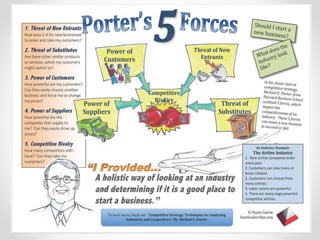

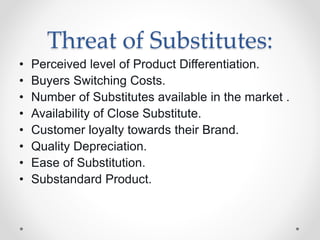

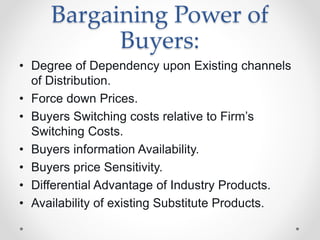

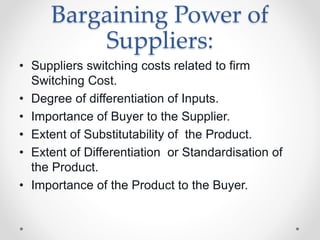

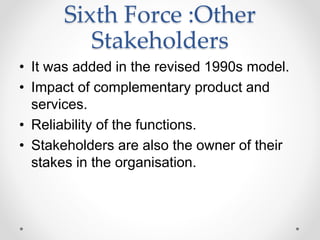

The document discusses Michael Porter's Five Forces model for analyzing competitive structure in industries. The model assesses the long-term attractiveness of industries by examining five competitive forces: the threat of new entrants, the threat of substitutes, rivalry among existing firms, bargaining power of buyers, and bargaining power of suppliers. A sixth force of other stakeholders was later added. Each force is influenced by several factors like barriers to entry, switching costs, number of competitors and substitutes. The model helps understand industry dynamics but provides just a snapshot and does not capture all complexities or account for corporate social responsibility.