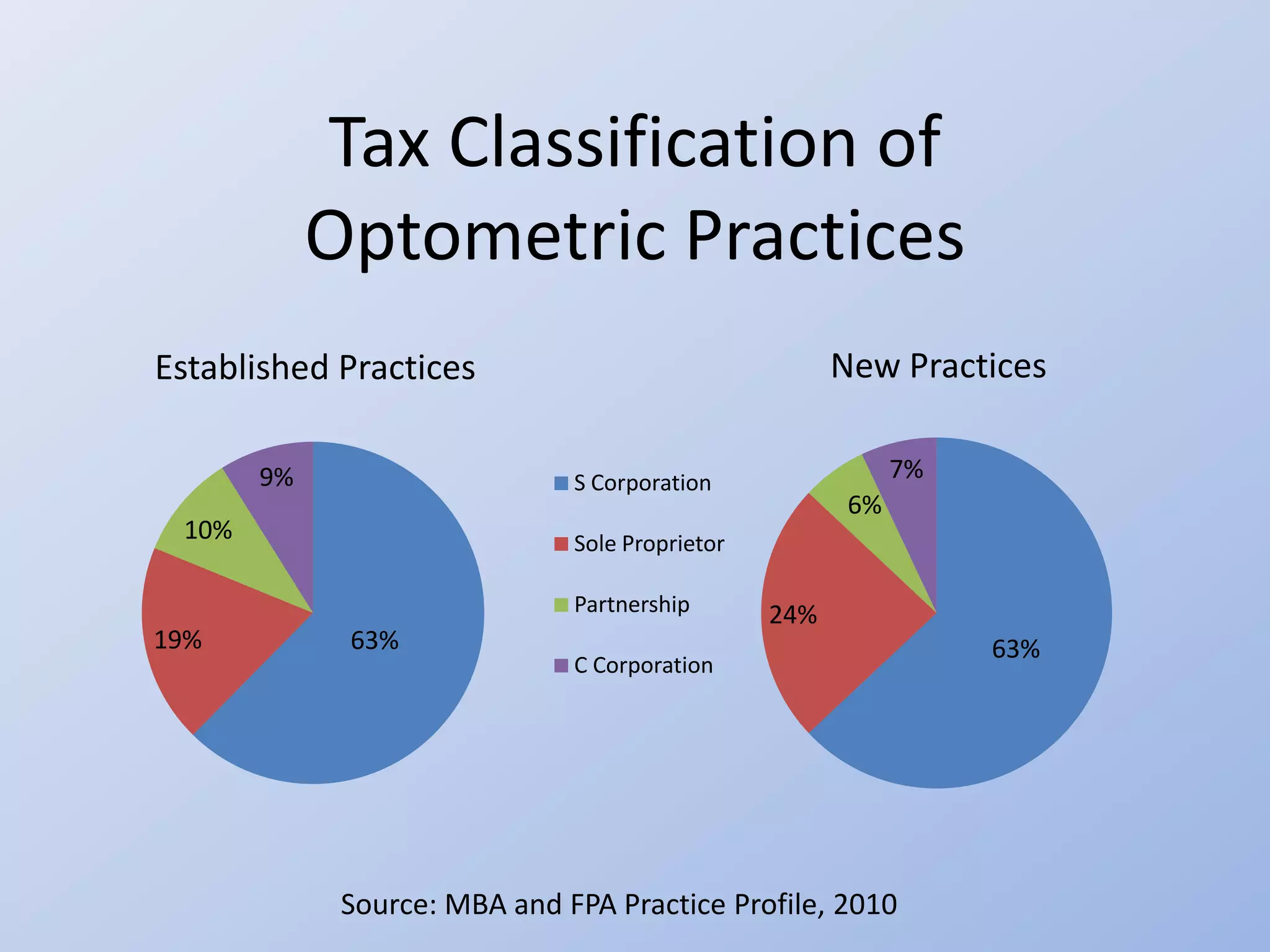

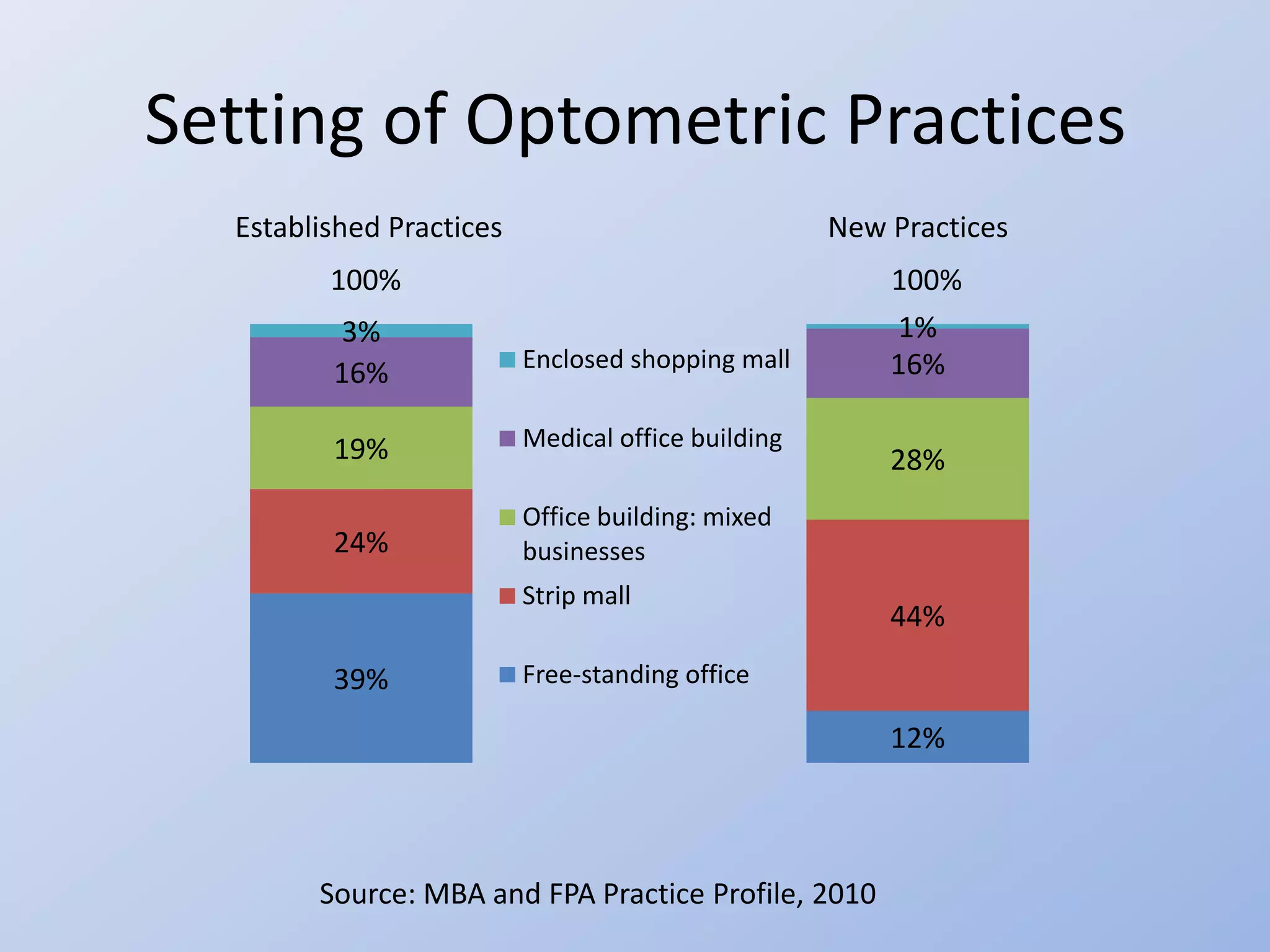

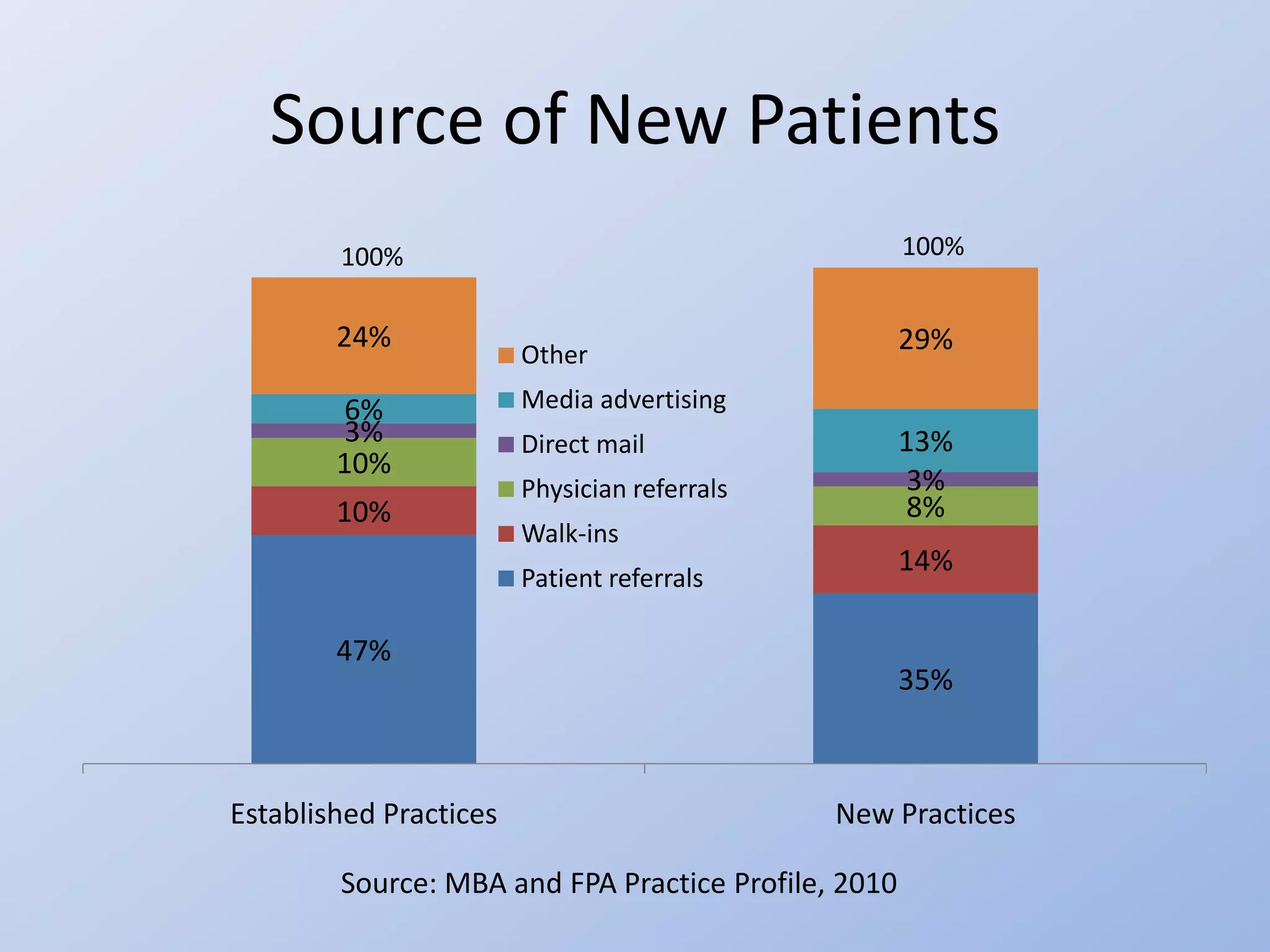

