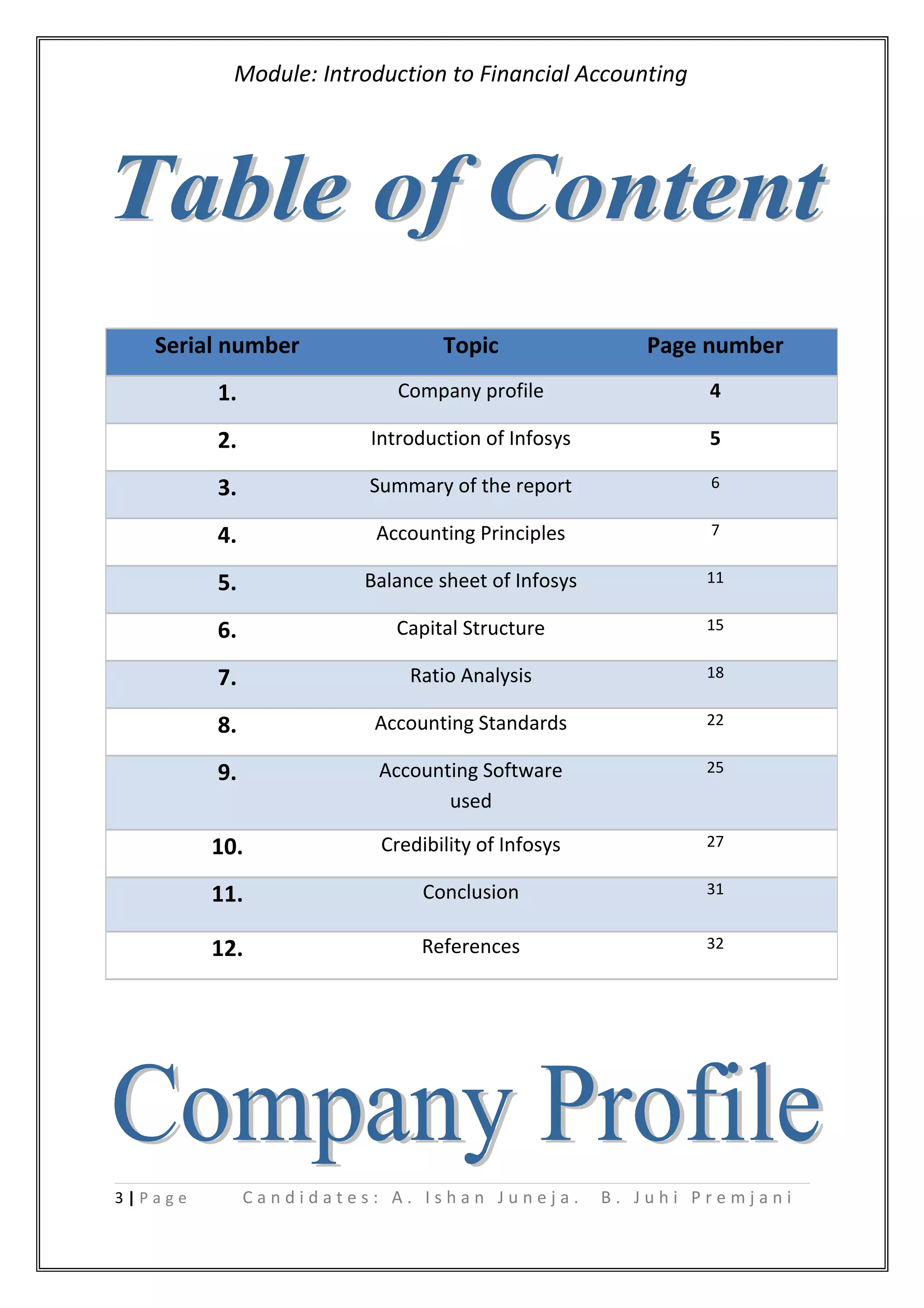

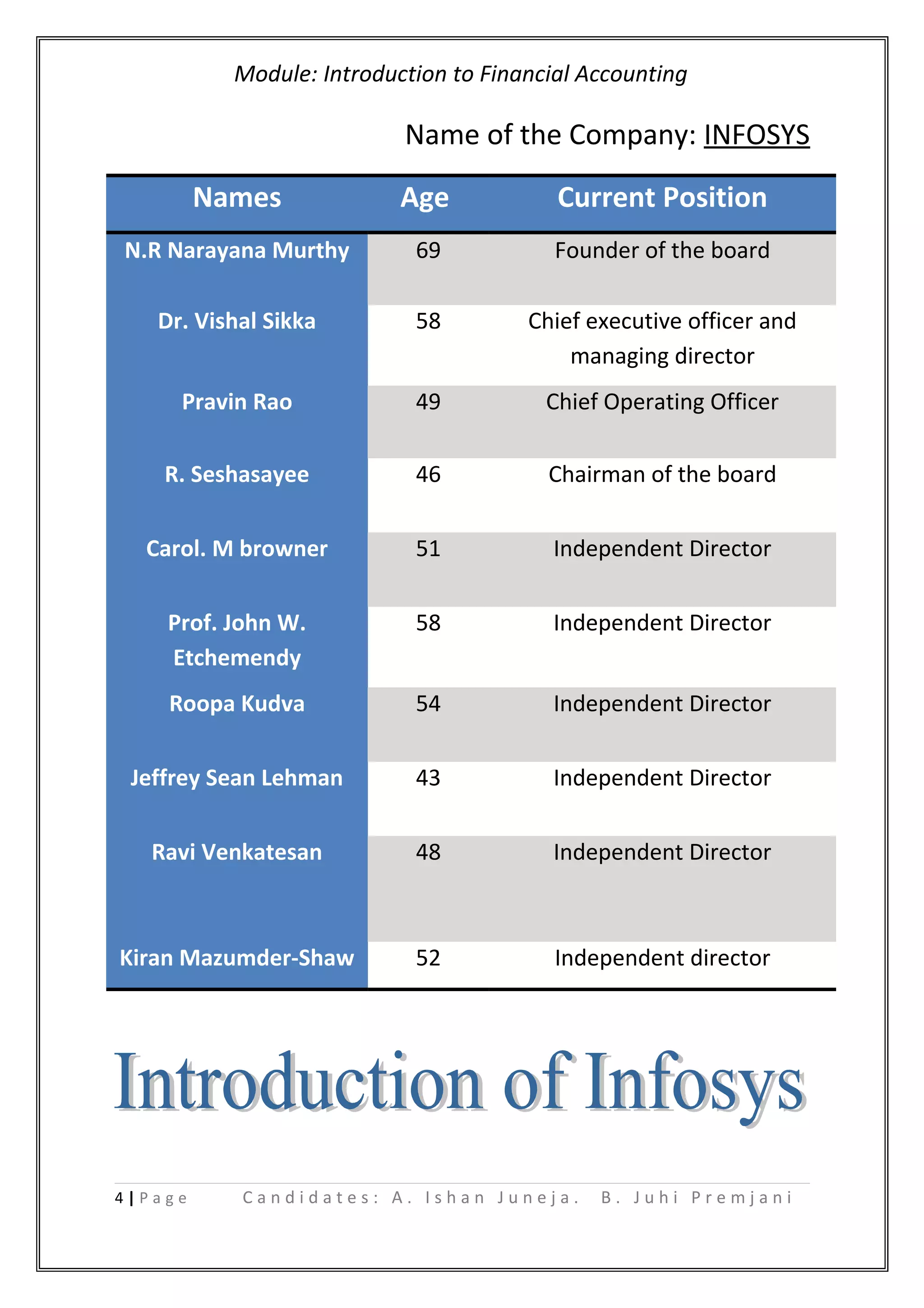

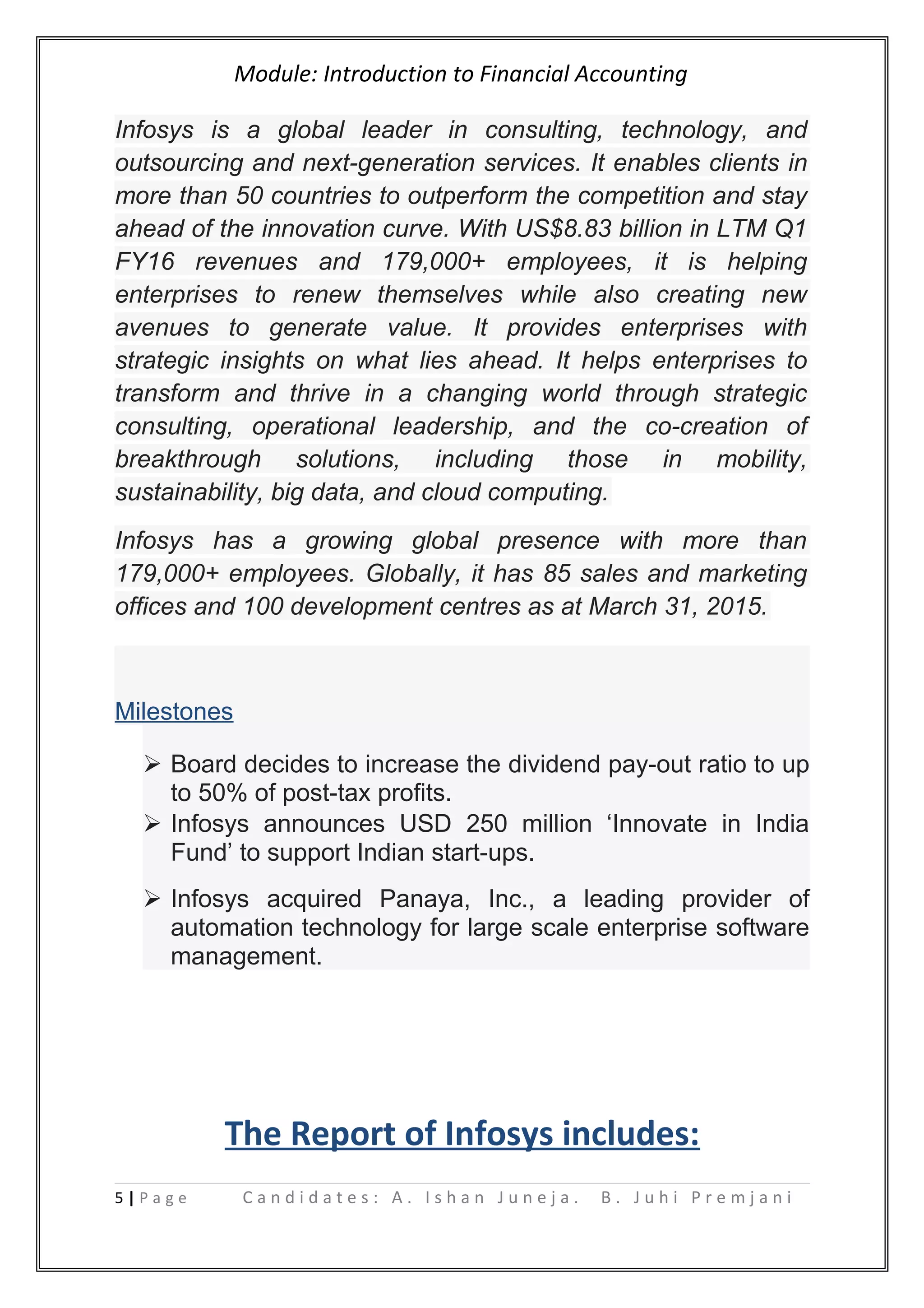

