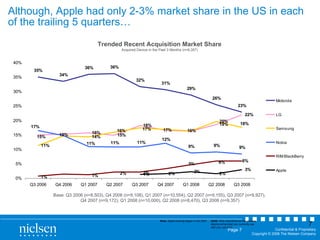

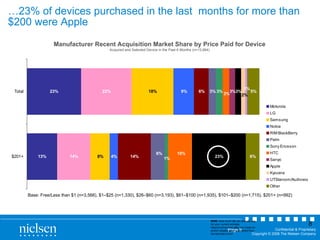

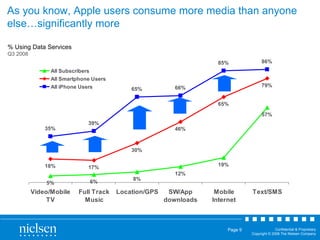

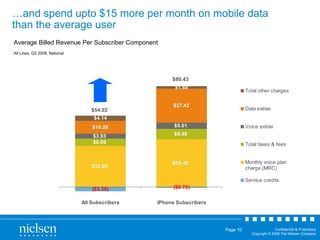

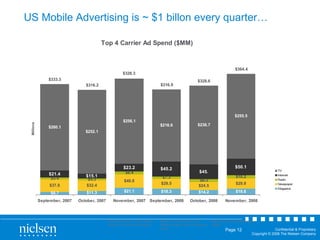

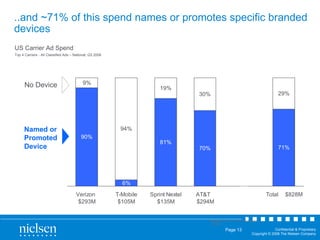

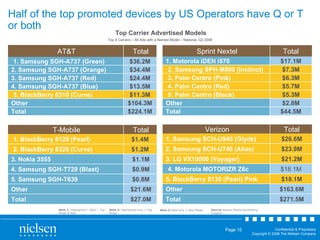

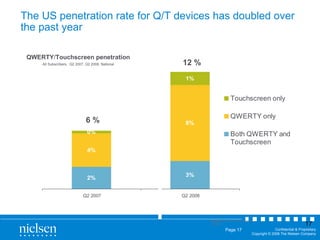

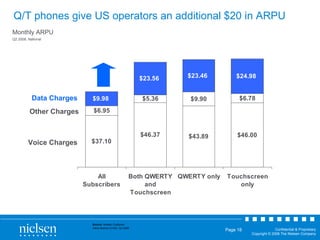

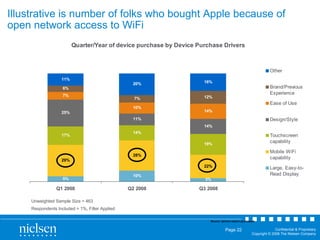

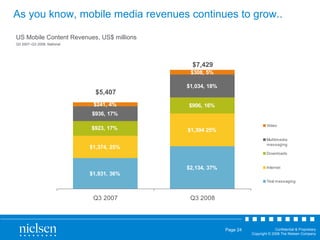

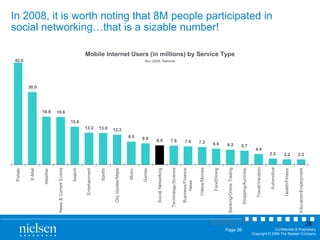

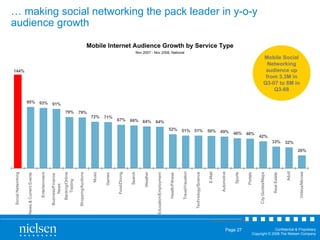

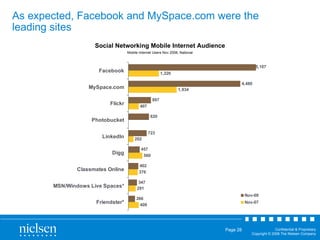

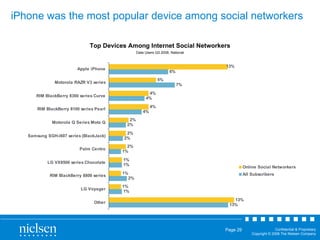

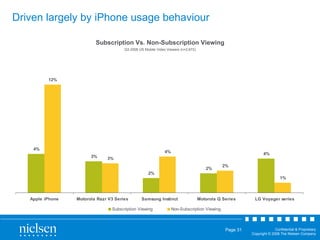

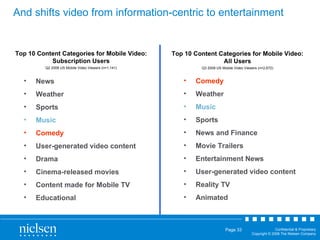

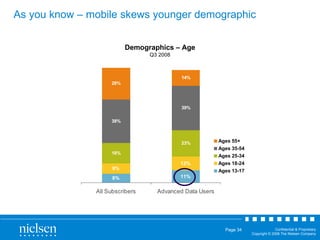

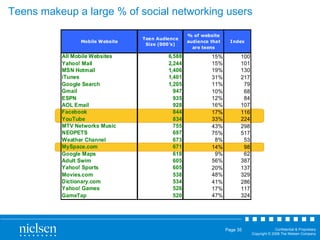

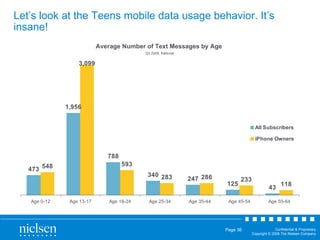

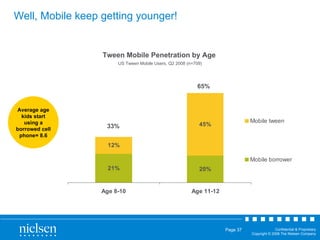

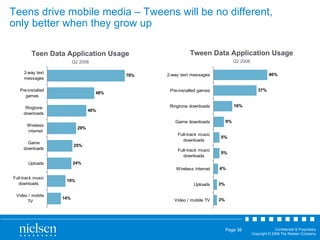

The document discusses trends in mobile devices and media in 2008 according to Nielsen data. Key points include: Apple led the industry with its integrated data experience on the iPhone and spurred competitors. Carriers invested in QWERTY/touchscreen devices expecting higher usage fees, which increased ARPU. The US penetration rate for Q/T devices doubled over the past year. Social networking grew rapidly on mobile, with Facebook and MySpace as leaders, and the iPhone was the most popular device. Teenagers and tweens drove growth in mobile media usage including social networking, videos, and games.