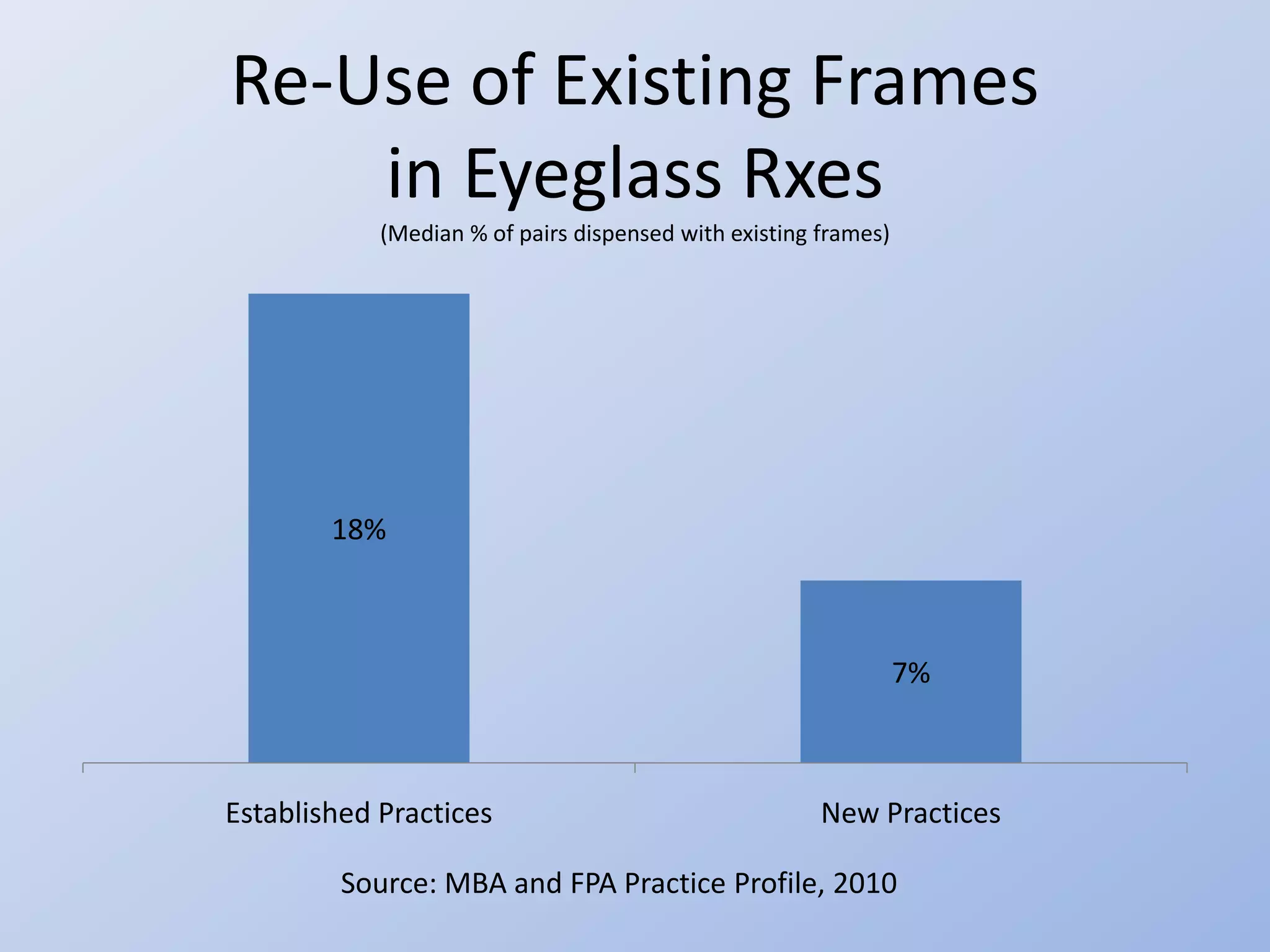

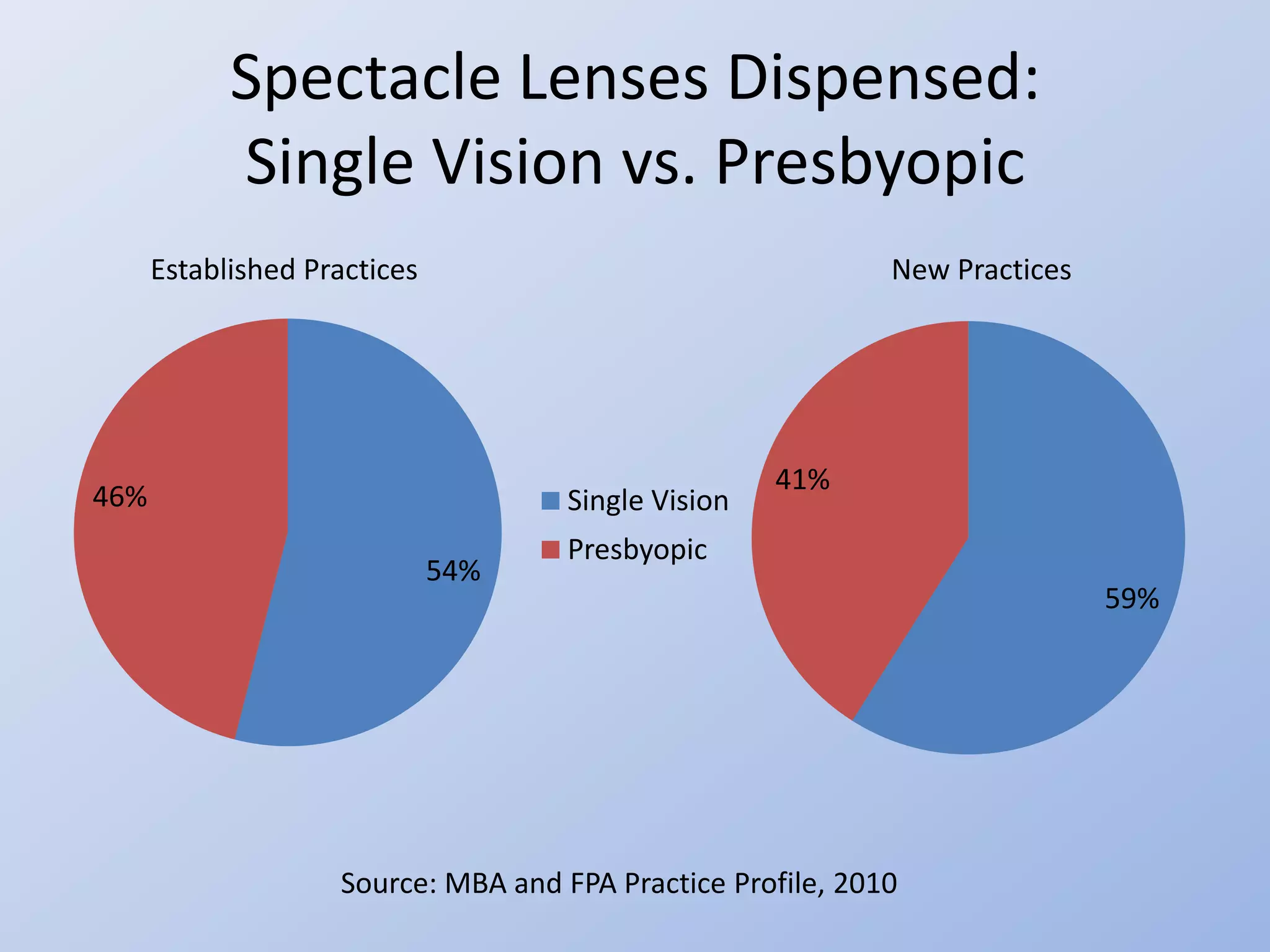

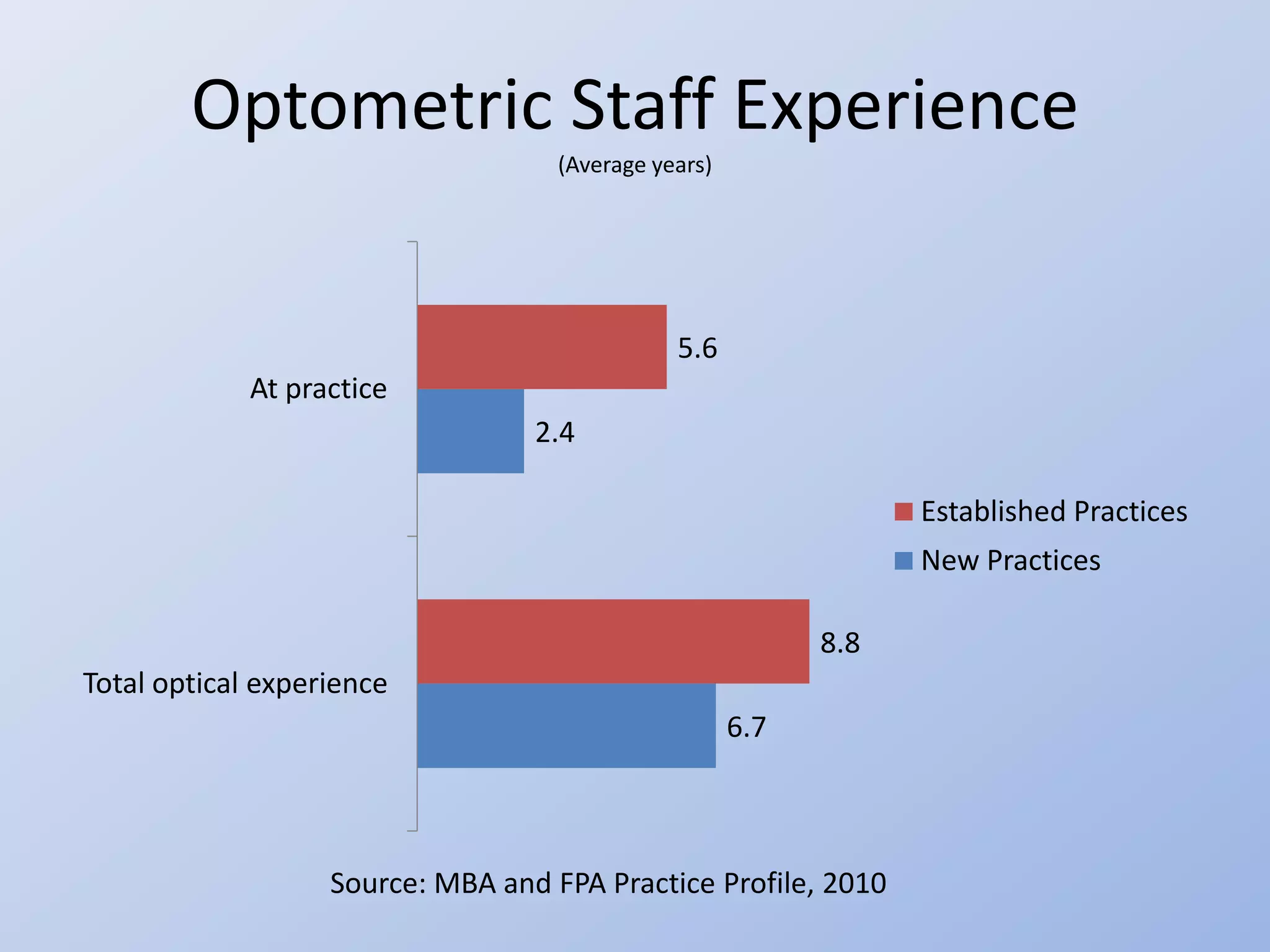

