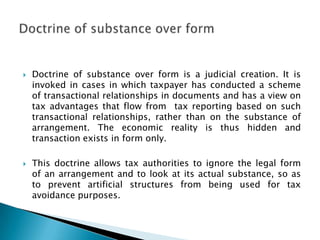

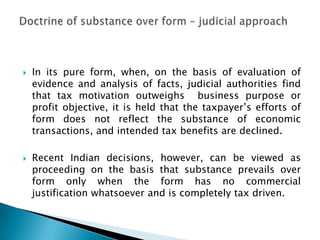

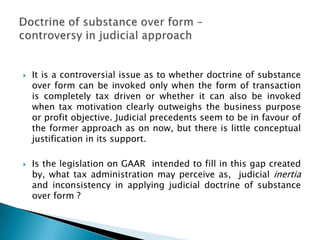

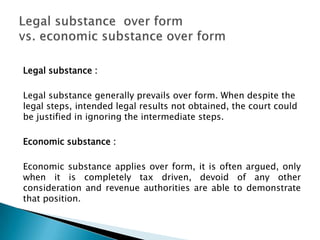

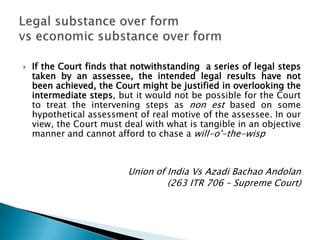

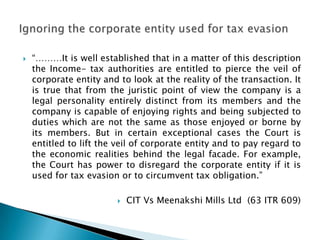

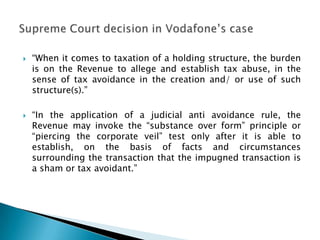

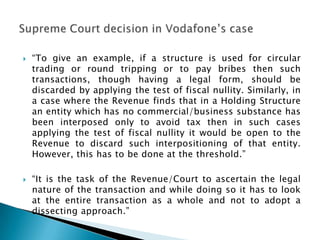

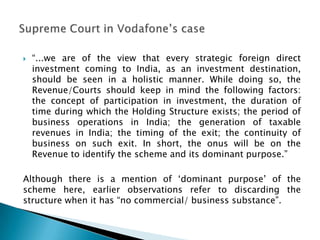

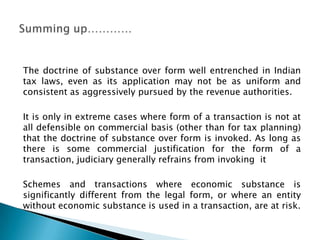

This document discusses the judicial doctrine of substance over form in Indian tax law through various judicial precedents and perspectives. It notes that substance over form allows tax authorities to ignore the legal form of an arrangement and look at the actual substance to prevent tax avoidance. However, courts generally apply substance over form only when the legal form has no commercial justification and is completely tax driven. There is ongoing debate around the appropriate test for applying this doctrine and its relationship to statutory anti-avoidance rules.