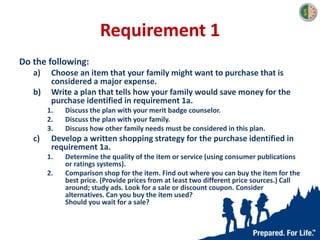

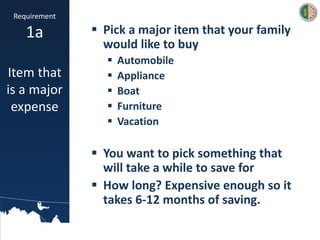

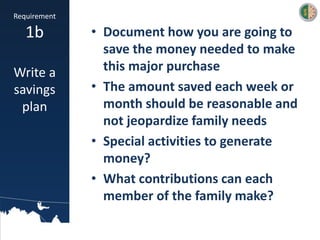

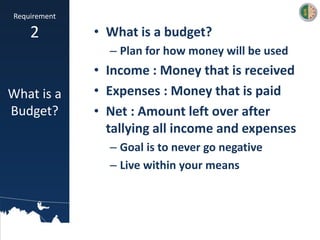

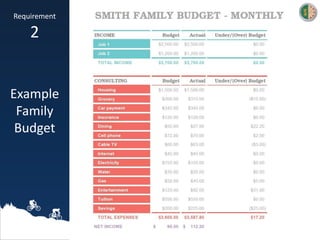

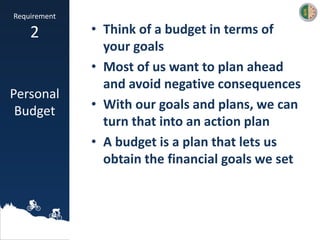

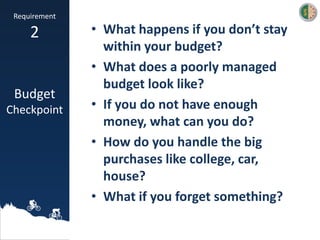

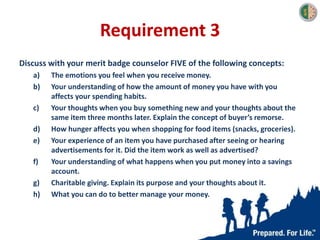

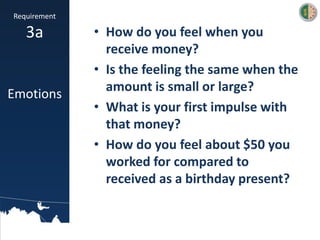

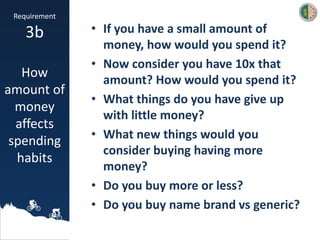

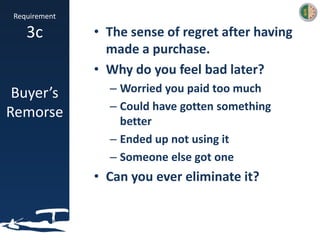

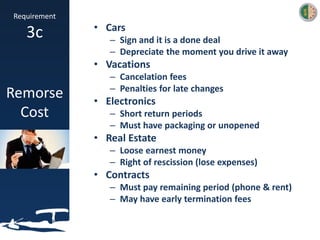

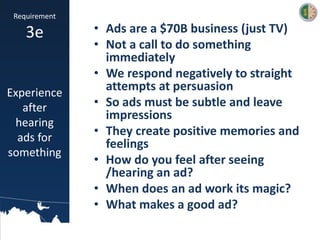

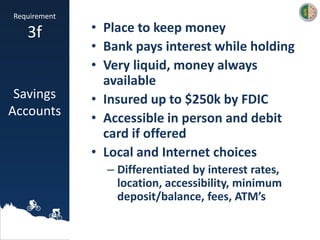

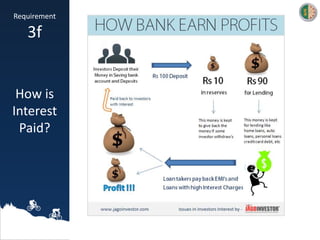

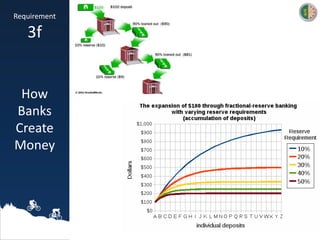

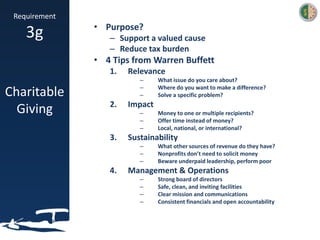

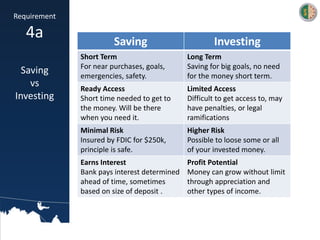

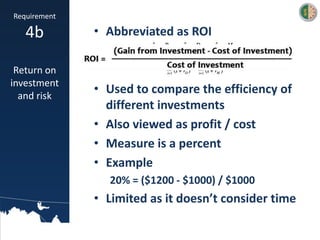

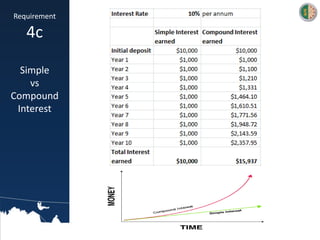

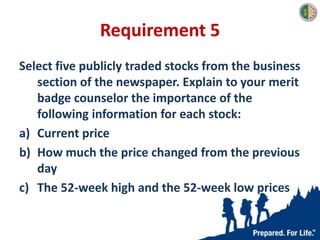

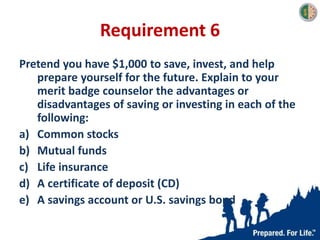

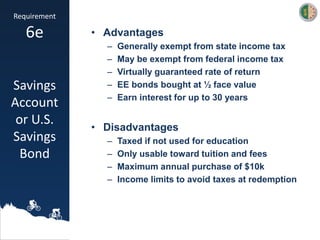

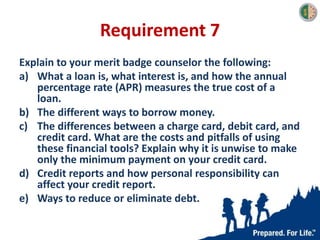

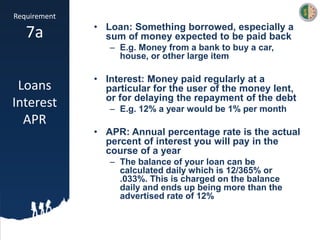

This document provides an overview of the Personal Management merit badge presentation by Robert Casto. It outlines the requirements covered, including developing a savings plan for a major purchase, tracking expenses and income in a budget for 13 weeks, and discussing concepts like emotions around money, buyer's remorse, and charitable giving. The presentation encourages participation, asks attendees about their financial experiences, and provides examples and discussions to help scouts complete some of the badge requirements.