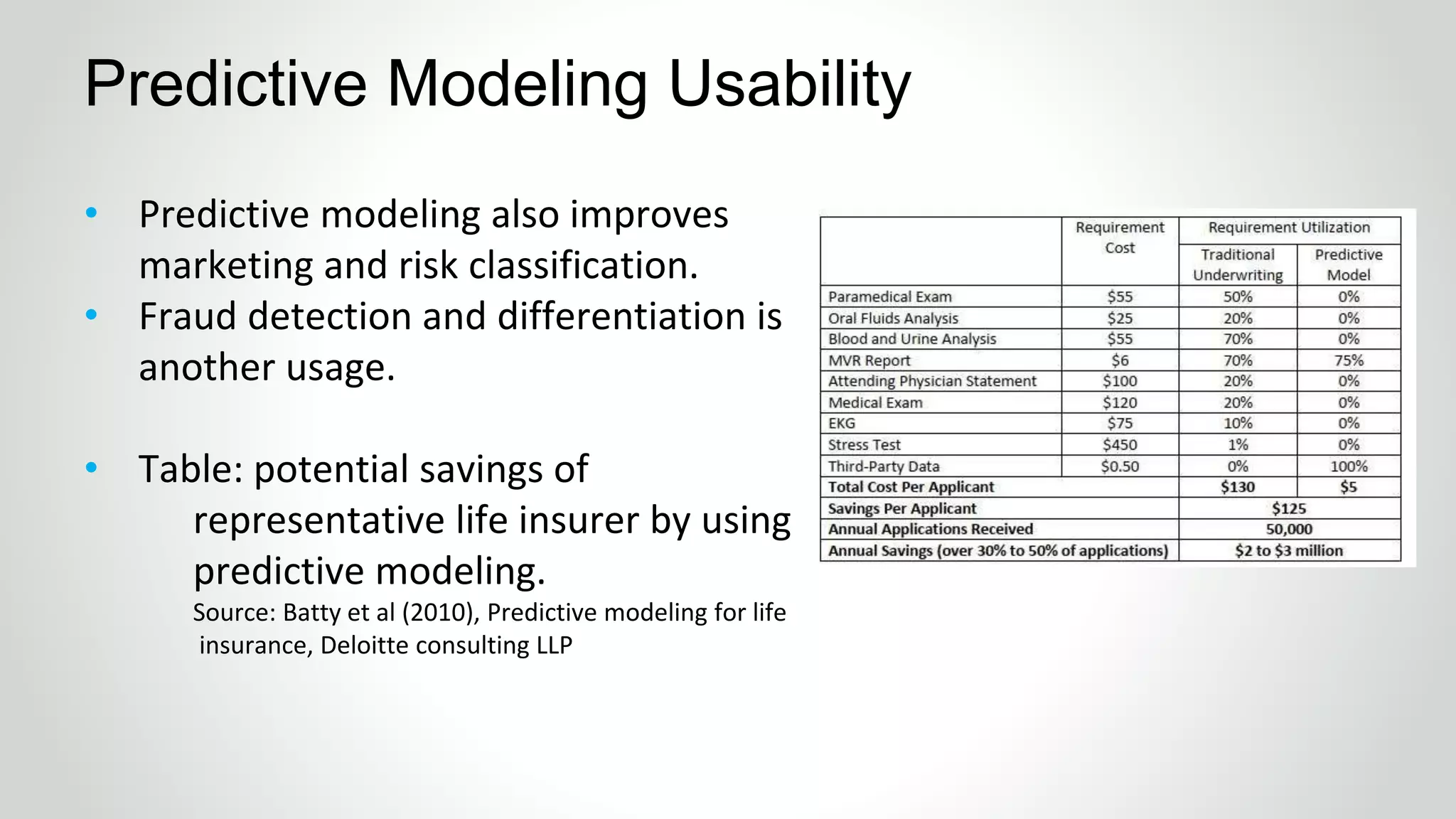

This document discusses predictive analytics and modeling in life insurance, highlighting the contract between insurers and policyholders, historical context, and benefits of insurance for individuals and companies. It outlines challenges faced by insurance firms, including risk management, premium setting, and underwriting processes, emphasizing the role of predictive modeling in optimizing these aspects. The evolution of predictive analytics in the insurance sector over centuries is also touched upon, showcasing its increasing importance in decision-making and customer assessment.