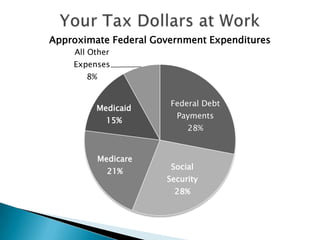

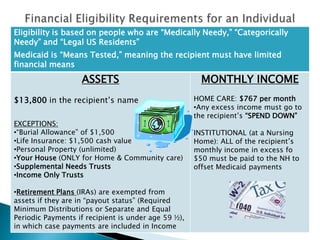

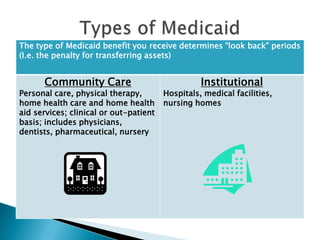

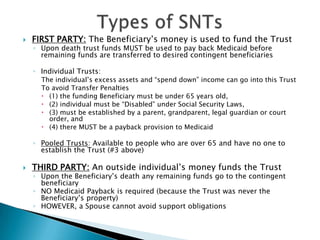

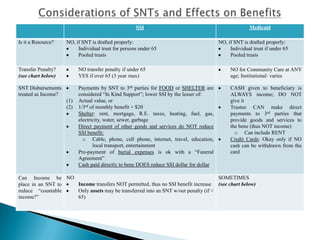

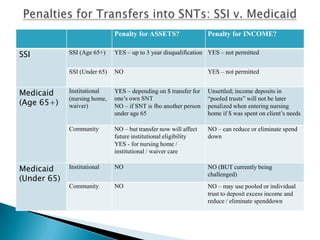

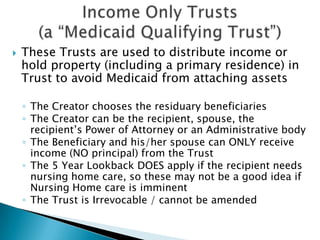

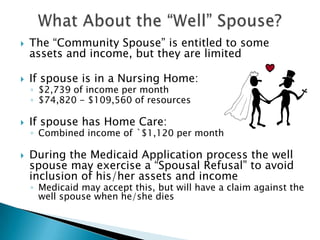

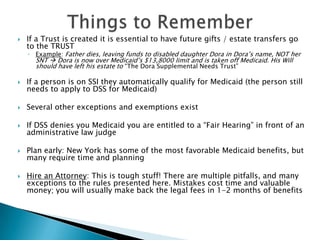

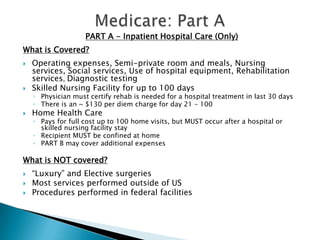

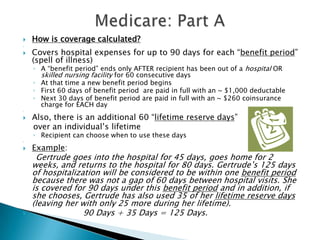

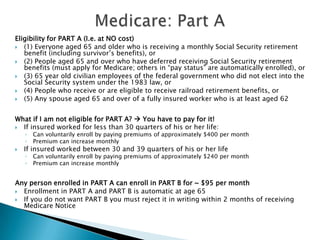

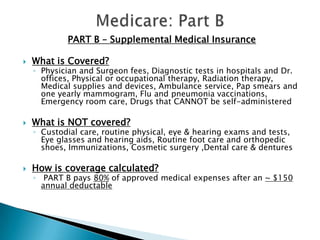

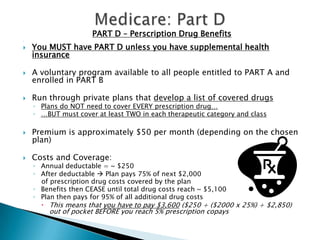

The document outlines essential information regarding Medicaid planning and Medicare benefits, focusing on types of trusts and eligibility criteria to maintain benefits. It covers various types of supplemental needs trusts and highlights the financial eligibility requirements for Medicaid in New York, as well as the different parts of Medicare and their coverage details. The importance of early planning, legal assistance, and understanding benefits to avoid pitfalls is emphasized throughout.