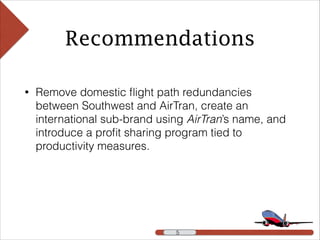

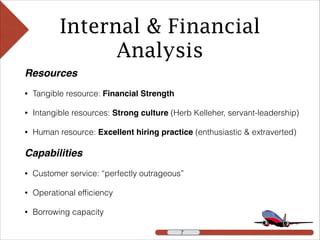

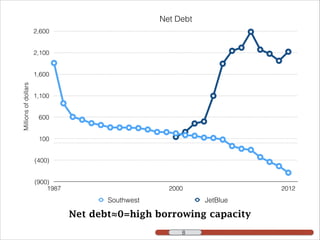

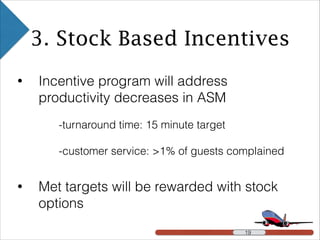

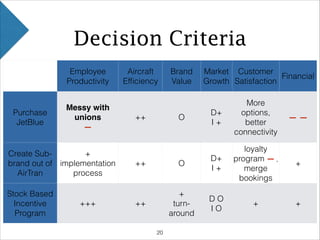

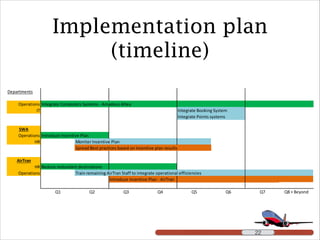

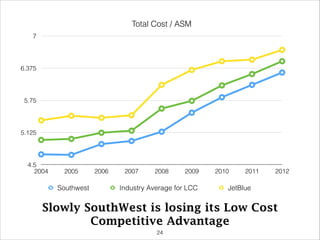

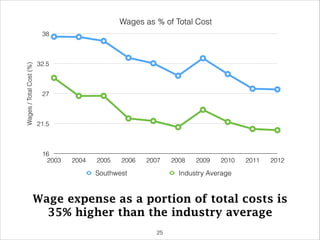

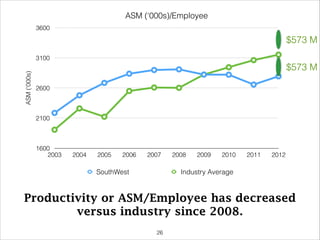

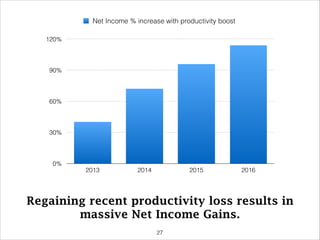

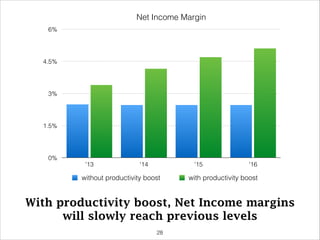

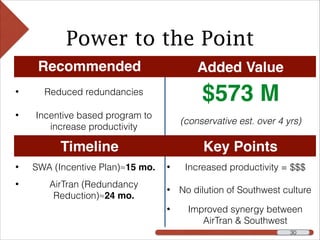

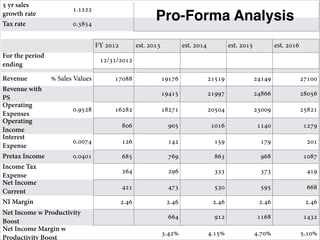

The document provides a recommendation for Southwest Airlines to maintain its competitive advantage while growing internationally. It recommends integrating AirTran's computer booking and rewards systems, establishing AirTran as an international sub-brand by reducing redundant staffing, and introducing an incentive plan tied to productivity measures to boost employee performance and financial results. The recommendations are estimated to generate over $573 million in additional net income over four years by increasing productivity while preserving Southwest's culture.