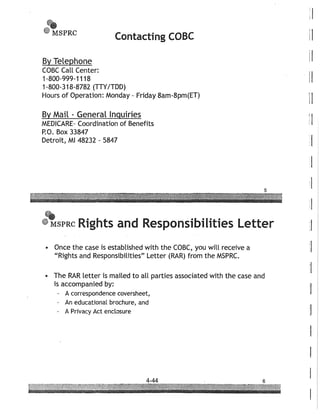

This document provides guidance on identifying and negotiating third-party claims to an injured party's recovery in a personal injury case. It discusses common third-party payers like Medicare, private health insurers, workers compensation, Medicaid, and crime victim compensation programs. For each, it provides details on notification procedures, important documents to obtain, and potential avenues for negotiating reimbursement claims. Key points include differentiating between self-funded ERISA plans and insured health plans when negotiating with private insurers, using equity principles and recent case law to negotiate Medicare and ERISA reimbursements, and properly following each state's procedures for workers compensation reimbursement.