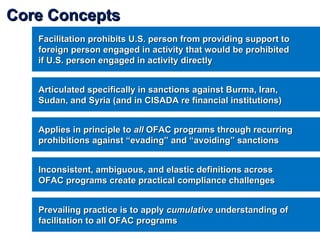

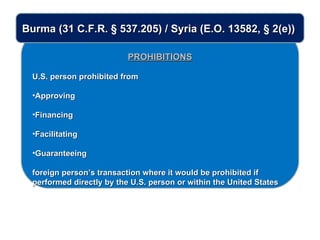

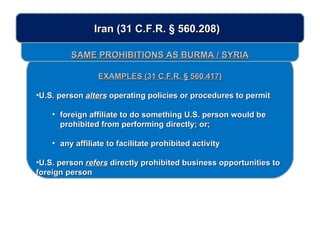

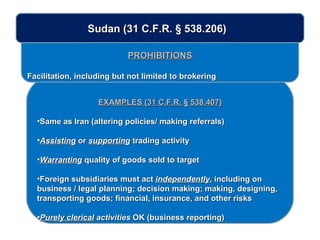

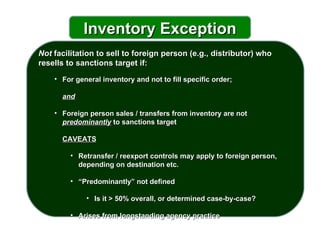

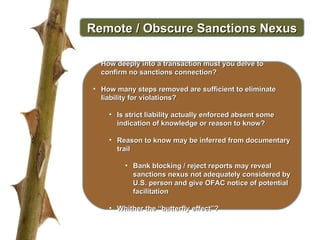

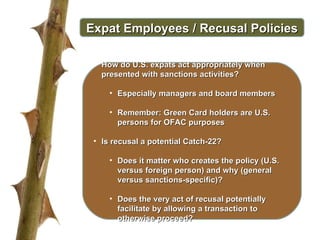

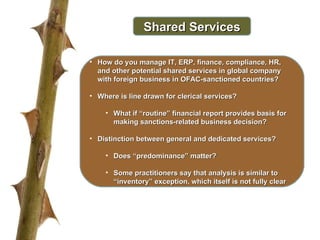

The document discusses OFAC regulations regarding facilitation prohibitions and the challenges they pose for compliance. It defines facilitation broadly as any action that could help bring about a prohibited activity. This creates uncertainty, as even remote or indirect support of sanctions targets risks violation. Key challenges include determining the independence of foreign subsidiaries and the level of entanglement that is permitted with sanctioned countries. Compliance requires understanding all aspects of transactions to avoid any connection to prohibited activities.

![Merriam-Webster : to make easier : help bring about facilitate fə-si-lə-tāt (transitive verb) OFAC : to do anything [pretty much] that can be associated, however remotely, with a sanctions target](https://image.slidesharecdn.com/facilitation2october2011-111118152438-phpapp01/85/Pisa-Relli-OFAC-Facilitation-October-2011-2-320.jpg)