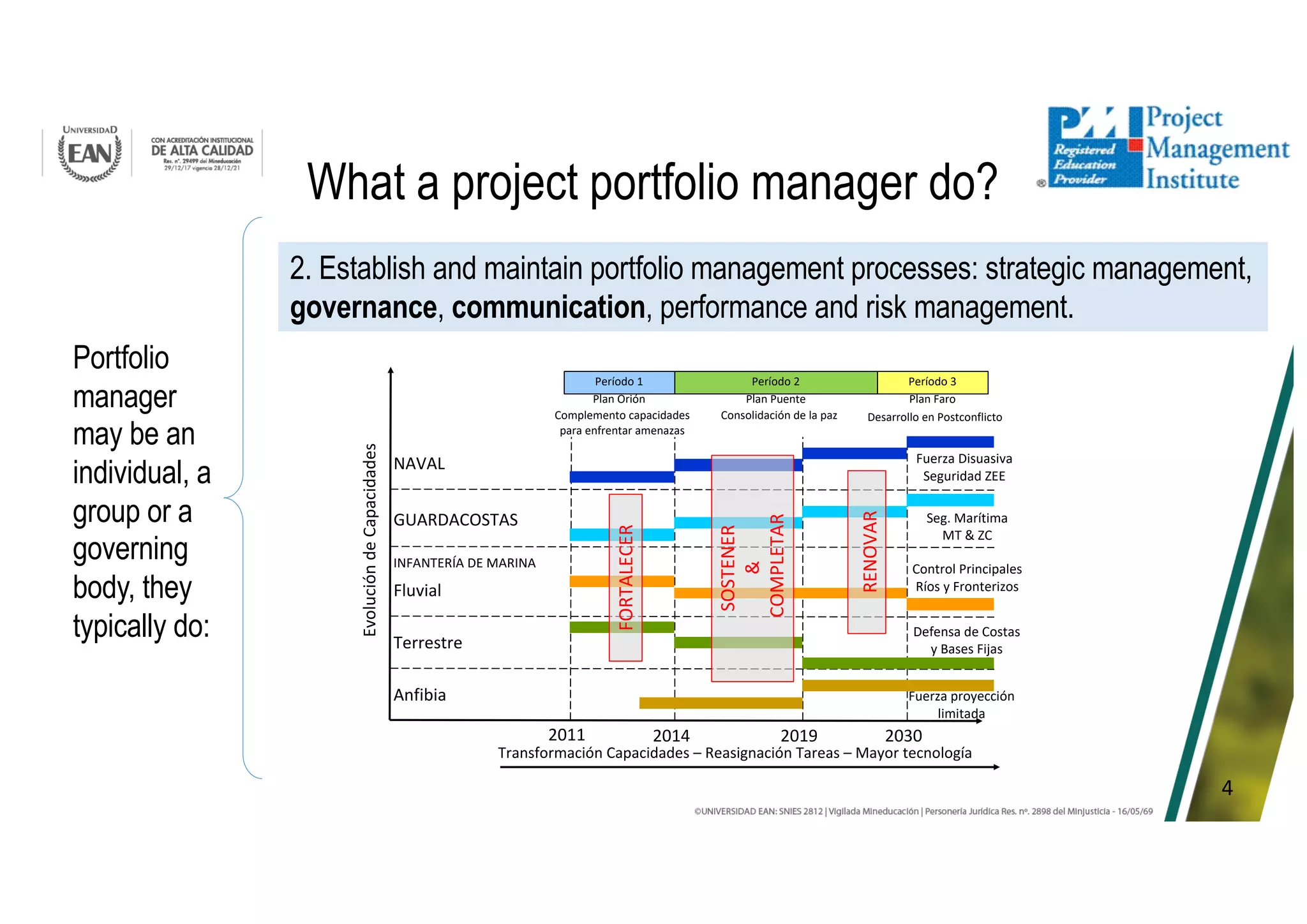

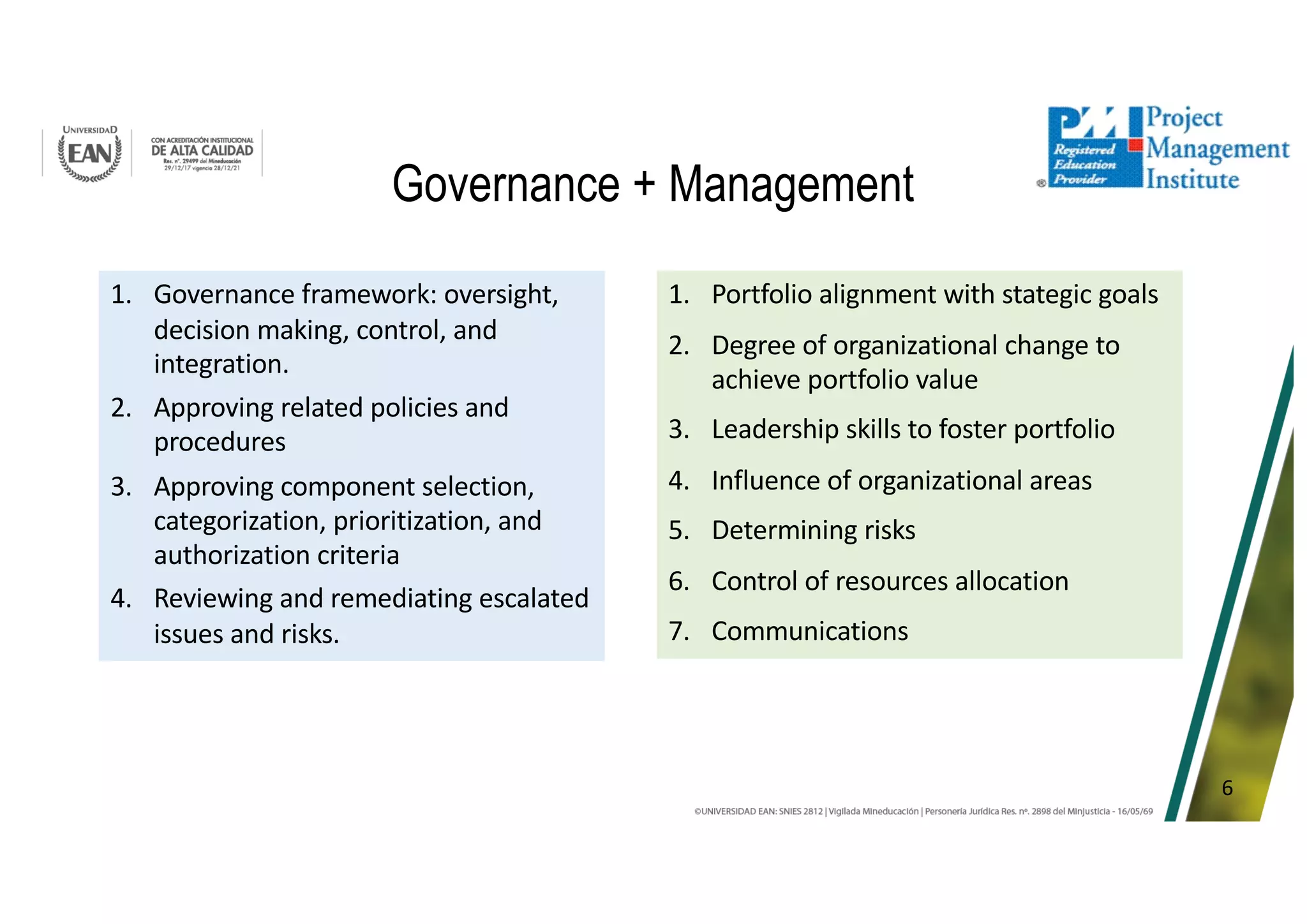

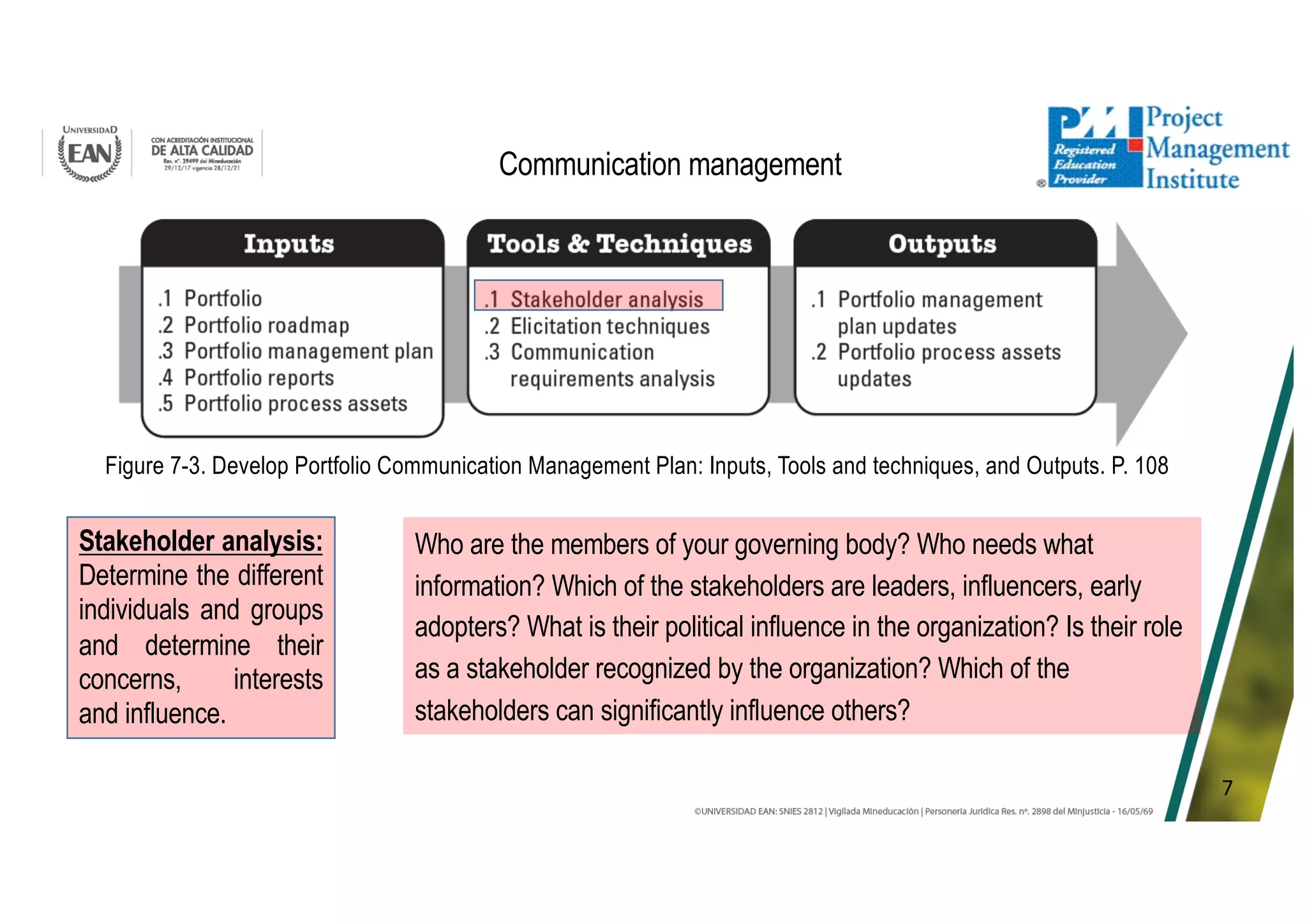

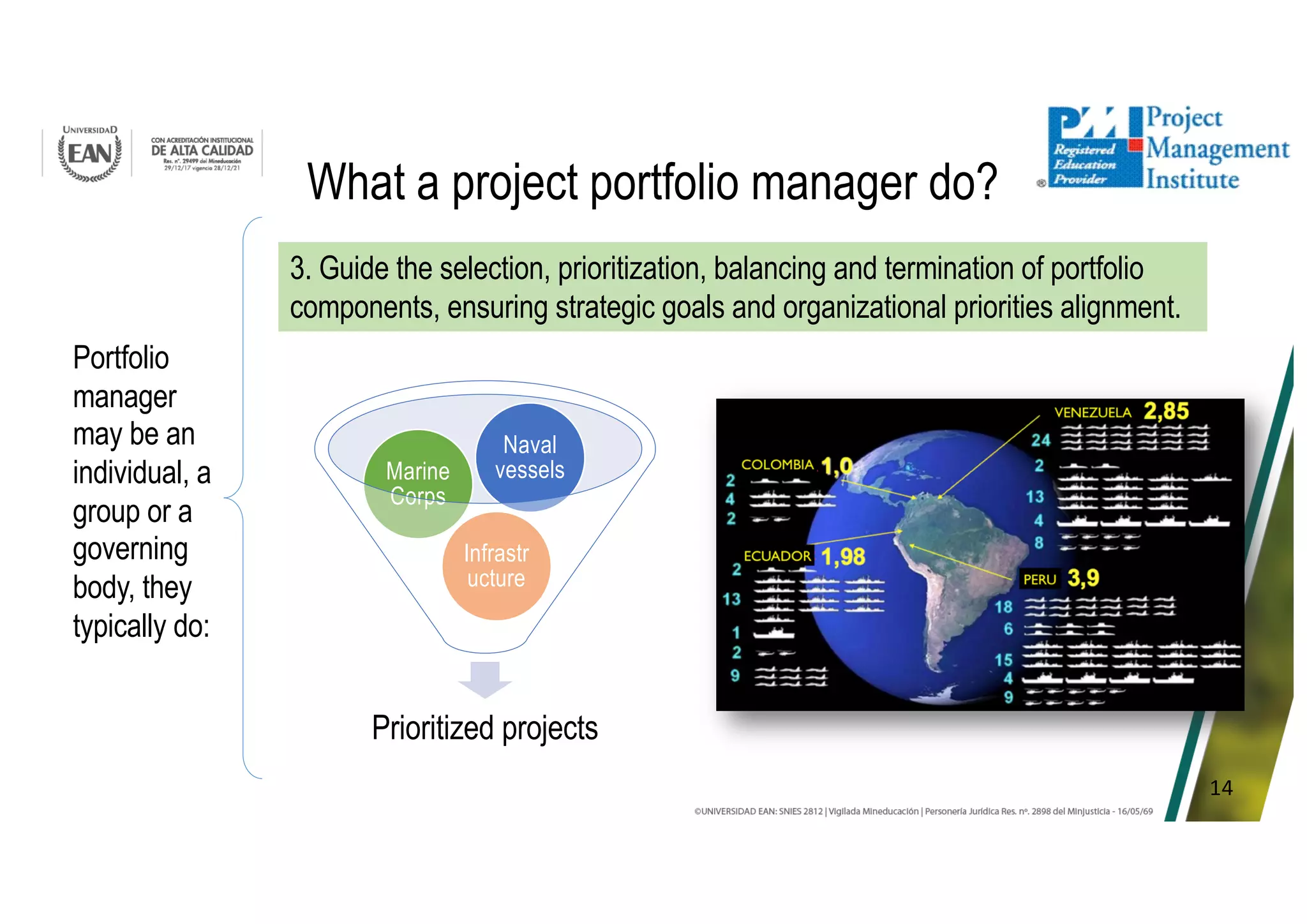

