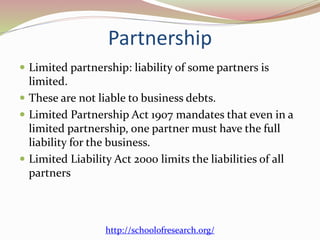

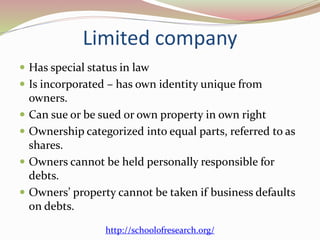

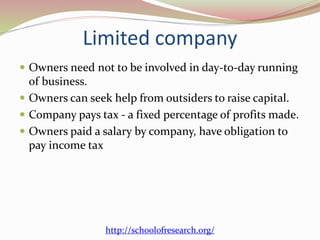

The document compares partnerships and limited companies, outlining the structure, responsibilities, taxation, and liabilities of each. In partnerships, all partners share profits and losses and have personal liability for business debts, whereas limited companies are separate legal entities with owners not personally liable for debts. Limited companies can raise capital more easily and are subject to corporate taxation, while partnerships have simpler tax reporting requirements.