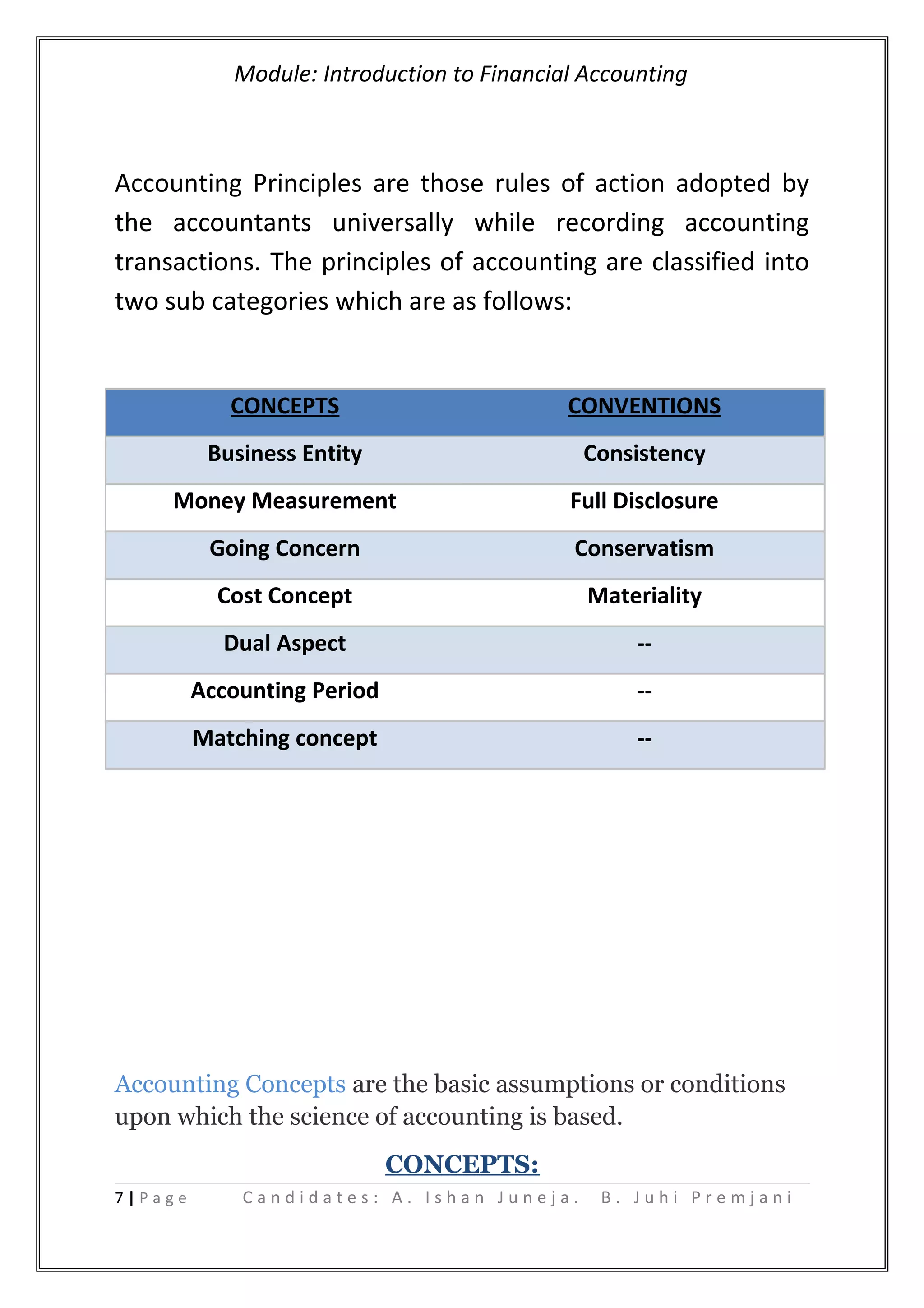

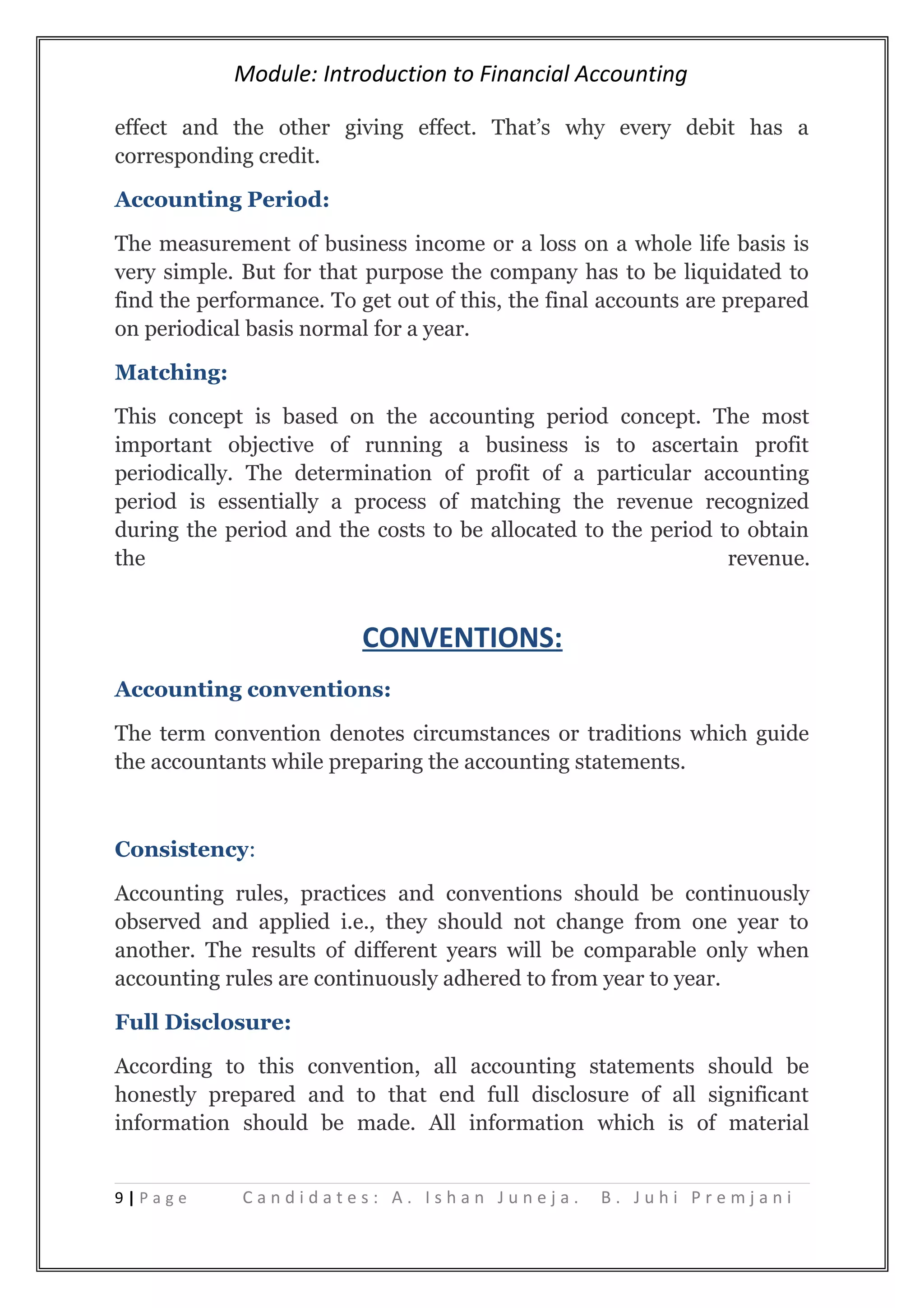

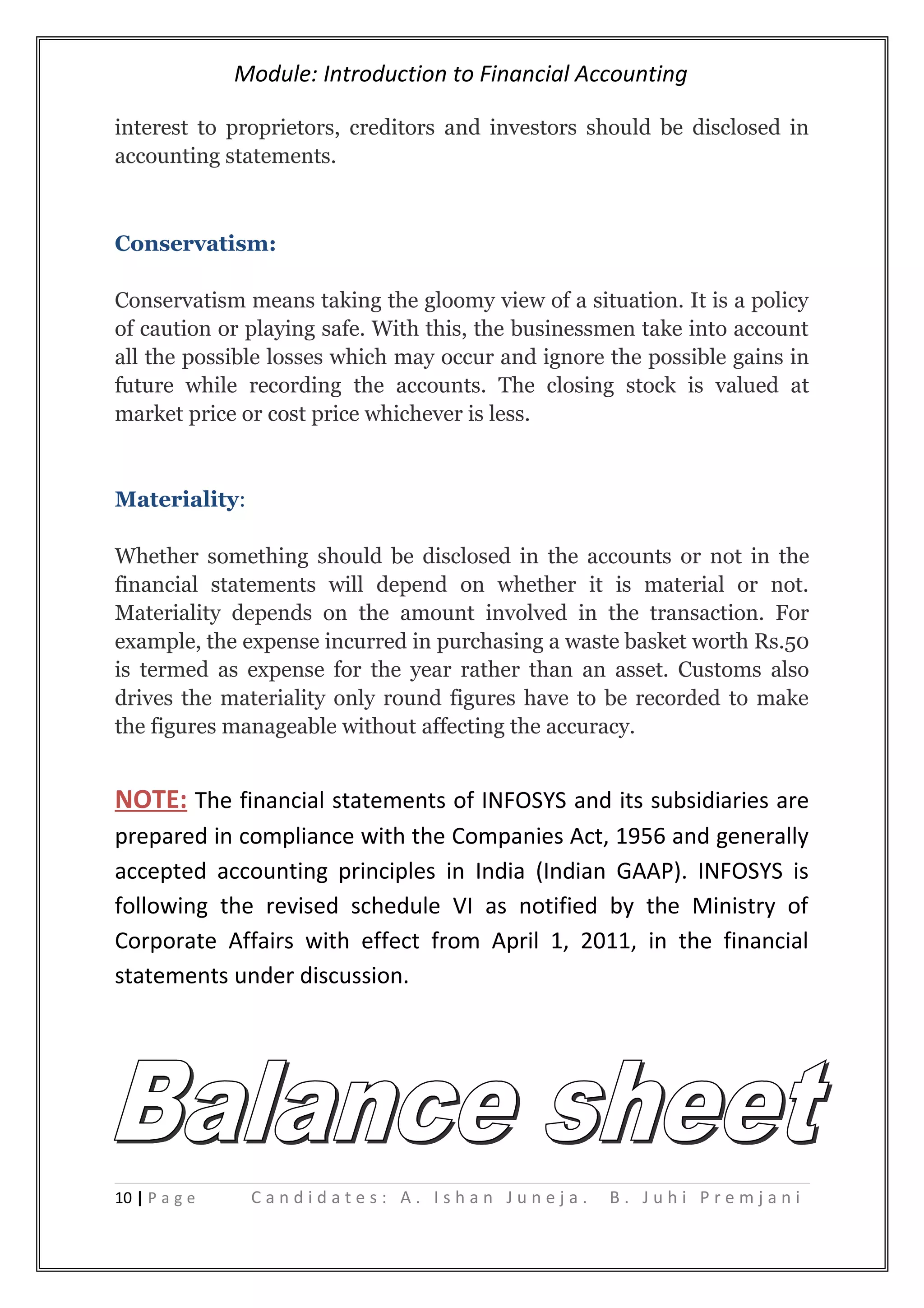

