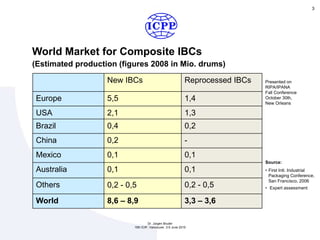

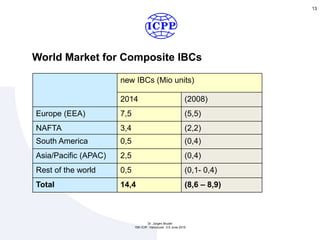

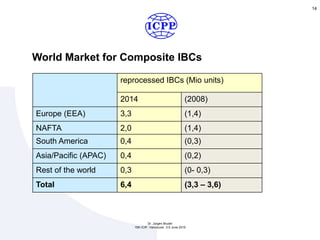

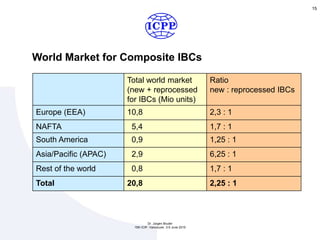

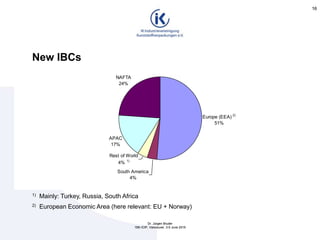

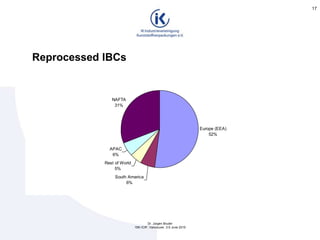

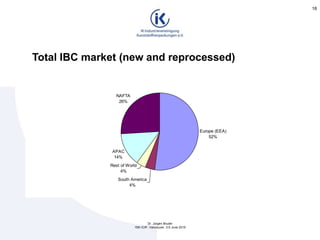

Dr. Jürgen Bruder presented on trends in the global IBC markets at the 15th ICIP conference in Vancouver. The presentation included figures on the 2008 global IBC market, trends affecting new and reprocessed IBCs between 2008-2014 including economic, logistical, and technical developments, and estimates of the 2014 global IBC market breakdown by region. Key points were that growth rates for new IBCs have declined to 2-3% in Europe and 8% in Asia, reprocessing of IBCs has expanded strongly, and the estimated total 2014 global IBC market was over 20 million units with over half in Europe.