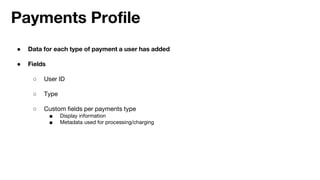

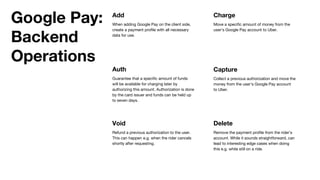

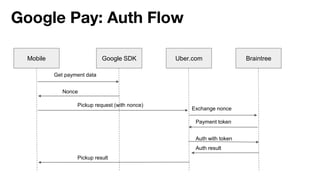

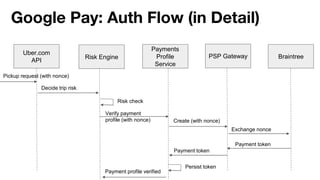

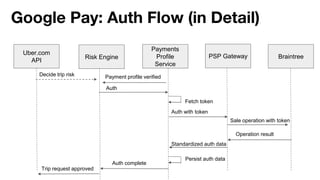

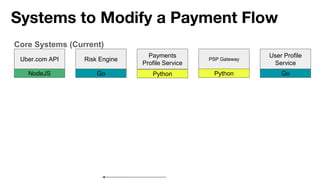

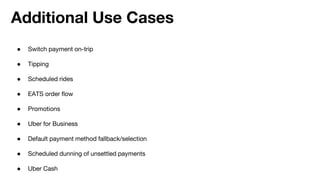

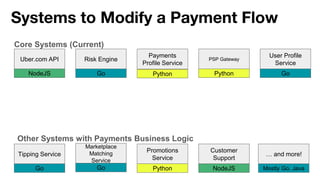

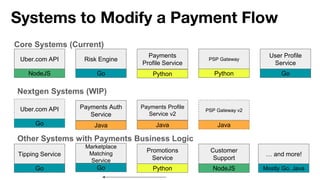

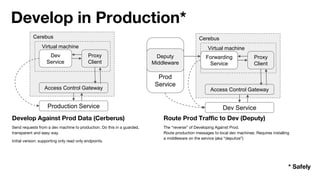

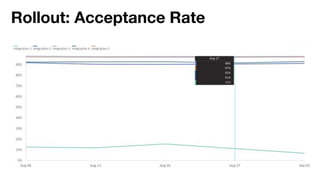

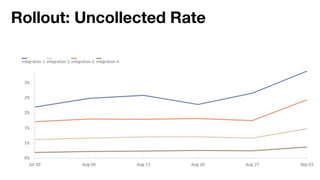

The document outlines a case study on integrating payment systems within Uber, focusing on Google Pay's various client-side functions and backend operations. It details the complexities of payment flows, testing methodologies, monitoring strategies, and fraud detection. The study emphasizes the importance of a careful rollout strategy and ongoing monitoring to ensure system stability and reliability.