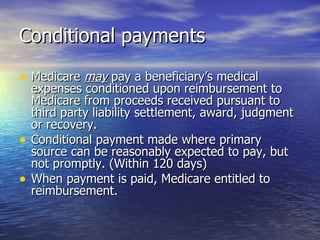

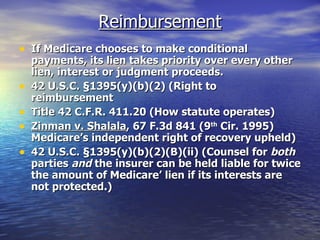

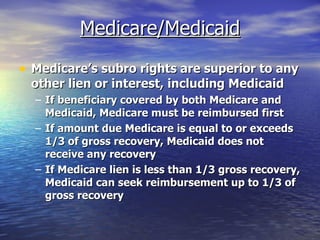

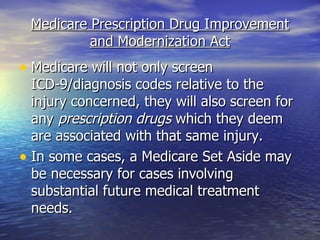

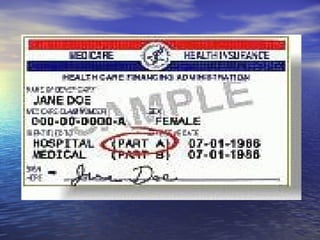

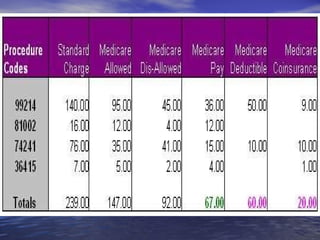

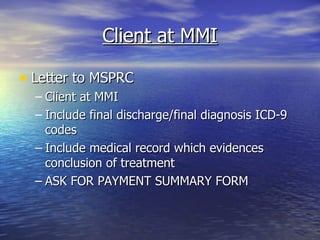

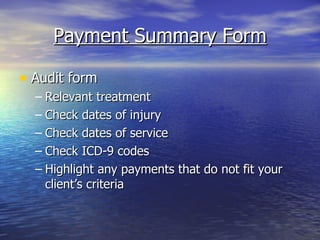

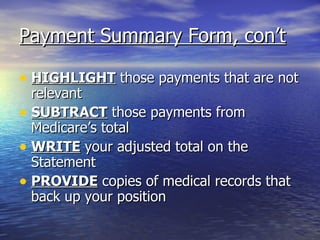

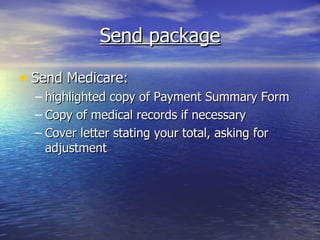

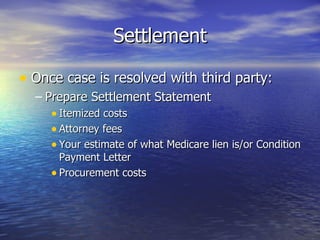

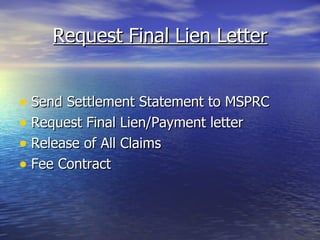

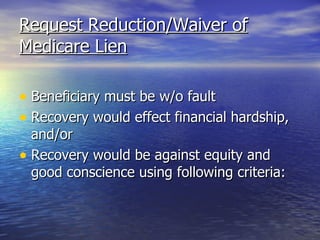

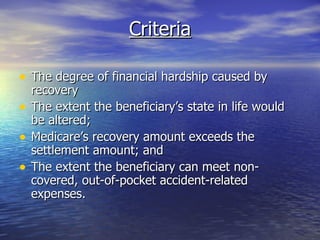

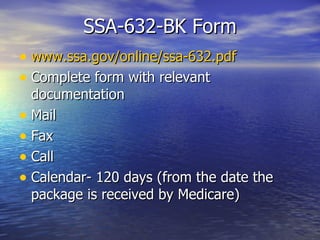

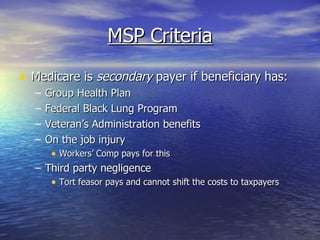

This document provides a step-by-step process for paralegals to handle Medicare liens when a client has received a settlement from a third party. It discusses Medicare's right to reimbursement for conditional payments made on behalf of beneficiaries. The process involves notifying Medicare of representation, gathering medical records, submitting documentation for payment summaries, negotiating adjustments, and requesting a final lien amount or reduction/waiver of the lien prior to disbursing settlement funds.

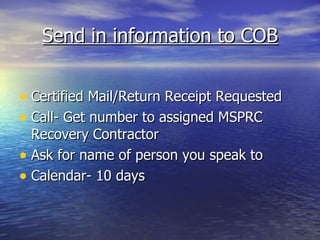

![Medicare Coordination of Benefits [COB] Centralized office Investigate and ID other health benefits available to beneficiary Coordinate payment process Looks at injury codes Looks for trauma or injury http://www.cms.hhs.gov/COBGeneralInformation/ .](https://image.slidesharecdn.com/powerpointmedicarestepbystep2-12499817247374-phpapp01/85/Power-Point-Medicare-Step-By-Step-2-11-320.jpg)