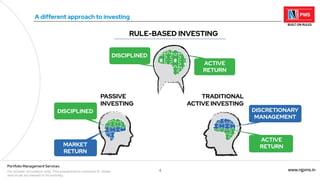

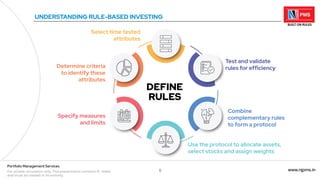

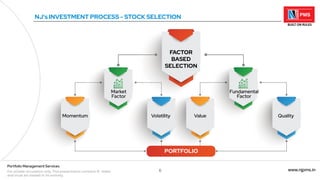

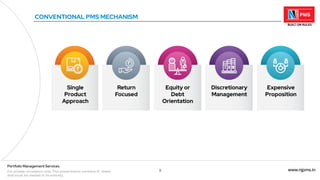

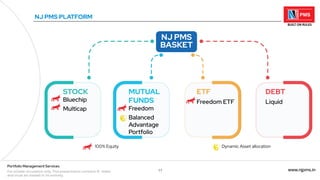

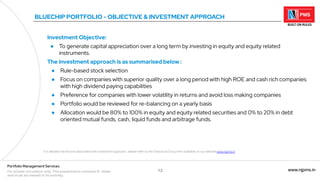

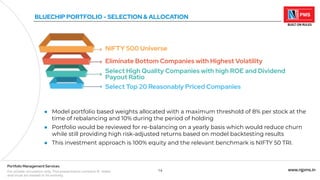

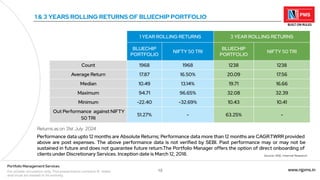

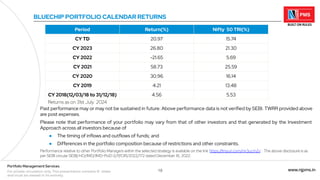

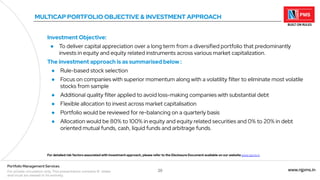

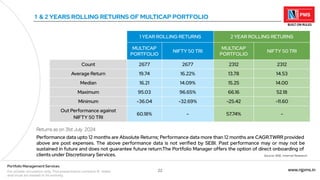

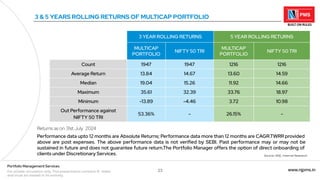

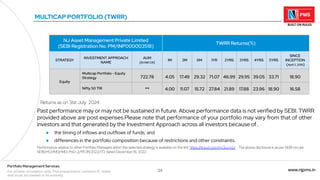

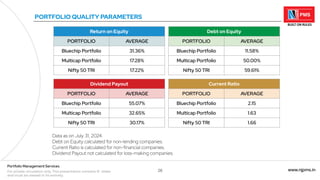

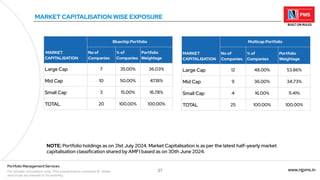

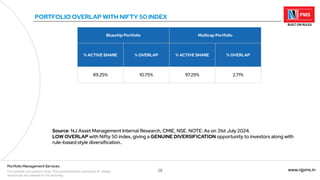

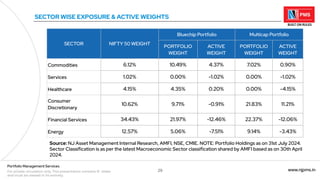

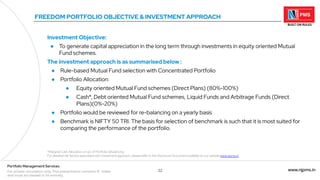

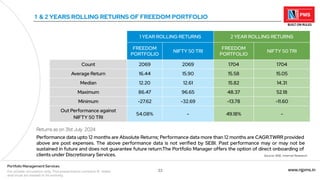

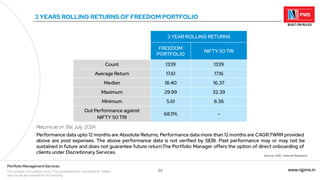

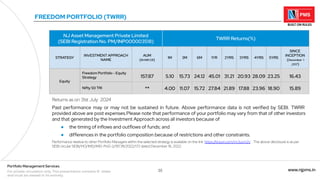

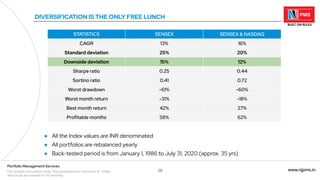

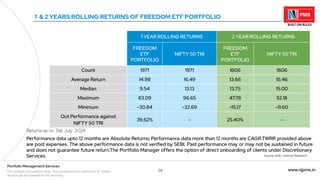

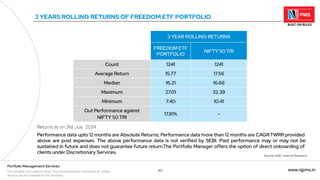

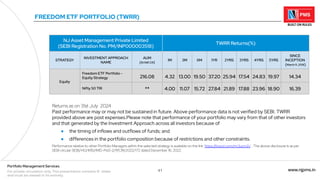

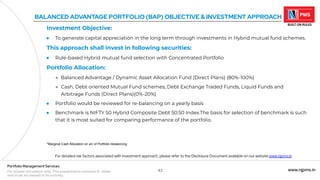

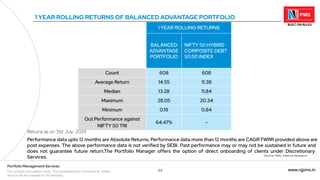

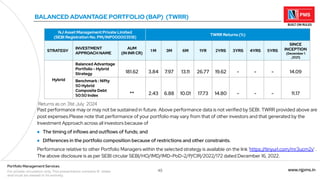

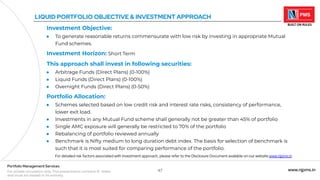

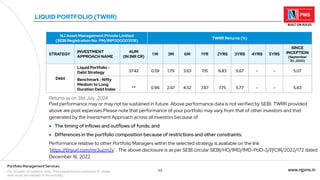

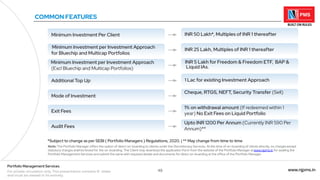

The document presents an overview of NJ Group's portfolio management services, highlighting their rule-based investing strategy initiated in 2010, with assets under management exceeding INR 4,410 crores. It details various investment portfolios such as bluechip and multicap, focusing on capital appreciation through disciplined stock selection across different market capitalizations. Performance data indicates outperformance against benchmarks like the Nifty 50 TRI, offering potential clients insights into their investment process and historical returns.