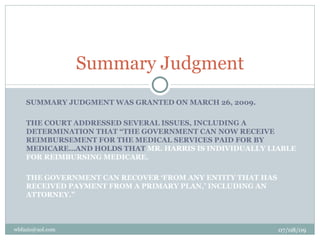

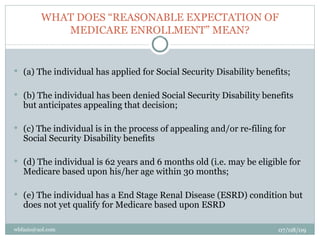

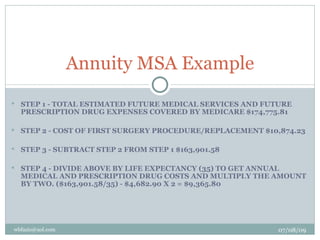

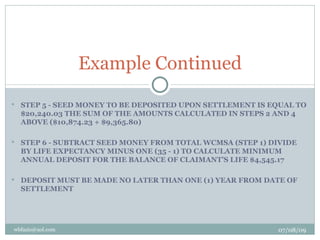

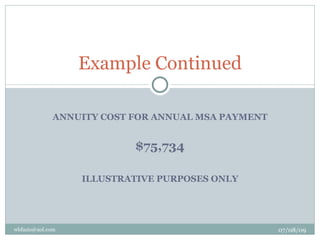

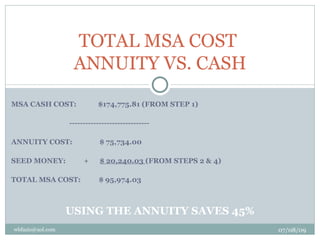

The document discusses Medicare Set Asides (MSAs), which allocate a portion of a settlement involving a Medicare beneficiary to future medical expenses that would normally be covered by Medicare. An MSA is needed because Medicare is precluded from paying for medical expenses if payment has been made through other means like workers' compensation. The 2007 Medicare Act expanded MSA requirements to other plans like liability and no-fault insurance and added penalties for noncompliance. Setting up a structured MSA using annuities can significantly reduce costs compared to paying the full amount in cash. Attorneys need to understand MSA thresholds and protect Medicare's interests to avoid potential liability.