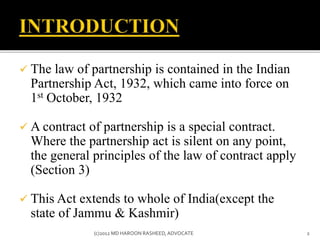

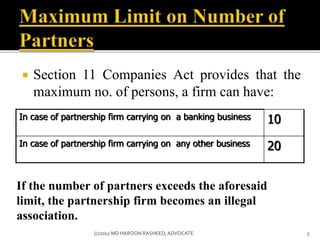

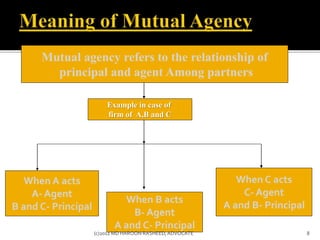

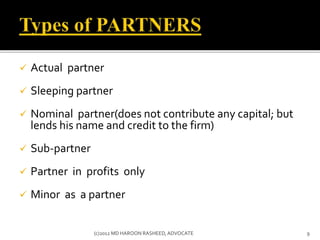

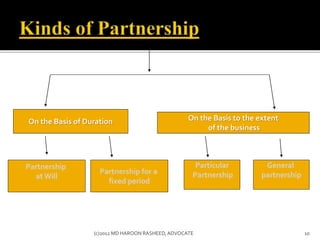

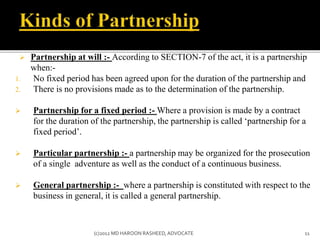

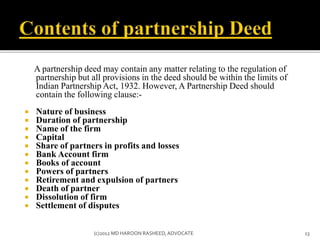

The document outlines the principles of partnership as defined in the Indian Partnership Act of 1932, detailing its formation, essential elements like mutual agency and profit sharing, and types of partnerships. It also discusses the advantages and disadvantages of partnerships, such as unlimited liability and lack of legal separateness. Additionally, it highlights the legal rights and responsibilities of partners, including implied authority and the effects of their actions on the partnership.

![By,

MOHAMMED HAROON RASHEED

B.A.LL.B (Hons.), [BSW] & [LLM]

Advocate

Email ID: adv.mdharoon@gmail.com

1(c)2012 MD HAROON RASHEED,ADVOCATE](https://image.slidesharecdn.com/partnershipact1932-150830181941-lva1-app6891/85/Partnership-act-1932-1-320.jpg)