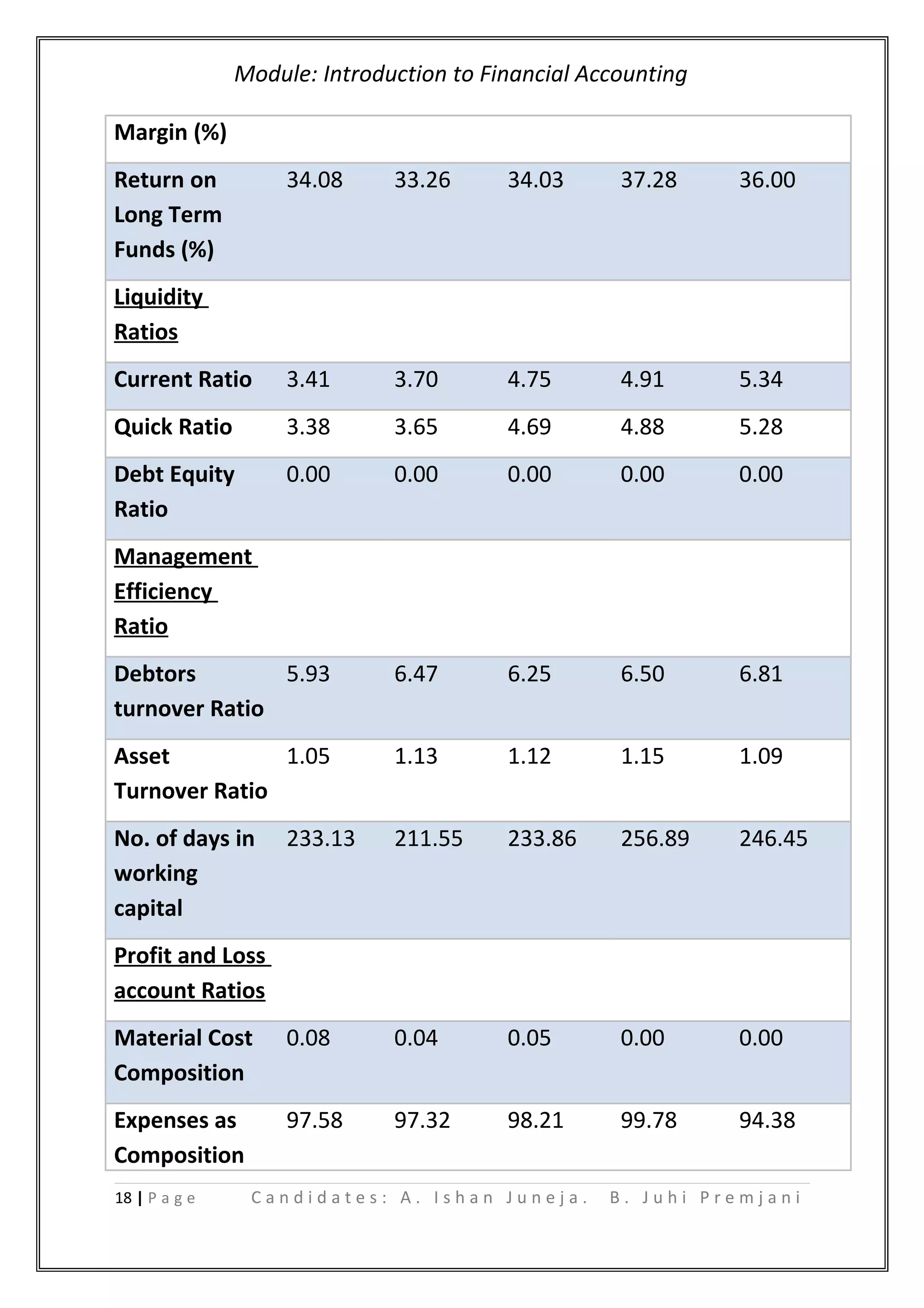

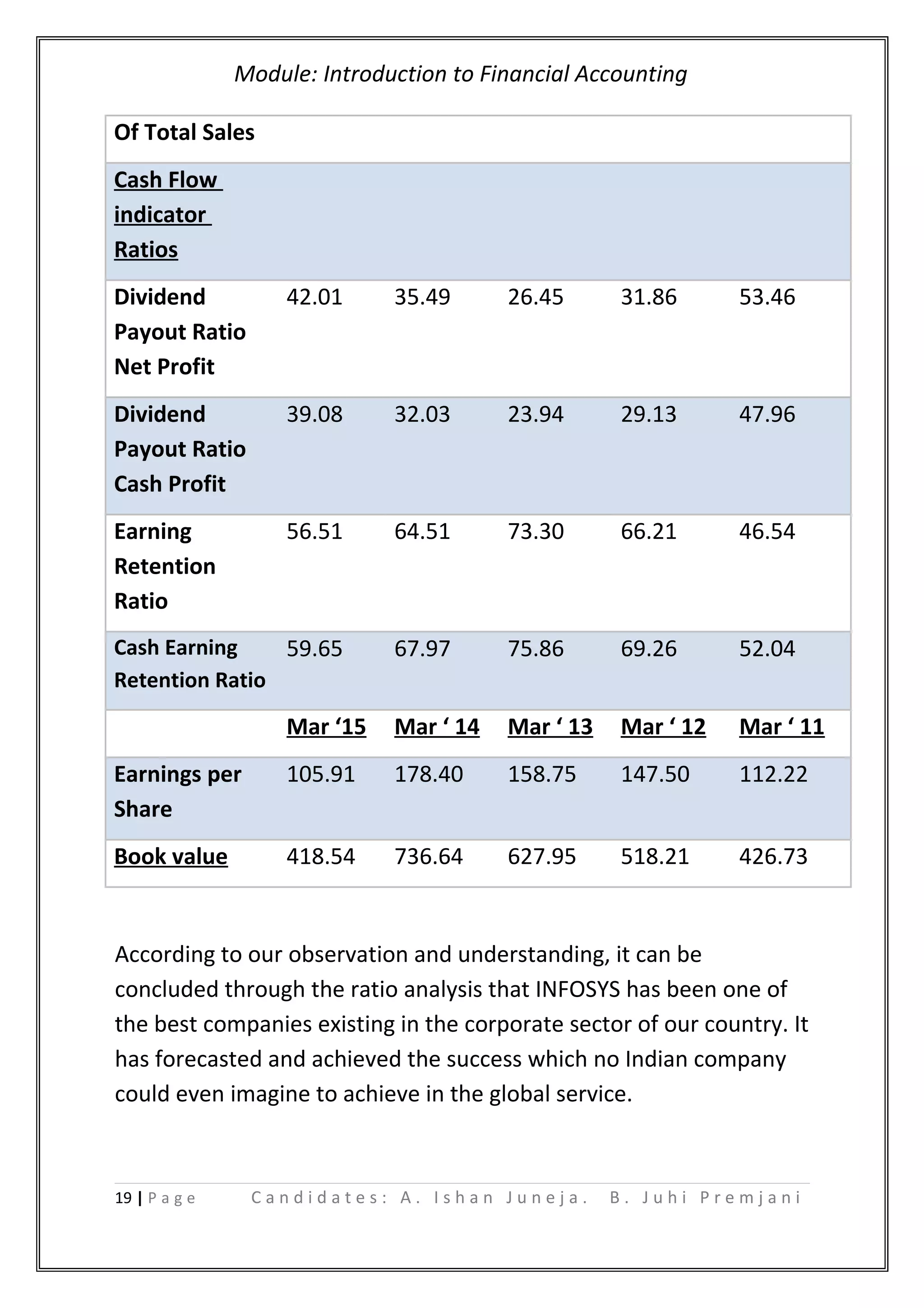

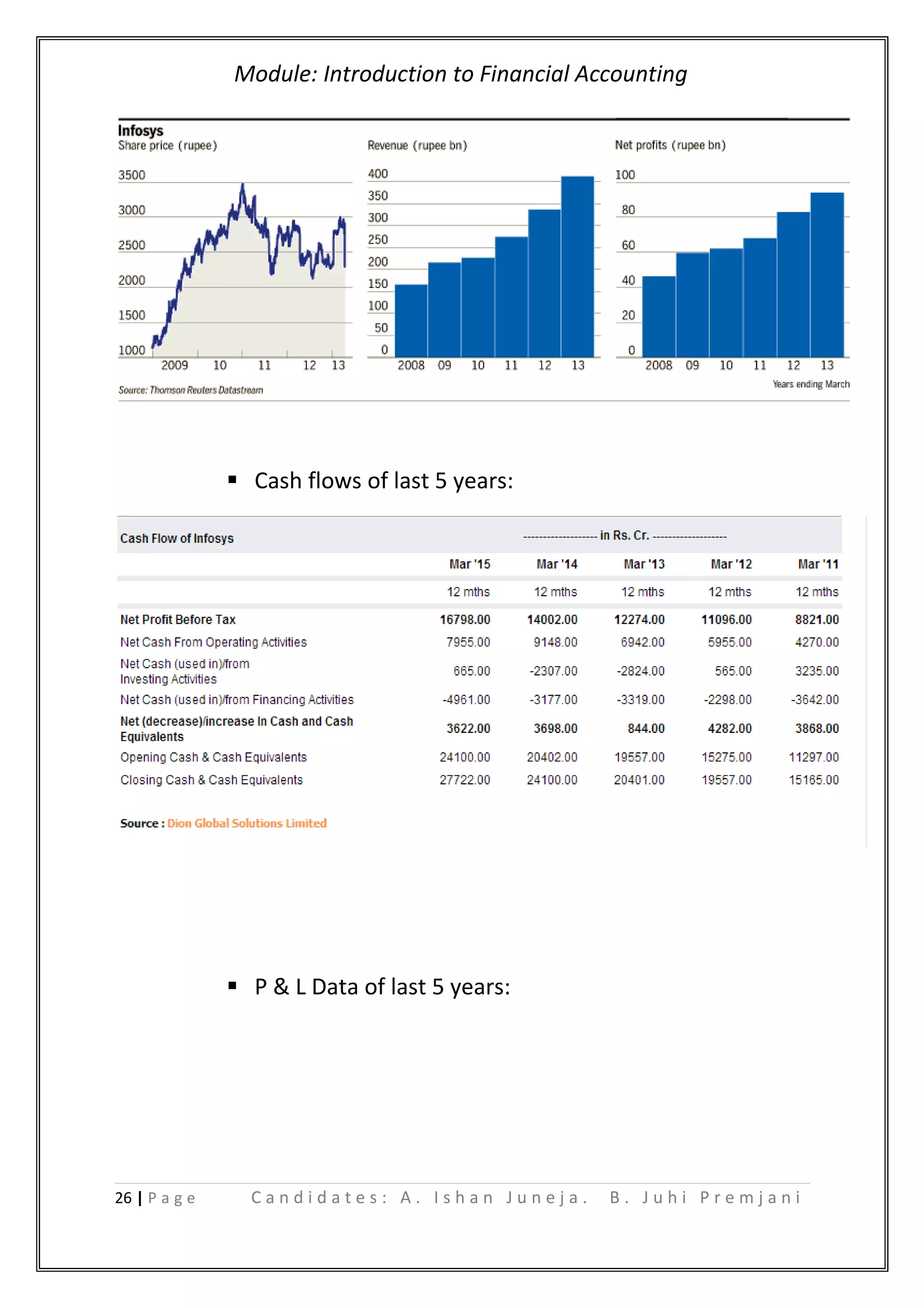

