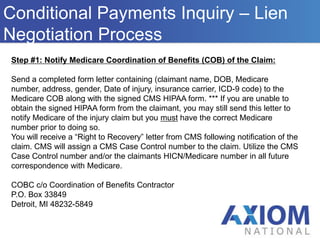

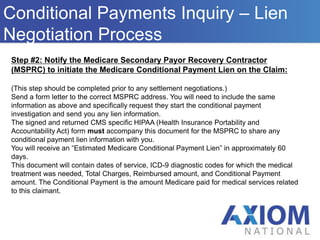

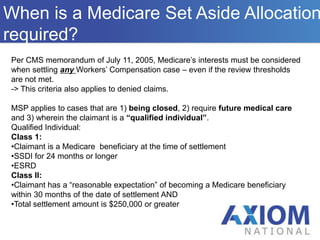

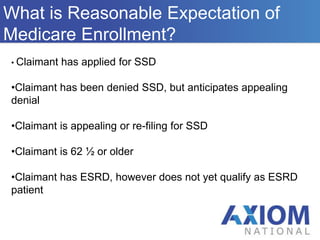

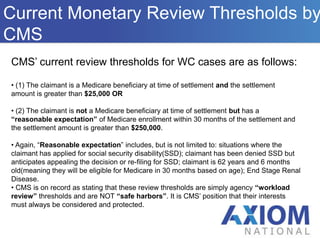

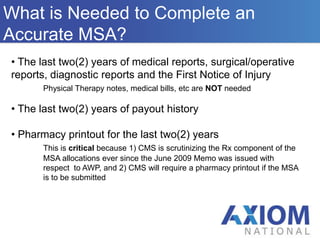

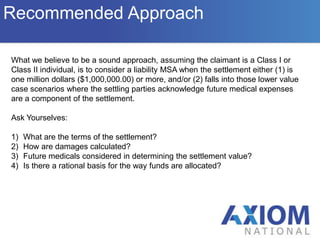

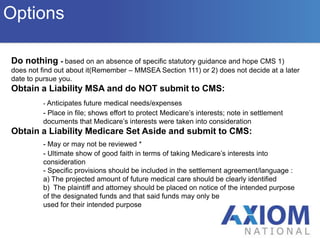

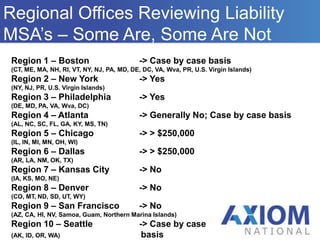

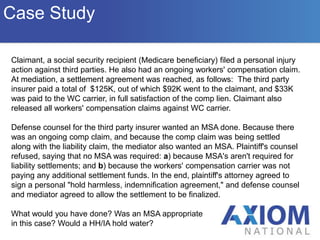

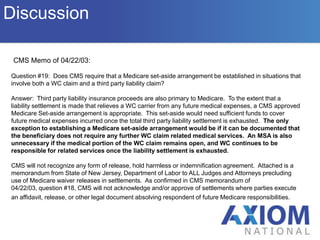

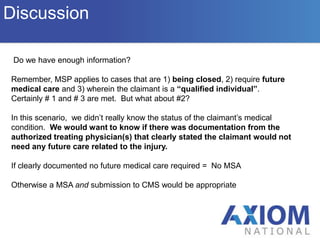

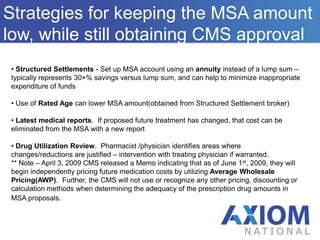

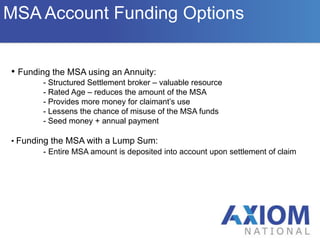

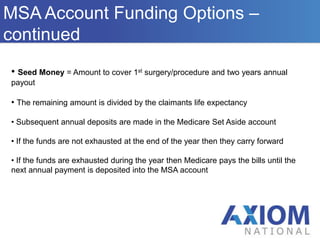

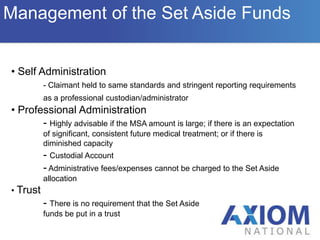

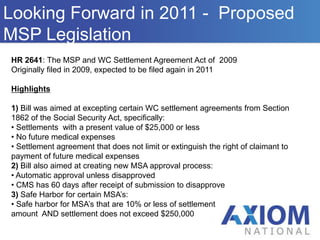

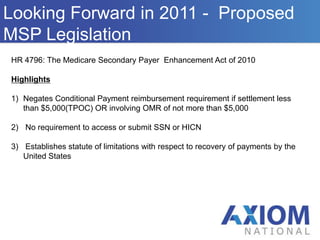

The document provides an overview of the Medicare Secondary Payer (MSP) statute, which requires primary payers to cover medical expenses before Medicare pays. It details the responsibilities of primary payers, the process for negotiating Medicare conditional payment liens, and the requirements for Medicare set-asides (MSAs) in workers' compensation cases, including the criteria for when an MSA is needed. Additionally, it discusses the implications of recent legislation affecting liability claims and the variability of regional office practices concerning MSA reviews.