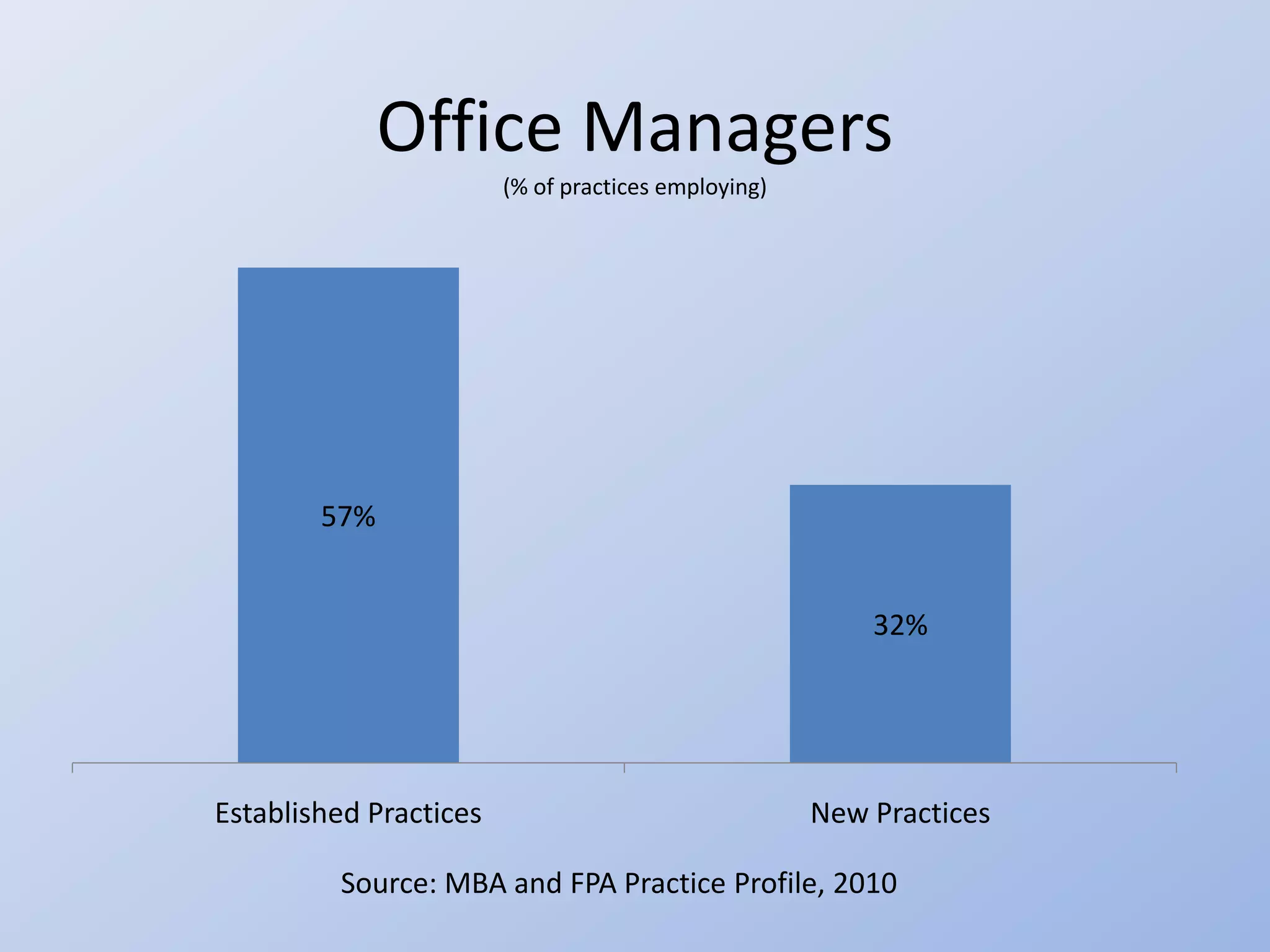

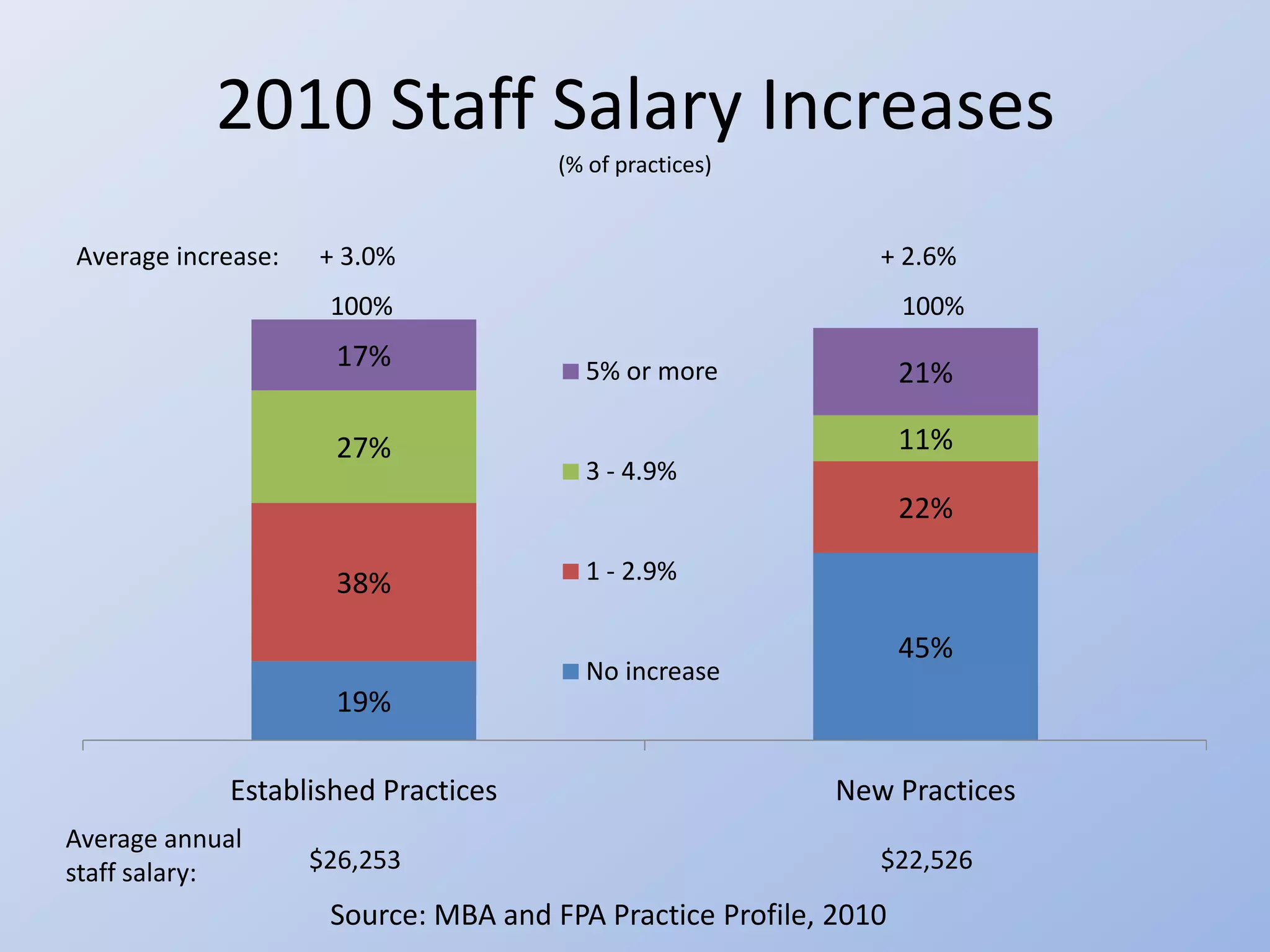