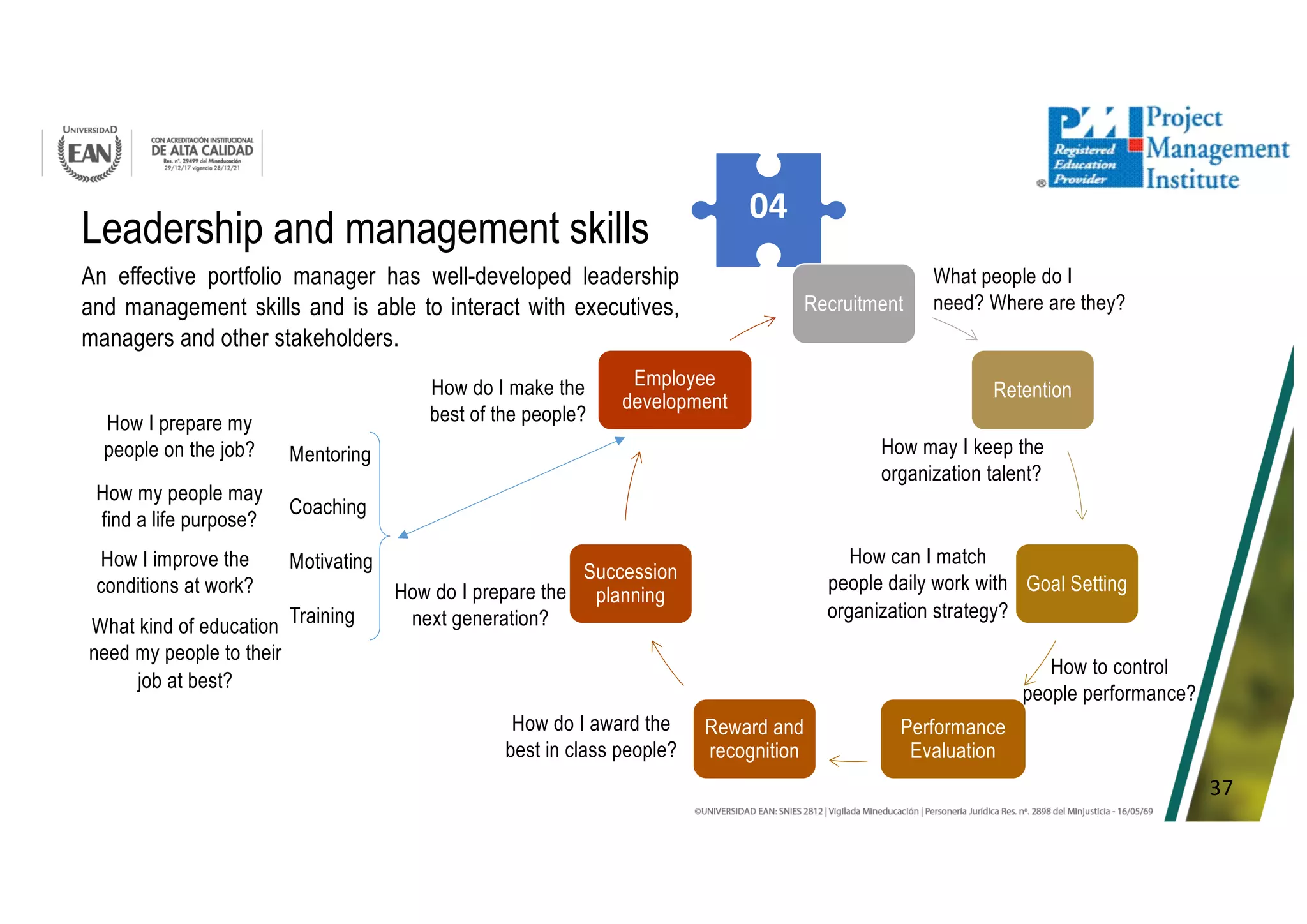

The document discusses the roles and responsibilities of a project portfolio manager. A portfolio manager typically establishes frameworks and processes for portfolio management, guides the selection and prioritization of portfolio components, and ensures strategic alignment. They provide oversight and governance, communicate with stakeholders, and support senior-level decision making. Effective portfolio managers have expertise in areas like strategic management, methods and techniques, stakeholder engagement, leadership, and risk management.