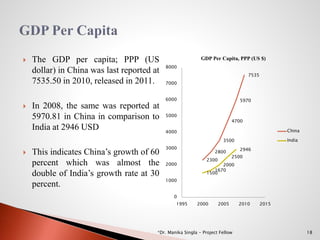

The document discusses India's ability to outpace China's exports. It analyzes factors that have contributed to China's strong economic growth, such as foreign investment, export competitiveness, and government support for manufacturing sectors. The document also examines India and China's comparative contributions to GDP and exports in different industry sectors from 2000-2010. It identifies opportunities for India in areas like food processing, engineering goods, and biotechnology. Finally, the document provides a SWOT analysis and recommends strategies for India to strengthen infrastructure, attract investment, and develop labor-intensive manufacturing to better compete globally.