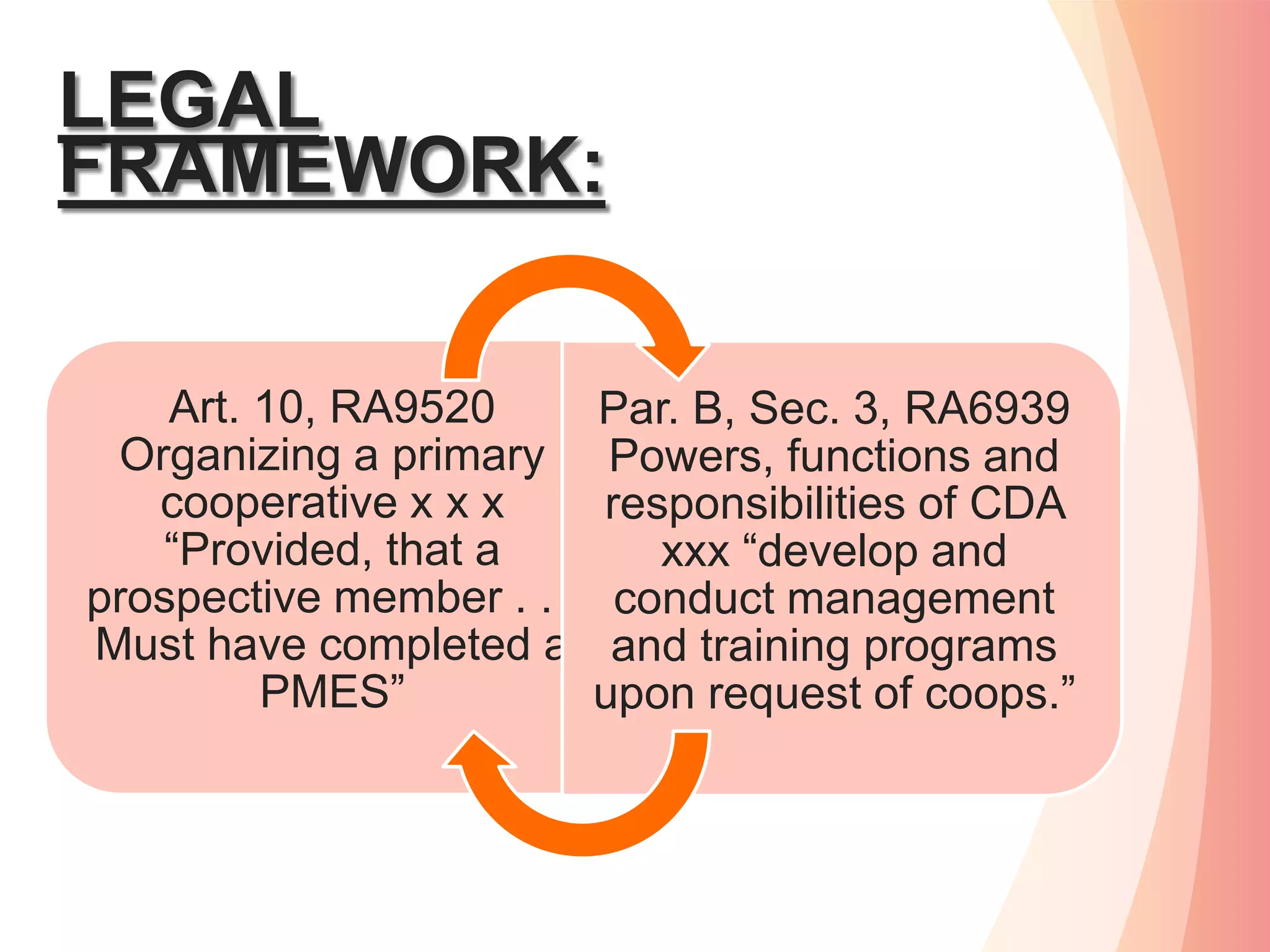

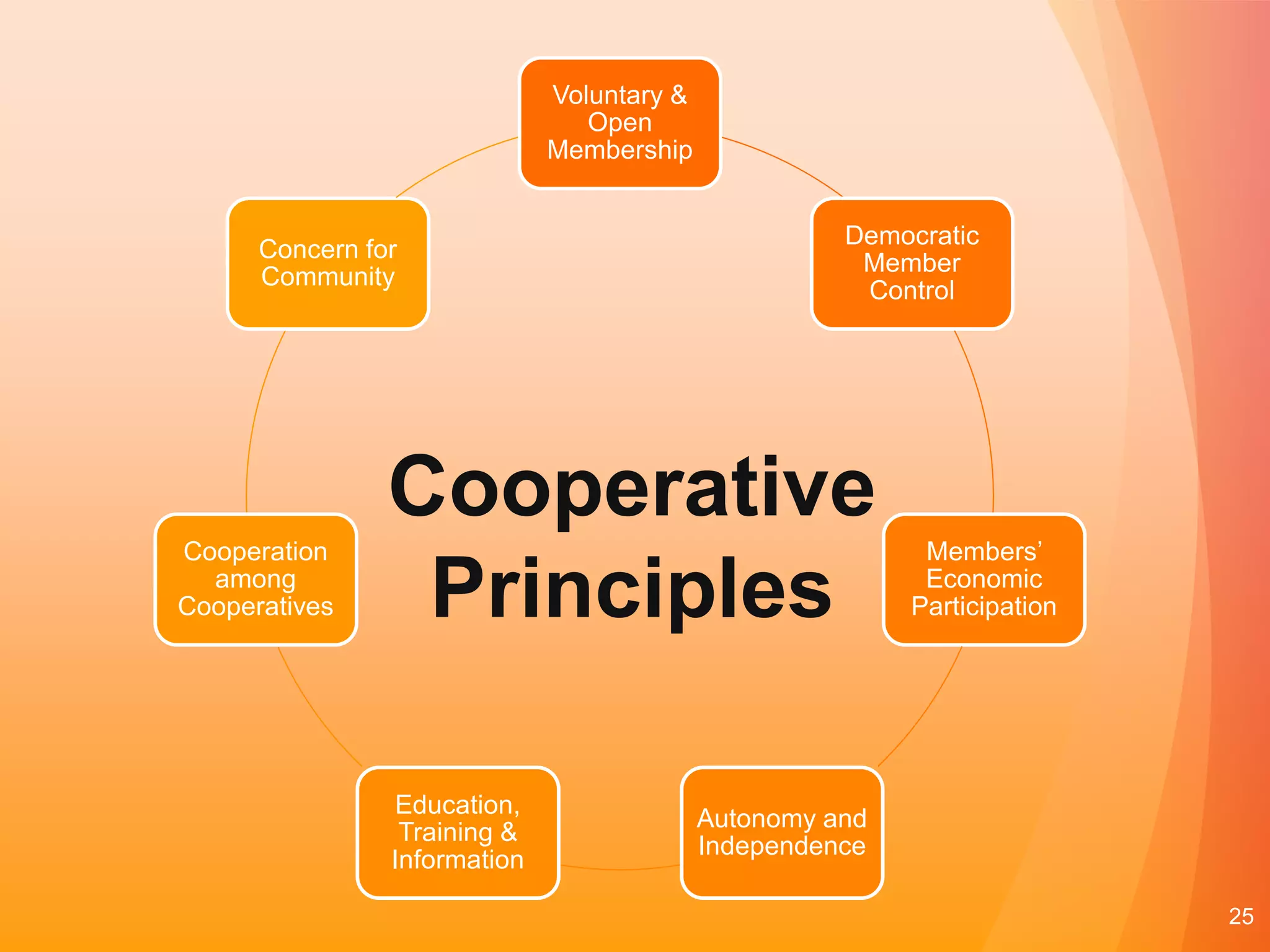

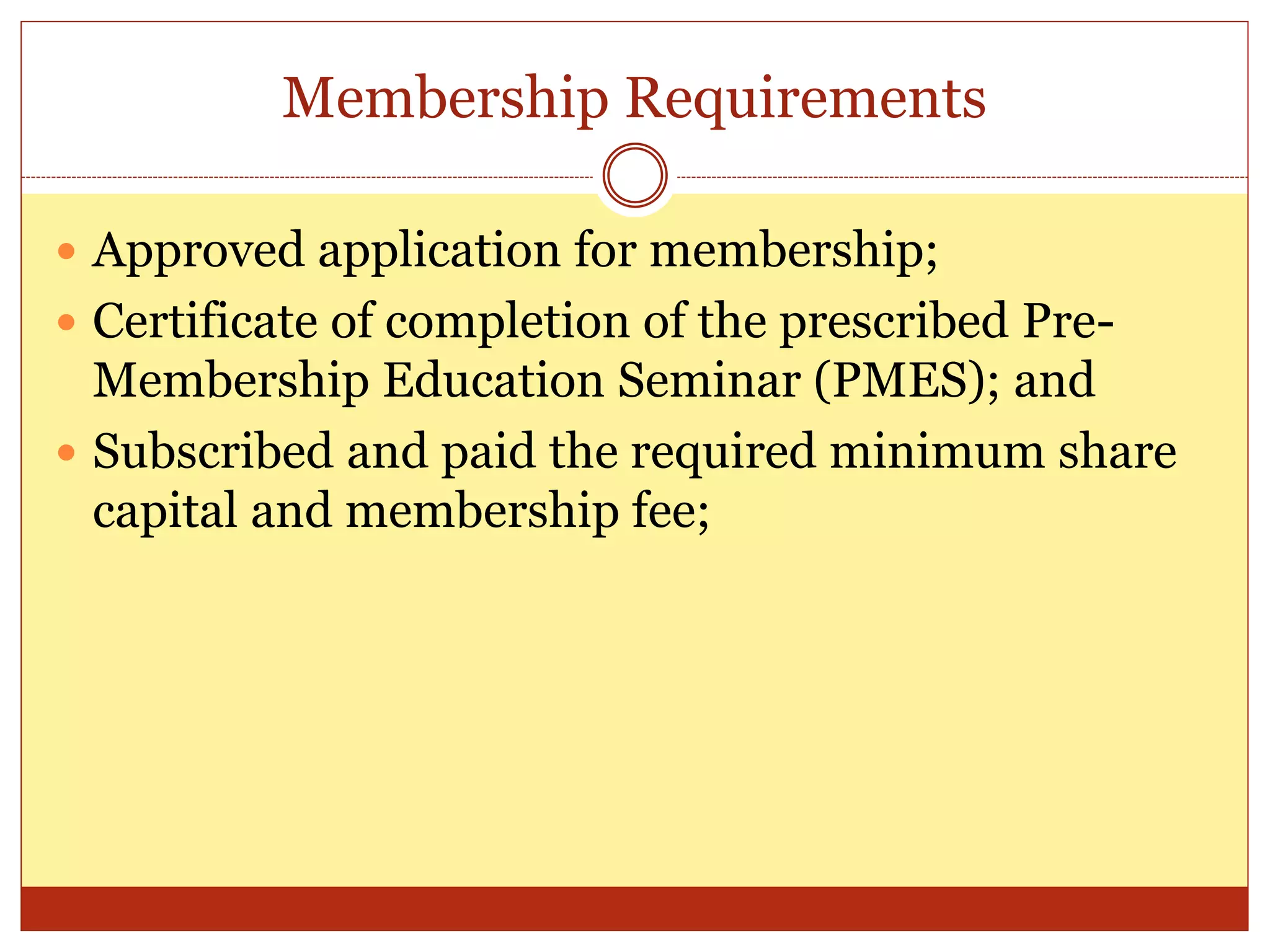

The document discusses the Pre-Membership Education Seminar for Santa Monica Credit Cooperative. It provides an overview of why PMES are required by law, the functions of the Cooperative Development Authority, and an introduction to cooperative principles and types. It then describes the purpose, objectives, membership options, registration process, activities, and loan services of Santa Monica Credit Cooperative.