The document discusses various topics relating to mortgage markets including:

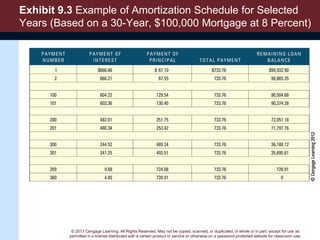

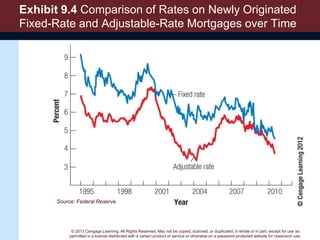

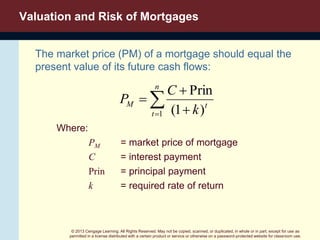

- Types of residential mortgages like fixed-rate, adjustable-rate, and balloon payment mortgages.

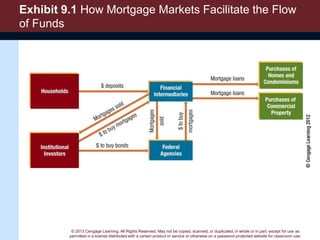

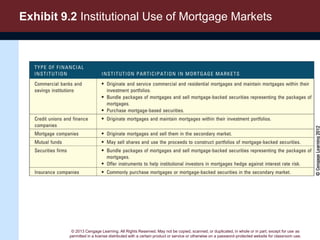

- How mortgage markets facilitate the flow of funds from households and institutions to finance home purchases.

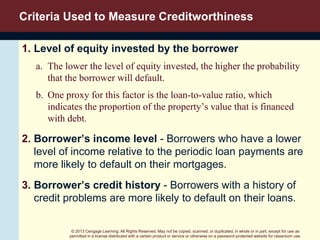

- Factors that determine the creditworthiness and risk of borrowers like loan-to-value ratio, income, and credit history.