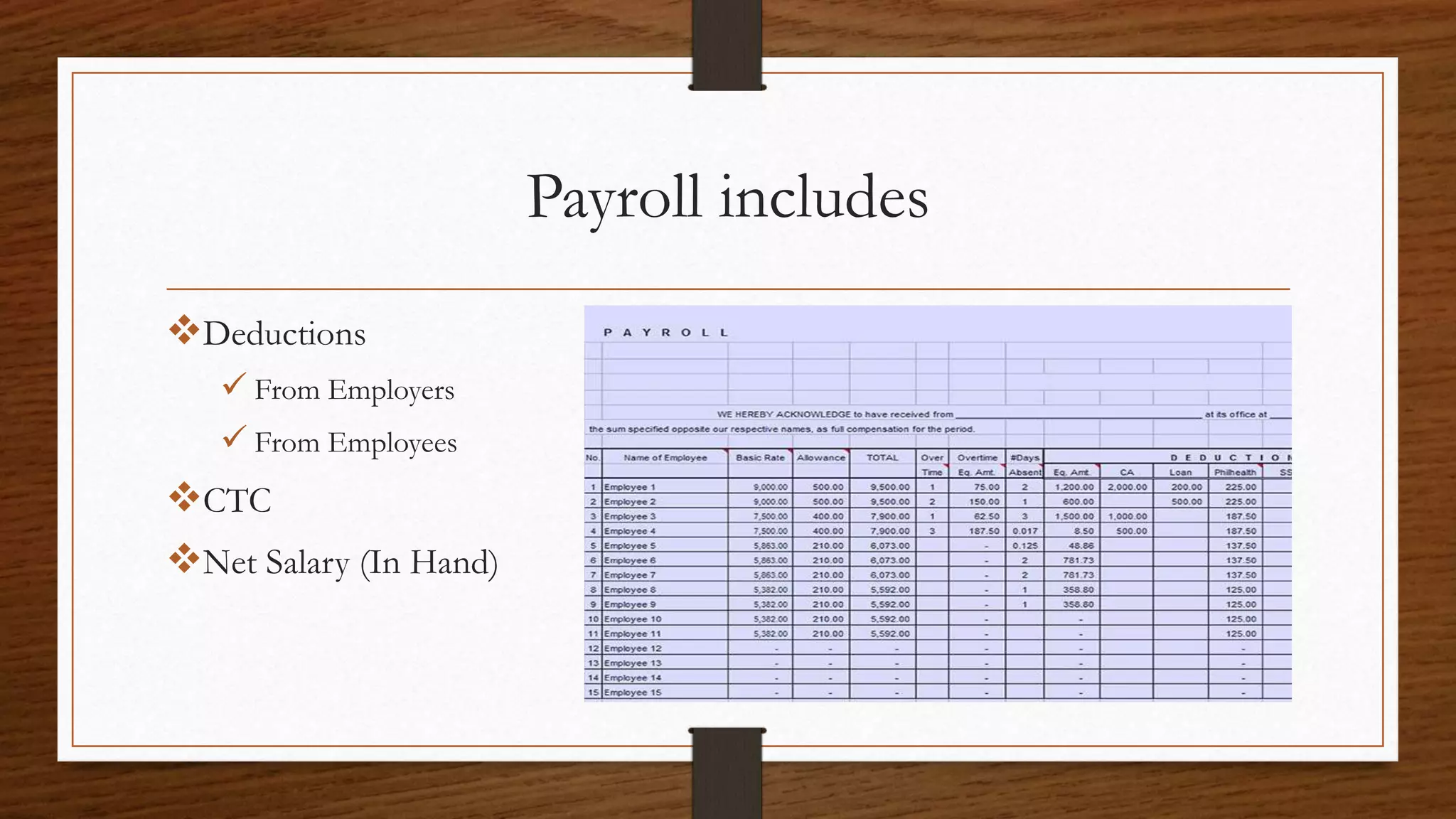

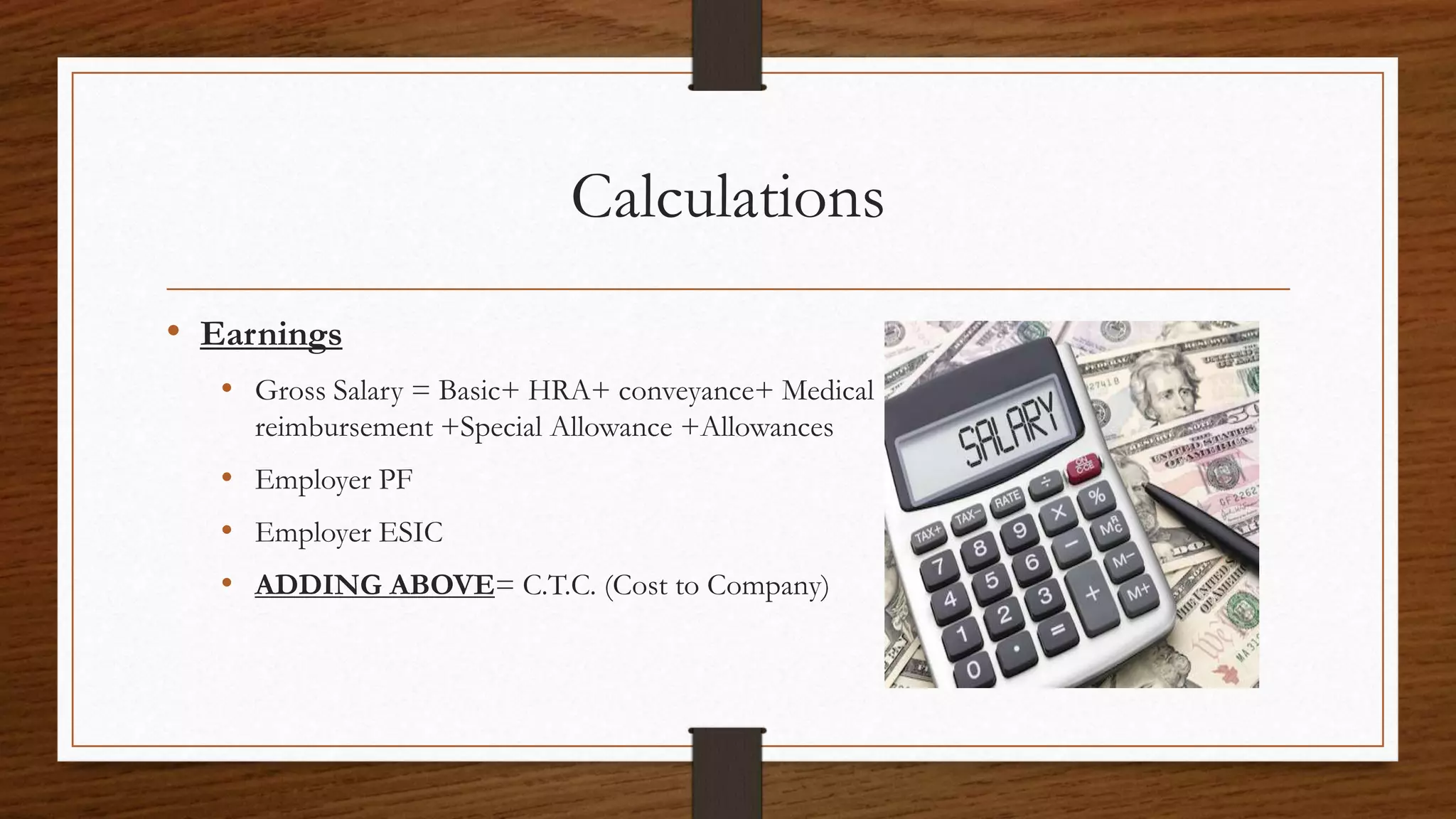

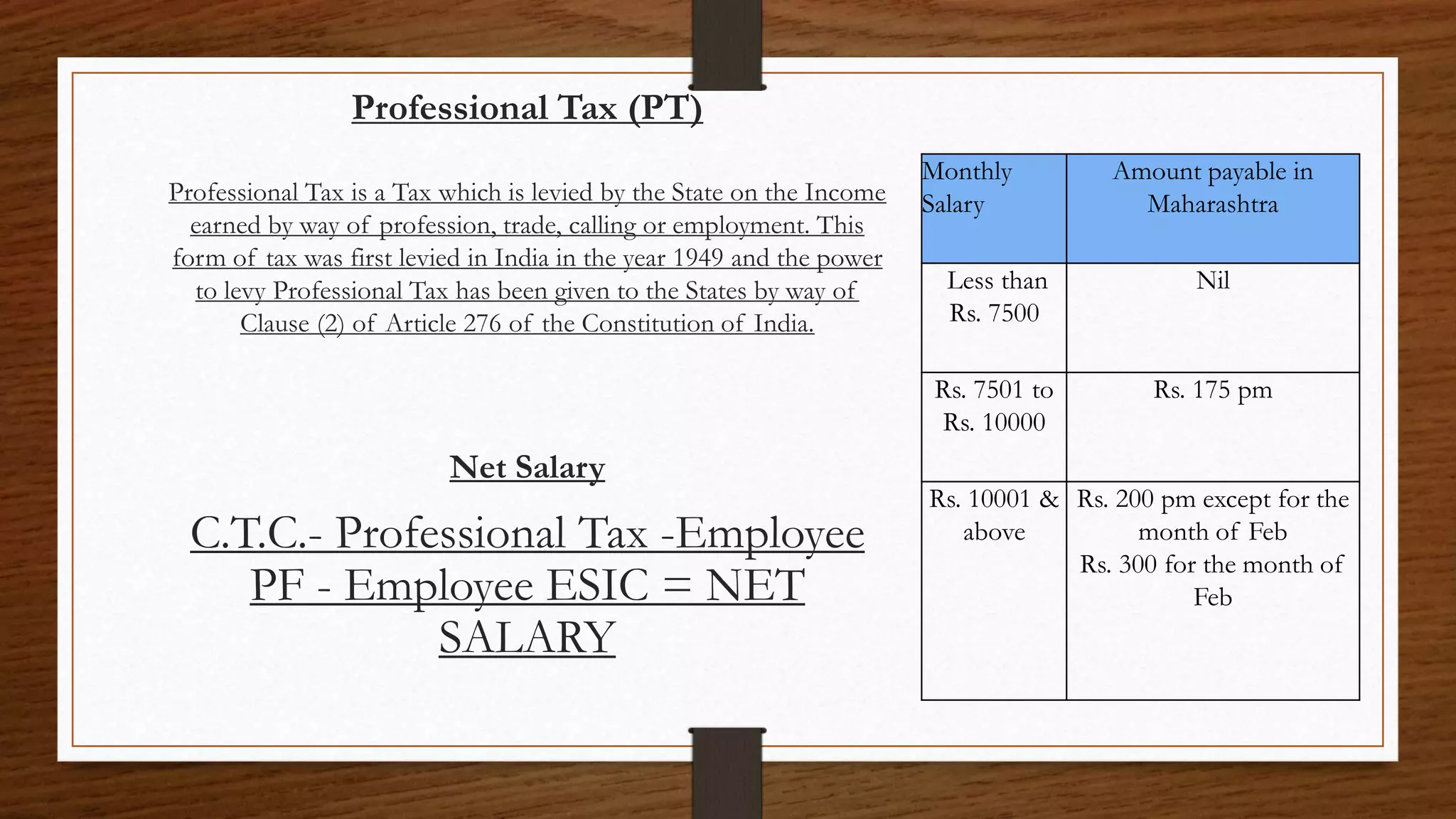

The document outlines the components and calculations involved in payroll management, detailing gross and net salary, cost to company (CTC), and various deductions such as employer and employee provident funds and professional tax. It explains key terms including employee state insurance (ESIC) and the implications of professional tax in India. Additionally, it presents a breakdown of sample salary figures to illustrate these concepts.