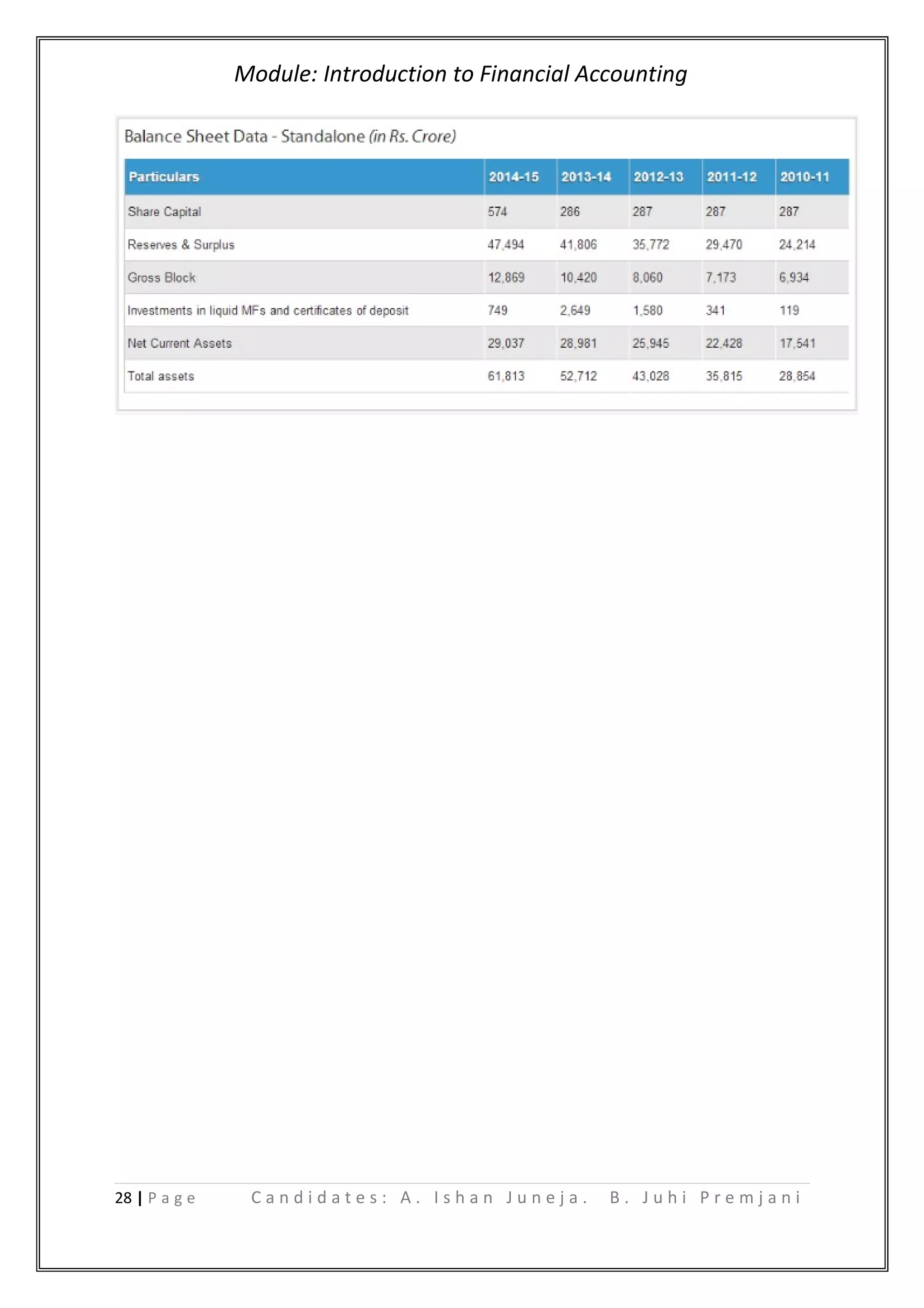

This document is an analysis of the company Infosys submitted to Mrs. Dhaarna Singh Rathore. It begins by thanking the guide for her support and guidance. It then outlines the topics that will be discussed in the analysis, including Infosys' profile, balance sheet, capital structure, ratio analysis, accounting standards and software used, and credibility. The body of the document discusses these topics, providing details on Infosys' leadership, financial statements over five years, accounting principles and conventions followed, and an overview of the company.