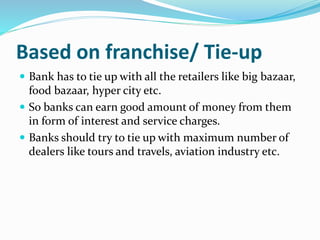

This document discusses credit cards and provides suggestions for making credit cards more accessible. It notes that eligibility requirements for credit cards are currently too complex, preventing many customers who can repay loans from getting cards. The author suggests that banks should issue credit cards to more customers regardless of savings account status or other criteria, as many can repay bills. Additionally, the document proposes several ideas to incentivize credit card use, such as special discounts, extended EMIs, and reward points programs. The goal is to expand card eligibility and encourage spending in order to increase business and loyalty for banks.