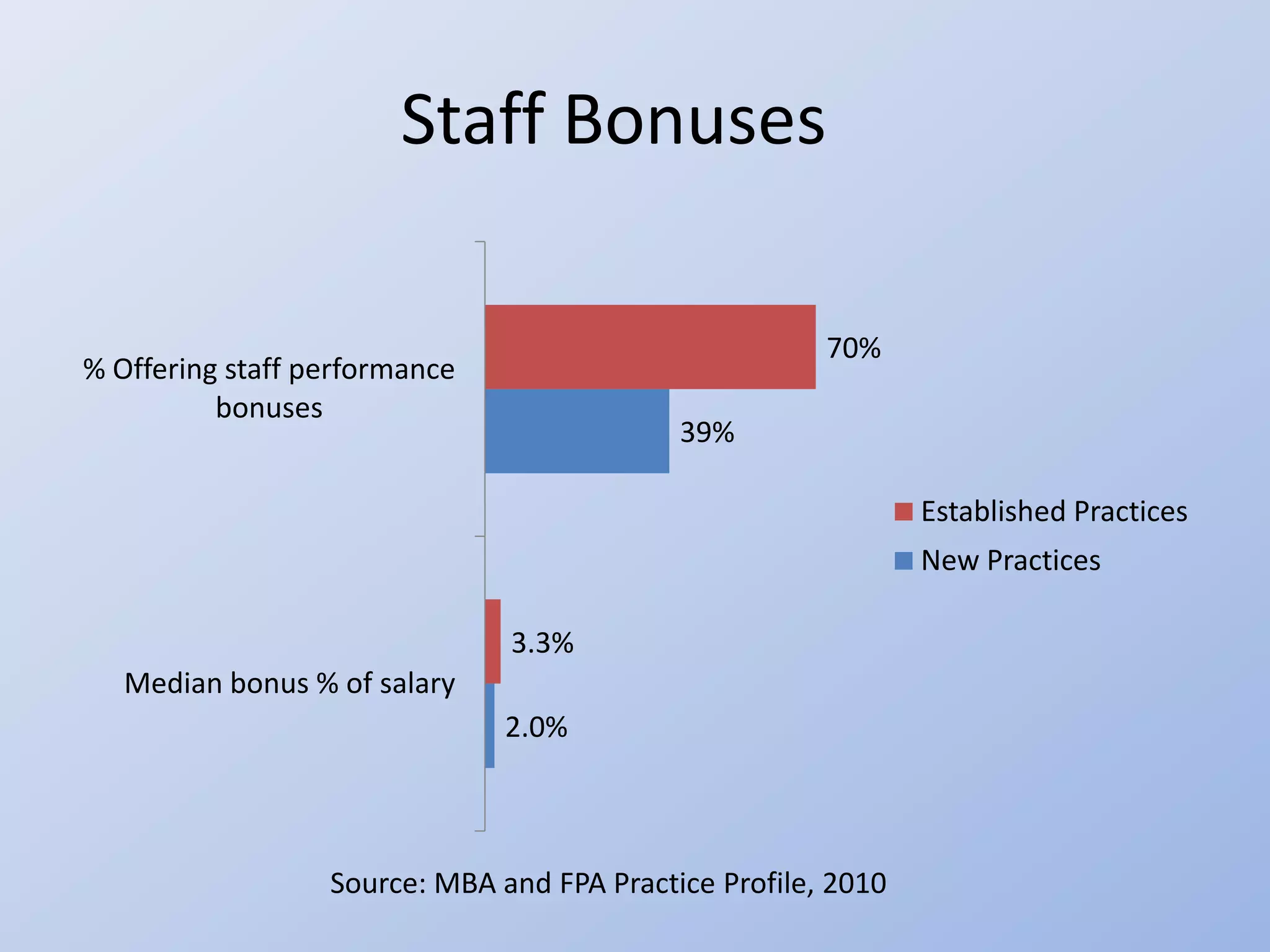

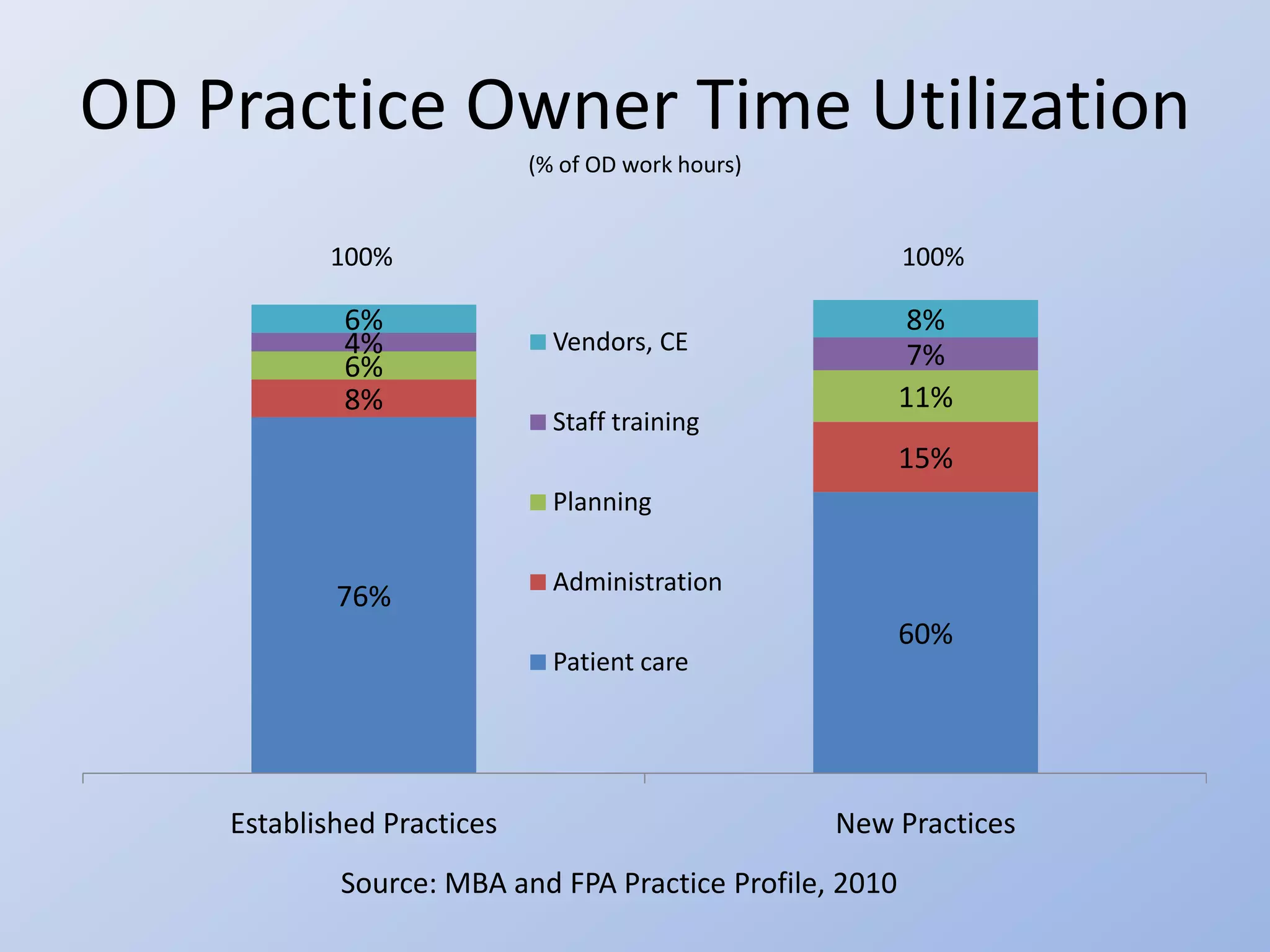

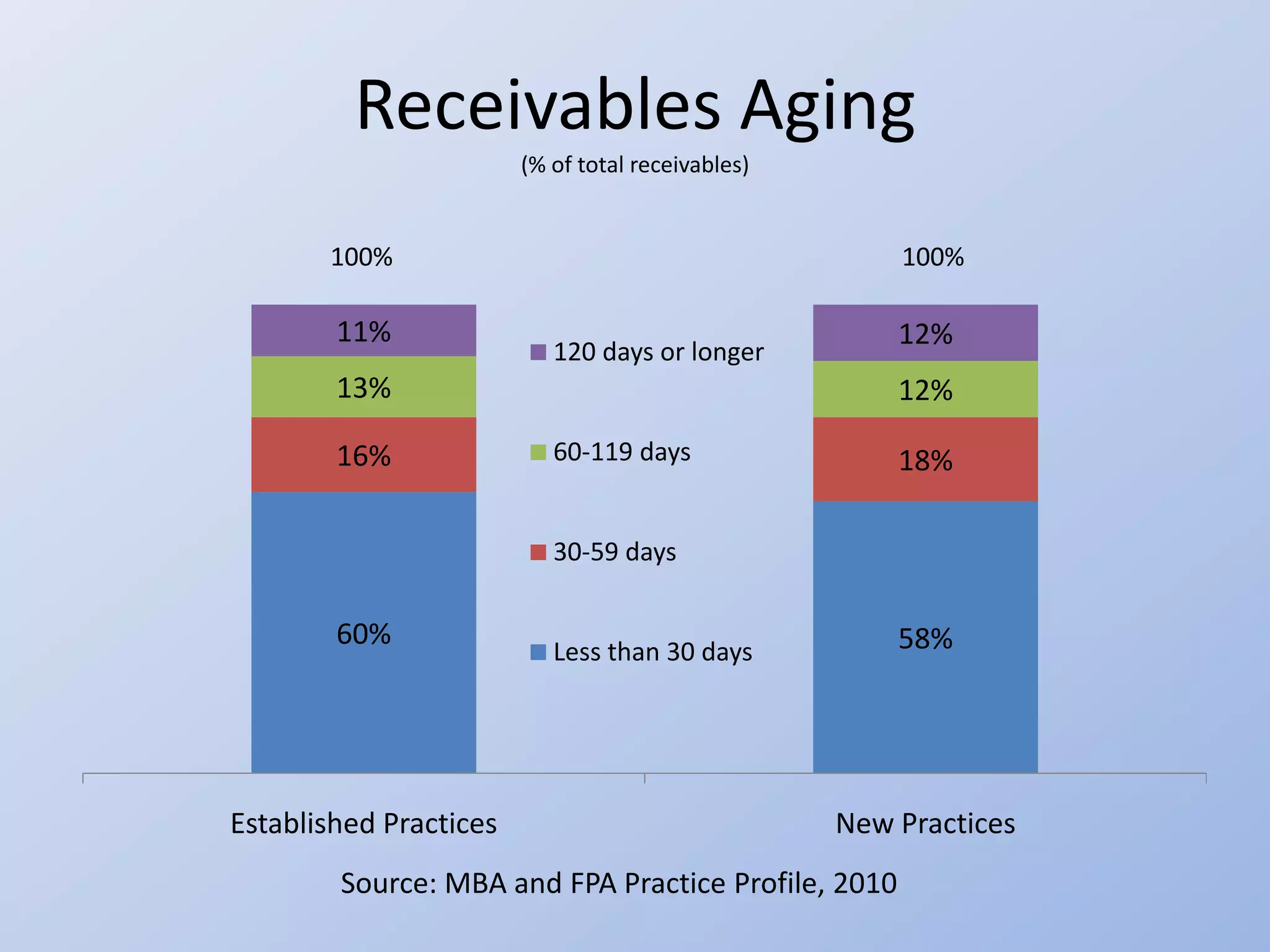

The document provides data from a 2010 survey comparing various characteristics of established optometric practices versus new practices. Some key differences included that established practices were more likely to be sole proprietorships or S-corps while new practices favored partnerships or C-corps. Established practices also tended to be located in strip malls, medical buildings, or free-standing offices while new practices favored office buildings or enclosed shopping malls.