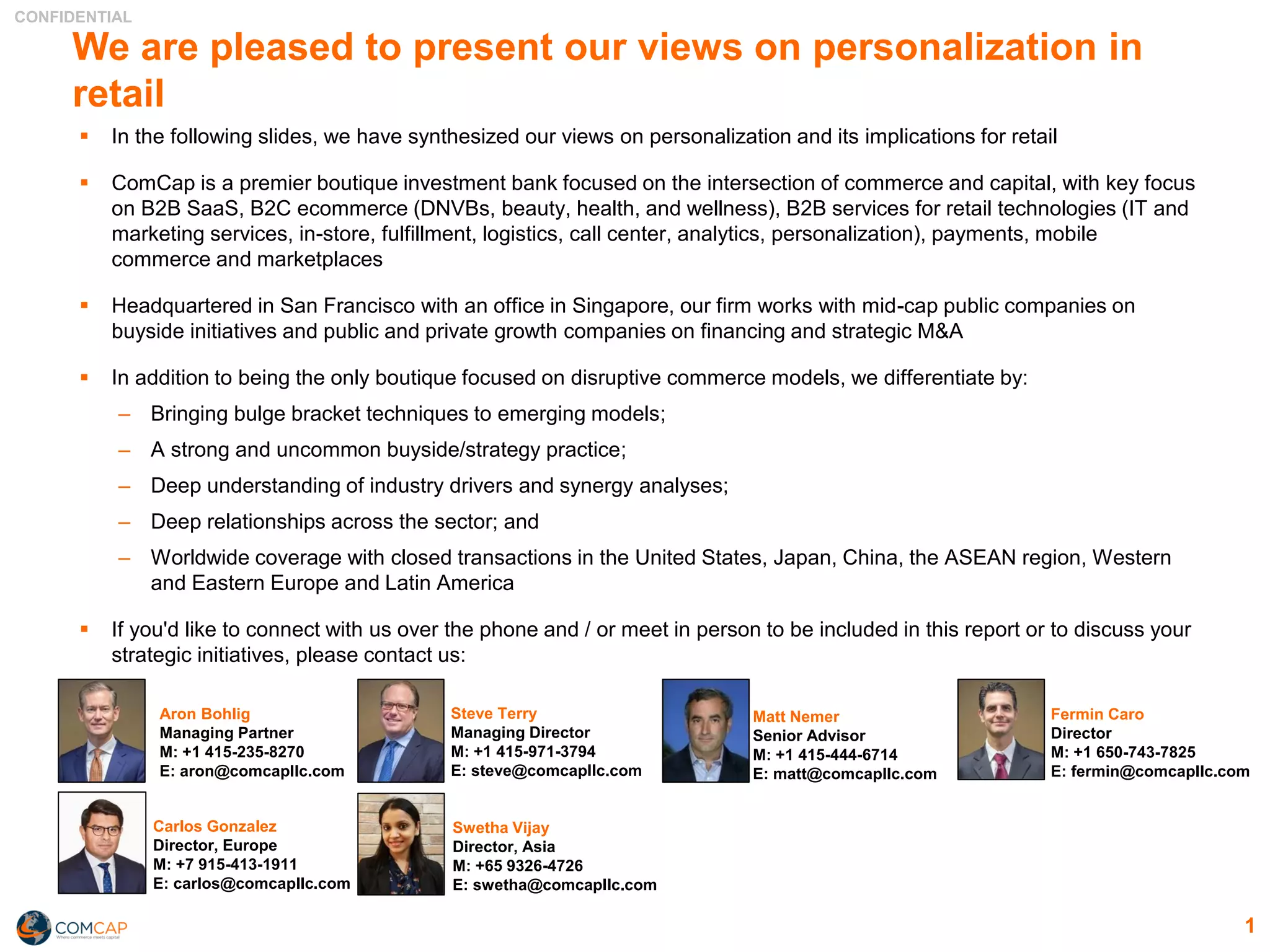

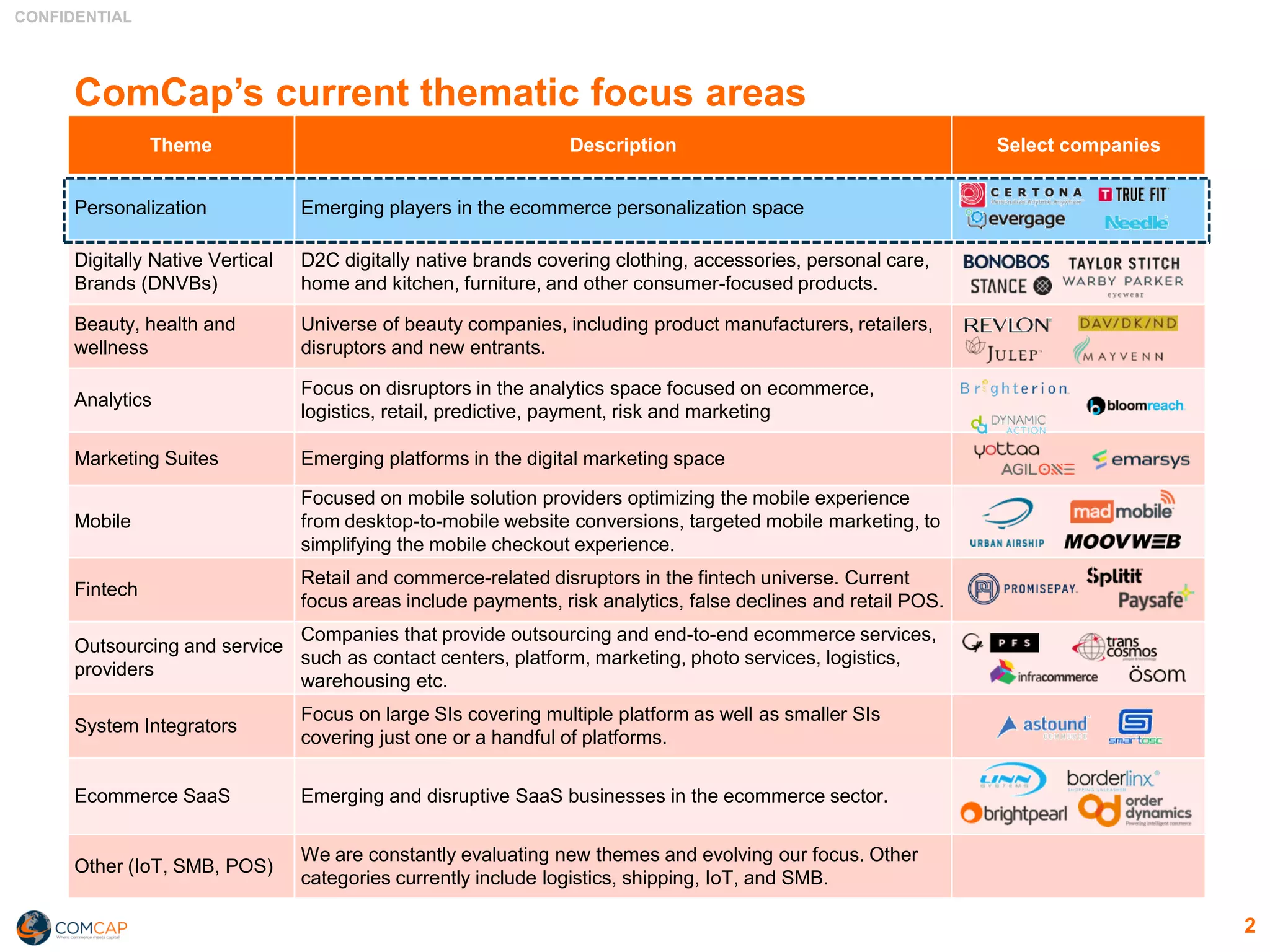

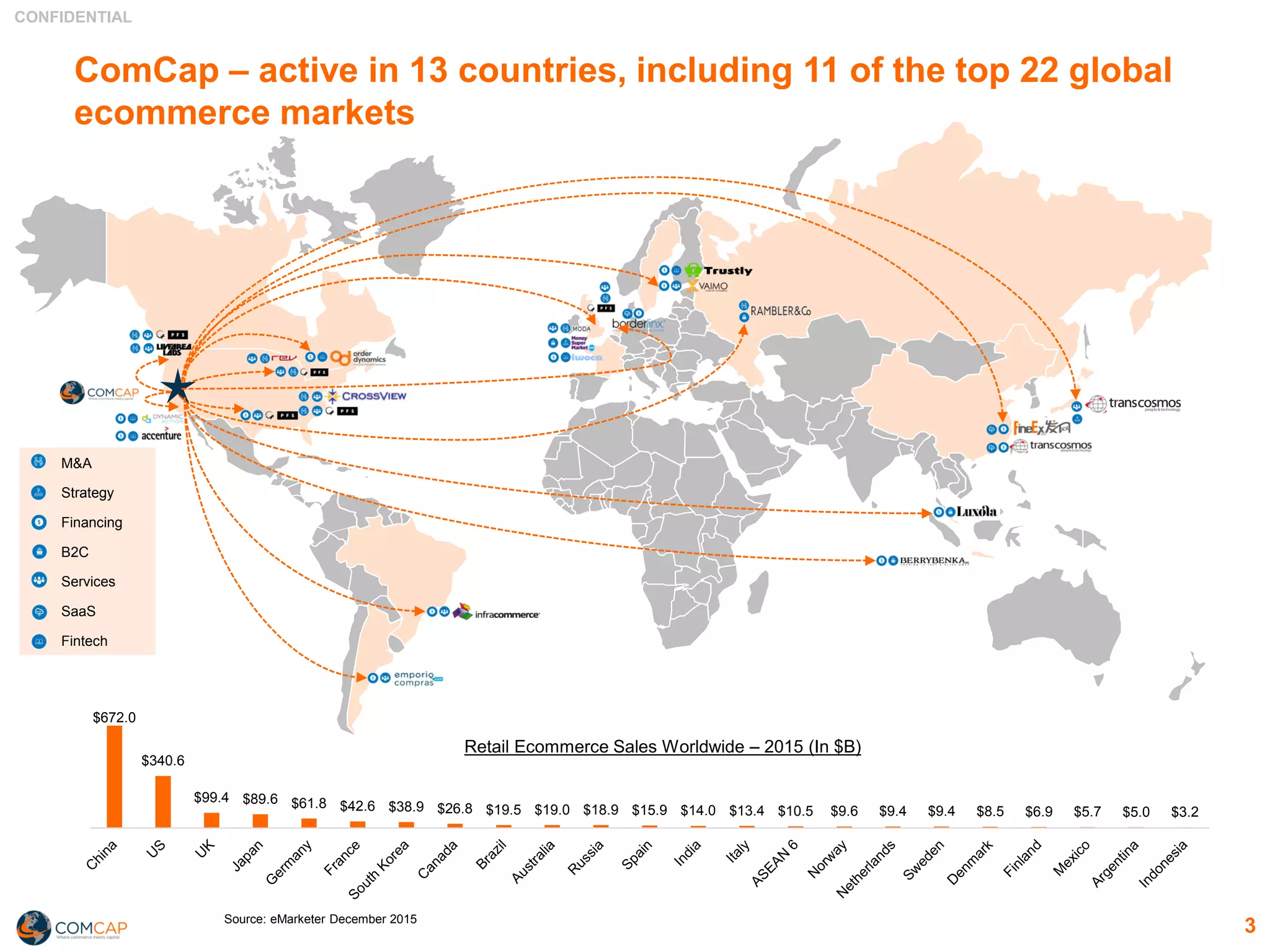

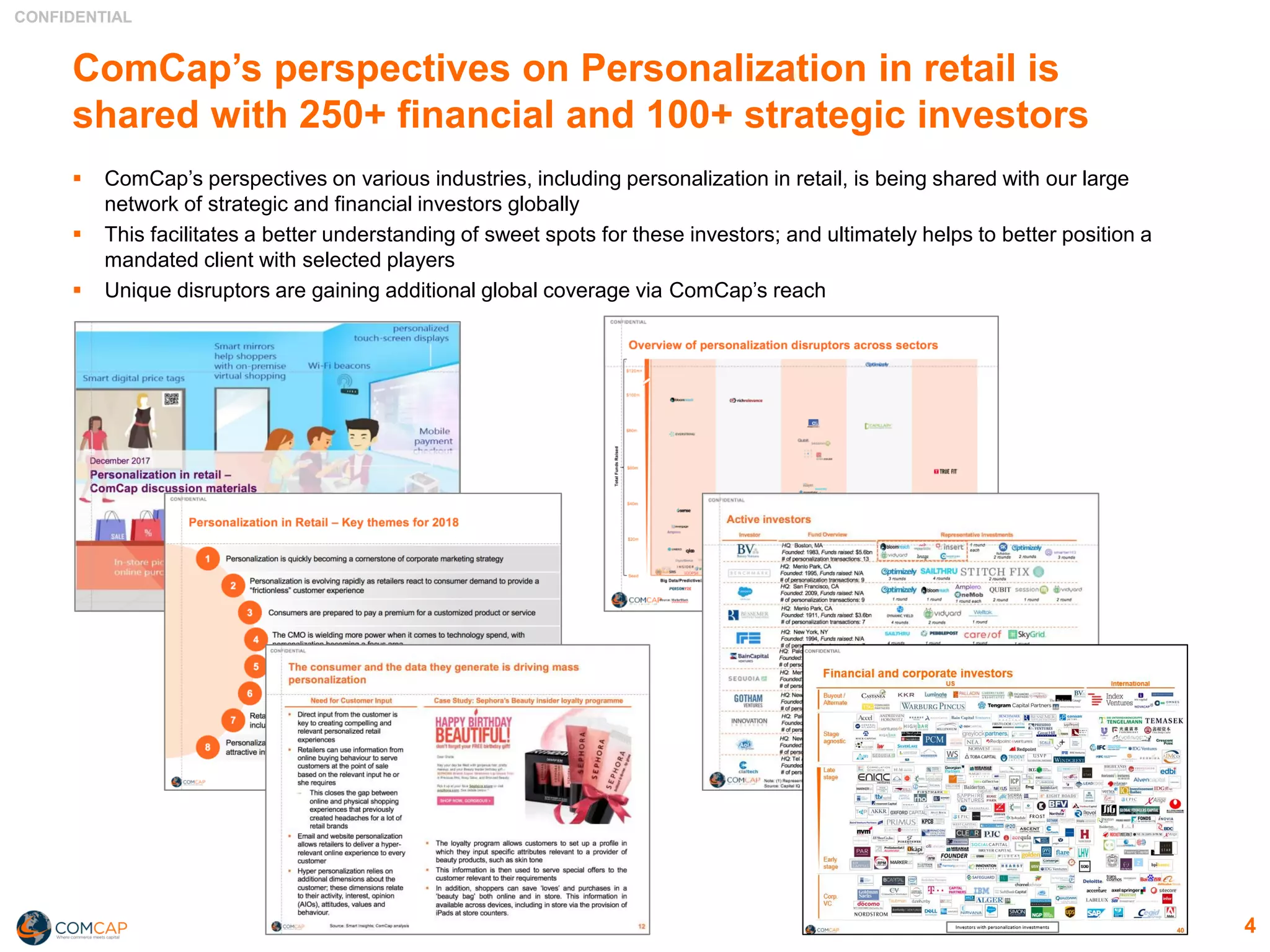

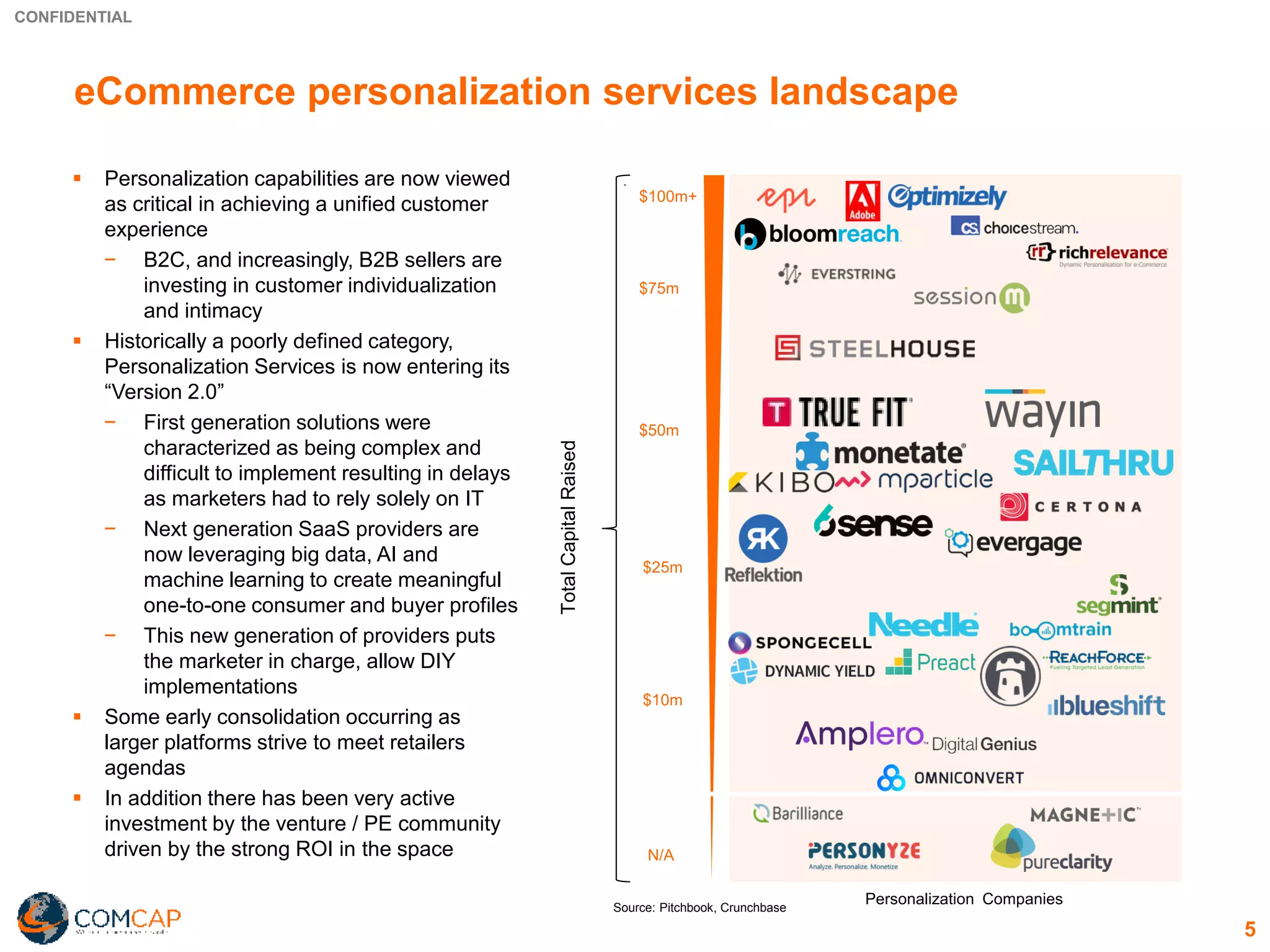

ComCap is an investment bank focused on commerce and capital markets that provides M&A advisory, financing, and strategic services. The document discusses ComCap's views on personalization in retail and how disruptive personalization companies are attracting significant investment. It also