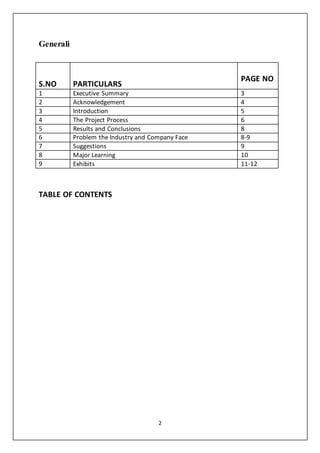

1. The report analyzes recruitment of front line sales employees at Future Generali Life Insurance. It found high attrition and challenges in acquiring new talent.

2. Direct competition mapping identified strengths and weaknesses of Future Generali compared to competitors. It found Future Generali provided fewer leads to employees and had longer turnaround times than peers.

3. Recommendations included outsourcing hiring, reducing turnaround time, providing more leads to employees, and lowering sales targets to improve recruitment and retention.