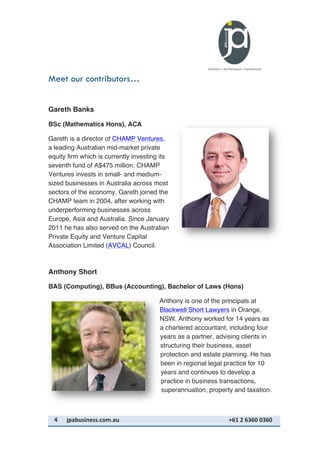

The document provides an in-depth overview of private equity and its implications for business owners, discussing its advantages, potential risks, and how to prepare for investment. It covers various business structures, including sole traders, companies, partnerships, and trusts, with insights from legal and investment professionals. Additionally, it emphasizes the importance of having proper agreements and an understanding of the dynamics between business partners.