outlines ComCap's network of investors and clients that it shares insights on personalization trends with.

![CONFIDENTIAL

7

Personalization is of current paramount importance

“The bottom line is that if you can't identify customers

through the interaction channels, you can't engage with

them in a meaningful way… Businesses must integrate

their customer relationship management (CRM) systems

with data sources from other customer touchpoints, [and]

need to consider new approaches and programs that

will enable them to capture additional customer

behavior information that will provide deeper insights”

-Brian Chung, Head of Global Solutions

Marketing, SAP

“Personalization is helping us build relationships with our

customers that translate into increased engagement,

loyalty and revenue.”

- Simon Pritchard, Group Digital Director,

Arcadia

“59% of shoppers who have experienced personalization

believe it has a noticeable influence on purchasing.”

-Rethinking Retail, Infosys

“77% of consumers have chosen, recommended, or paid

more for a brand that provides a personalized

experience.”

- Forrester Research

“In 2017, personalization will continue to drive customer

engagement for retailers….it will empower sales

associates to build stronger connections, increased

brand trust, and loyalty.”

- Oscar Sachs, CEO, Salesfloor

“70% of retailers cited personalization of the customer

experience as a leading customer engagement priority

for 2017.”

- Boston Retail Partners 2017 Customer

Engagement Survey

“In-store shopping is far from dead — but it does have to

change to keep up with the trends. Instead of telling

customers how, when and where to shop, retail stores are

catering to their customers’ individual shopping

requirements — the shopper is in charge, and retailers

must adapt.”

Gary Ambrosino, CEO, TimeTrade

1](https://image.slidesharecdn.com/personalizationkeythemes2018updated-180103170443/75/Personalization-Key-Themes-2018-8-2048.jpg)