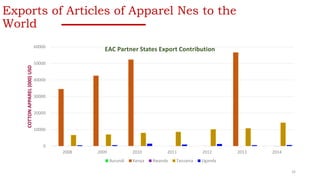

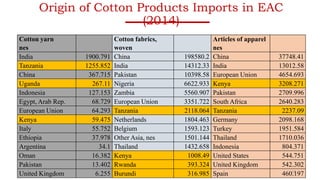

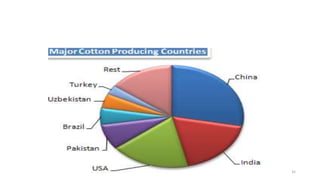

The document provides an overview of analyzing Uganda's cotton value chain. It discusses mapping the cotton value chain, which involves identifying the key processes, actors, and margins at each stage from input supply to final products. It also outlines questions the value chain analysis can answer, such as which exported cotton products have the highest value globally and which EAC countries are dominating certain cotton value chains. Graphs and tables presented show trends in global and regional demand for cotton yarn, fabrics, and apparel. Data on the main importers and exports of EAC countries for different cotton products are also presented.