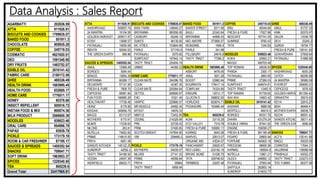

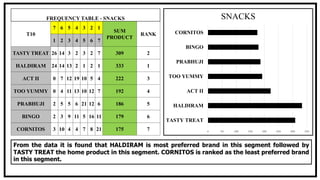

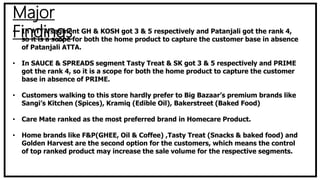

The document presents a comparative study of consumer preferences in home products and top FMCG brands, focusing on Big Bazaar as a case study. It outlines the retail landscape in India, emphasizing the dominance of unorganized trade and the potential for organized retail growth. Key findings highlight consumer preferences for specific brands across various product categories, with detailed sales data and analysis supporting these trends.